Smarter Home Loan Strategy: Looking Beyond Just Low Interest Rates

Don’t let low interest rates blind you! A smart home loan strategy goes beyond the initial rate, uncovering hidden costs like processing, legal, and prepayment fees that can save you lakhs.

Understand the floating vs. fixed rate debate and prioritize flexibility for prepayments and balance transfers. Your lender’s reputation, customer service, and digital tools are also crucial.

Arm yourself with this knowledge, ask the right questions, and negotiate to secure a home loan that truly aligns with your financial future, providing peace of mind and long-term security.

Securing a home loan in India? Don’t fall for the “lowest interest rate” trap. A truly smarter home loan strategy looks beyond this one number to save you lakhs. We’ll reveal hidden costs and key factors often overlooked, ensuring your decision is a truly smart investment for your future.

Your dream home deserves a loan that offers more than just a cheap rate. Our guide uncovers the critical details, from prepayment flexibility to balance transfer options, empowering you with a comprehensive understanding of Indian home finance.

Learn how to evaluate a loan’s total value, not just its price. Discover the secrets to a financially sound home loan that provides peace of mind and long-term security. Get ready to transform your approach to home financing with our expert insights.

Deconstructing the “Low-Interest Rate” Myth

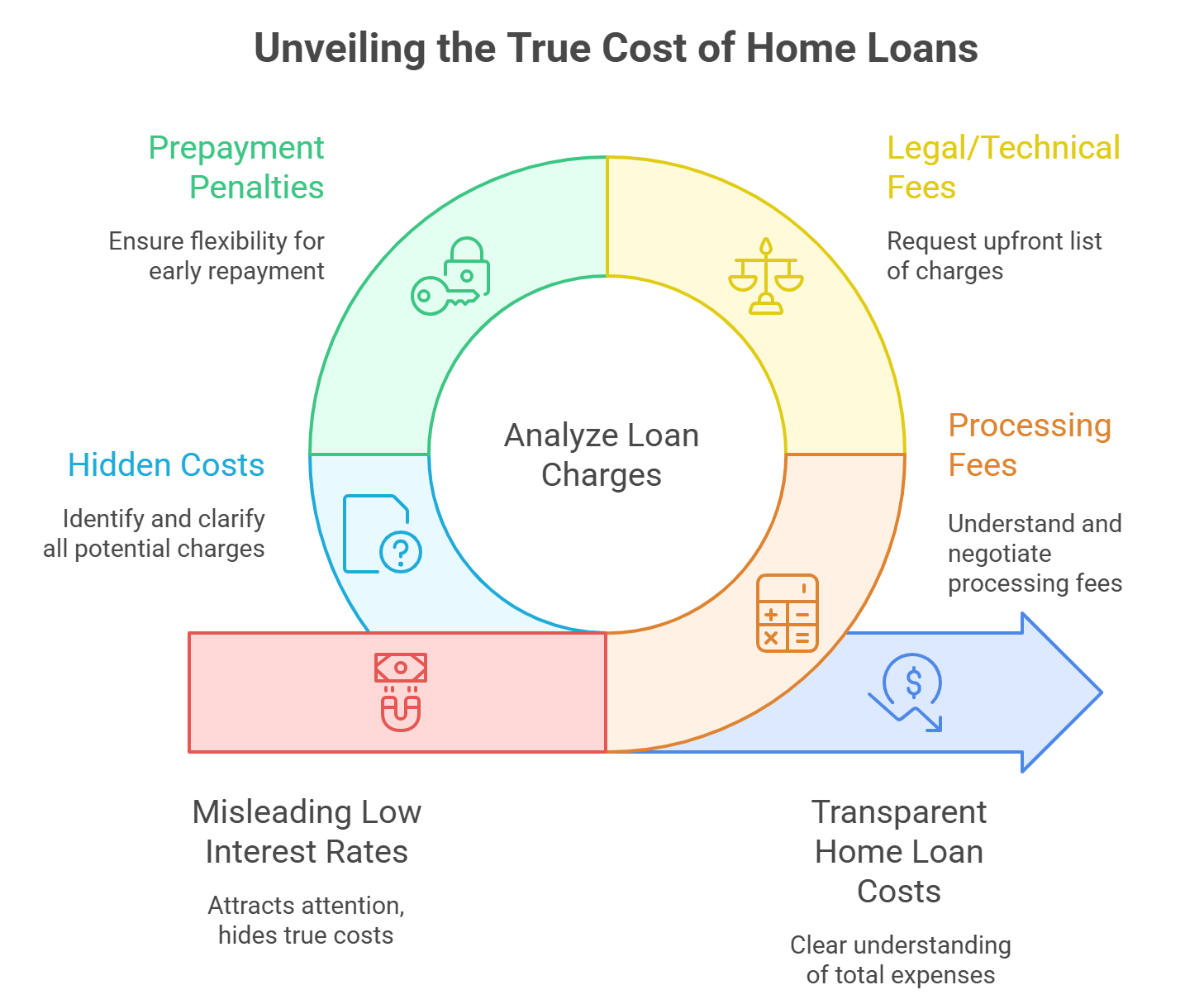

The first step in a smarter home loan strategy is to understand that a low interest rate is often just the beginning of the story. It’s a marketing tool used by lenders to grab your attention. To get the full picture, you must scrutinize every other cost associated with the loan.

The True Cost of a Home Loan: Beyond the Rate

1. Processing Fees

This is the most common fee charged by lenders. It’s a one-time, non-refundable charge for processing your loan application. While banks might charge 0.5% to 1.5% of the loan amount, NBFCs (Non-Banking Financial Companies) might charge a bit higher. On a ₹75 lakh loan, even a 1% processing fee is ₹75,000, a sum that could easily be used for interior work or furniture. Always ask for a clear breakdown of this fee and look for lenders offering a discount or even a waiver.

