Become Debt-Free, Faster with Smart Prepayments

By Mansvi Prajapati

Imagine a life where your salary isn’t just a number, but a gateway to possibilities. A life where every paycheck contributes directly to your dreams, not just to paying off old debts. This isn’t a fantasy- it’s a reality that’s closer than you think, and it all begins with one powerful financial action: making extra payments on your loans.

Securing a home loan is a monumental step toward achieving the