2. Legal and Technical Fees

Before they sanction the loan, lenders conduct a thorough legal and technical verification of the property. This involves a legal team checking the property’s title deeds, no-objection certificates, and other documents to ensure they are clean. A technical team will assess the property’s structure and valuation. These fees are almost always passed on to the borrower. Don’t be afraid to ask for a list of these potential charges upfront.

3. Foreclosure and Prepayment Penalties

This is where many borrowers get trapped. While the Reserve Bank of India (RBI) has mandated that banks cannot charge foreclosure penalties on floating-rate home loans, this doesn’t apply to all lenders. Many NBFCs and housing finance companies (HFCs) may still charge a penalty, especially on fixed-rate loans. For a smarter home loan strategy, ensure you have the flexibility to pay off your loan early, whether through a bonus, inheritance, or a sudden financial windfall, without being penalized.

4. Additional Hidden Costs

Be wary of other potential charges, such as administrative fees, stamp duty on the loan agreement, and CERSAI (Central Registry of Securitisation Asset Reconstruction and Security Interest) charges. While these may seem minor individually, they can collectively add up and impact the total cost of your loan. A transparent lender will provide a clear schedule of all fees, not just the interest rate.

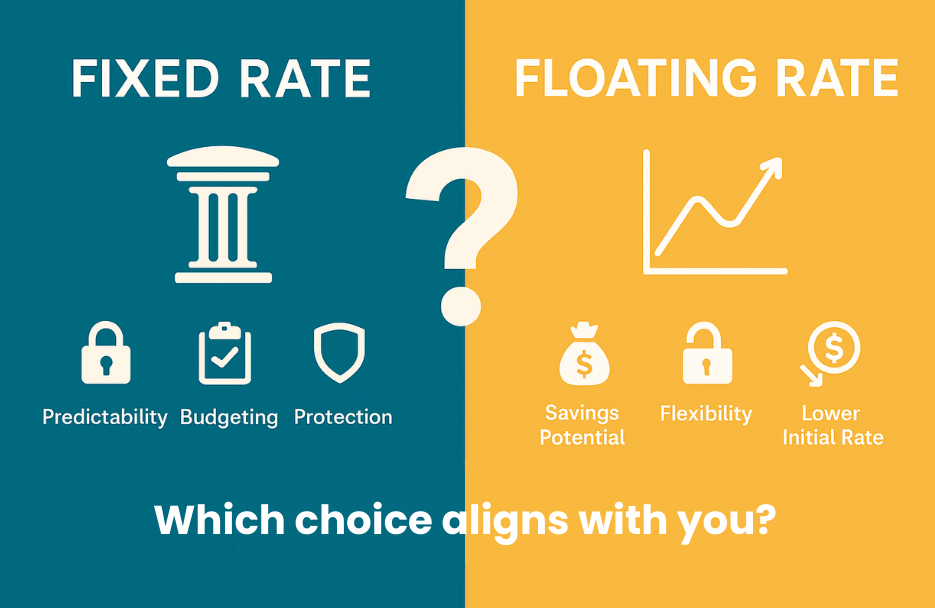

The Floating vs. Fixed Rate Conundrum

The decision between a floating and a fixed interest rate is one of the most critical you will make. It dictates the predictability of your monthly EMI and your vulnerability to market fluctuations. A smarter home loan strategy requires you to choose the rate type that aligns with your financial risk appetite and your view of the future economy.

Floating Interest Rate:

A floating rate is dynamic, linked to an external benchmark, primarily the Repo Rate in India. This means your interest rate changes whenever the benchmark rate changes.

-

Pros:

-

Potential for Savings: When the RBI cuts the Repo Rate, your interest rate and EMI will decrease, which can lead to significant savings over a long tenure.

-

No Prepayment Penalty: The biggest advantage is the freedom to prepay your loan without any penalty, giving you immense flexibility.

-

Generally Lower Initial Rate: Floating rates are usually a bit lower than fixed rates at the time of sanction.

-

-

Cons:

-

Unpredictable EMI: Your EMI can increase if the RBI hikes the Repo Rate, which can disrupt your monthly budget and financial planning.

-

Longer Tenure: If interest rates rise, your lender might keep your EMI constant and extend your loan tenure, meaning you end up paying for a longer period.

-

Fixed Interest Rate:

A fixed rate remains constant throughout the loan tenure, providing stability and certainty.

-

Pros:

-

Predictable Budgeting: You know exactly what your EMI will be for the entire loan period. This is perfect for those who are risk-averse and value a stable budget.

-

Protection from Rising Rates: If interest rates in the market rise, your fixed rate remains unaffected, protecting you from increased financial burden.

-

-

Cons:

-

Higher Initial Rate: Fixed rates are usually higher than floating rates to compensate the lender for the risk of future rate hikes.

-

No Benefit from Falling Rates: If interest rates fall, you won’t benefit from the lower rates.

-

Prepayment Penalties: Many lenders, especially NBFCs, may charge a penalty if you try to prepay a fixed-rate loan.

-

The Hybrid Approach:

For those who want the best of both worlds, a hybrid home loan is a compelling option. This model offers the security of a fixed rate for an initial period, typically the first 2-5 years, providing stability and predictability during a crucial phase of your loan journey. After this period, the interest rate automatically switches to a floating rate, allowing you to benefit from any potential drops in market rates.

This strategy is perfect for risk-averse individuals who need a stable budget at the start but want the long-term flexibility to capitalize on future market conditions. It’s a smart compromise that bridges the gap between certainty and opportunity.

The Verdict:

Ultimately, the verdict for a smarter home loan strategy often leans towards a floating interest rate. The flexibility it offers, especially with the RBI’s policies protecting against foreclosure penalties, gives you immense control. You gain the freedom to pay off your loan early, take advantage of falling interest rates, and easily switch to a different lender if a better deal emerges.

Making this crucial decision can be complex, but resources like https://butter.money/ can provide expert analysis to help you determine which rate model aligns best with your financial goals and risk tolerance for a truly tailored and effective strategy.

The Power of Flexibility and Features

A true smarter home loan strategy is not just about the cost, but also about the features and services the lender provides. These features can significantly impact your financial well-being and convenience over the life of the loan.

Navigating the Loan’s Hidden Potential

1. Prepayment Flexibility

This is a crucial feature. You should be able to make partial or full prepayments whenever you have surplus funds. A lender that allows this without a penalty empowers you to reduce your principal amount and, consequently, your interest burden. Even a small annual prepayment can save you lakhs over a 20-year tenure.

2. Home Loan Balance Transfer

The ability to transfer your home loan to a new lender is a powerful tool in your financial arsenal. If interest rates fall, or a new lender offers a better deal, a balance transfer allows you to move your outstanding loan. This gives you immense bargaining power. When considering a balance transfer, remember to calculate the total cost, including the new lender’s processing fees, to ensure the move is financially beneficial.

3. Top-Up Loan Facility

A top-up loan is a great feature to look for. It allows you to borrow additional funds on your existing home loan at the same attractive interest rate. This can be used for home renovations, a child’s education, or any other personal need, and is a far cheaper option than a personal loan.

4. Overdraft Facility

An overdraft facility on your home loan is a game-changer. Your home loan account is linked to your savings account. When you have surplus funds, you can deposit them into this account, and the interest is calculated only on the net outstanding balance. This allows you to reduce your interest burden while still having access to your funds. This is an advanced feature and a key part of an effective smarter home loan strategy.

5. EMI Holiday or Moratorium

In times of financial difficulty, a moratorium on EMI payments can be a crucial lifeline. To plan for such scenarios and understand the impact of a moratorium on your loan, you can use a sophisticated EMI calculator. For example, https://butter.money/tools/emi-calculator can help you simulate different repayment scenarios, including how your total interest and principal amounts are affected by a payment holiday. By using this tool, you can make informed decisions about your loan and stay on top of your financial health, even during challenging times.

The Importance of the Lender Itself

Your lender has been your financial partner for decades. Their policies, customer service, and digital capabilities are just as important as the loan’s terms.

1. Lender’s Reputation and Transparency

Choose a lender with a strong reputation for ethical practices and transparency. Look for a lender that clearly explains all terms and conditions, fees, and charges without any ambiguity. A lender who is vague about hidden costs is a red flag.

2. Customer Service and Support:

A responsive and efficient customer support system is crucial when you need a statement, a NOC, or have a query about your loan. Butter Money makes it incredibly easy to get quick answers through a convenient WhatsApp service. This direct messaging option simplifies communication and can save you a lot of time and hassle when dealing with important loan-related queries.

3. Digital Platforms

In today’s digital age, a robust online portal or a user-friendly mobile app is non-negotiable for a seamless banking experience. The ability to check your loan statement, pay your EMI, or apply for a top-up loan online can save you a lot of time and hassle, a modern convenience that a resource such as https://butter.money/ also prioritizes in its approach to finance.

4. Expertise in Your Segment

Some lenders specialize in certain types of home loans, such as loans for the self-employed, NRIs, or for properties in rural areas. Choosing a lender with expertise in your segment can lead to a smoother and faster approval process.

Step-by-Step Guide to a Smarter Home Loan Strategy

Here is a practical, step-by-step guide to applying a smarter home loan strategy to your search.

Step 1: Get Your Financial House in Order

Before you even start looking for a loan, check your CIBIL score. A score of 750 or above is considered excellent and will get you the best interest rates. Settle any existing debts and gather all necessary documents, including income statements, bank statements, and property documents.

Step 2: Research and Compare Thoroughly

Don’t just look at the big nationalized banks. Compare offers from a variety of lenders, including public and private sector banks, NBFCs, and housing finance companies. Use online comparison portals to get a quick overview, but always double-check the fine print on the lender’s official website.

Step 3: Ask the Right Questions

When speaking to a loan officer, go beyond just the interest rate. Ask about:

-

Processing fees and other administrative charges.

-

Prepayment penalties on both partial and full payments.

-

The benchmark for floating rates and how often they are reset.

-

The possibility of a home loan balance transfer.

-

The availability of a top-up loan facility and overdraft options.

-

Customer service support and digital platforms.

Step 4: Read the Fine Print

Once you have narrowed down your options, read the loan agreement in its entirety. If you don’t understand something, ask for clarification. A good lender will have a clear and transparent agreement.

Step 5: Negotiate

Don’t be afraid to negotiate. Based on your excellent CIBIL score and strong financial profile, you may be able to negotiate a lower processing fee or a waiver of certain charges.

Step 6: Plan Your EMI and Tenure

Use an online EMI calculator to determine a comfortable EMI amount. A longer tenure means a lower EMI but a higher total interest payout. A shorter tenure means a higher EMI but significant savings on interest. Choose a tenure that balances your comfort with your goal of becoming debt-free sooner.

Conclusion

Don’t let the promise of a low interest rate blind you to the full picture. Your home loan is a multi-decade commitment, and a truly smarter home loan strategy is your blueprint for financial freedom. It’s about securing a loan that empowers you, offering the flexibility to pay it off faster and the features that provide real peace of mind.

Ready to take control of your financial future? Don’t let a single number define your dreams. Discover a better way to approach home financing. Explore expert insights and make a decision that truly fits your needs, just like the principles you’d find at a resource like https://butter.money/

Frequently Asked Question(FAQs)

- Is a low interest rate always the best deal?

No. A low interest rate can be misleading. You must consider the total cost, including processing fees, legal charges, and prepayment penalties, to determine the loan’s true value.

- What is a home loan balance transfer?

A home loan balance transfer is the process of moving your outstanding loan to a new lender, typically to secure a lower interest rate or better terms. It’s a key tool for long-term savings.

- How does my CIBIL score affect my home loan?

Your CIBIL score is crucial. A score above 750 can help you secure a lower interest rate and faster approval, as it shows you are a reliable borrower.

- Should I choose a longer or shorter loan tenure?

A longer tenure means a lower EMI but a higher total interest payout. A shorter tenure has a higher EMI but saves you significant money on interest. Choose based on your financial comfort and goals.

- What is an EMI holiday or moratorium?

An EMI holiday is a temporary pause in your monthly payments during financial hardship. While it provides a break, interest continues to accrue, increasing your total loan amount.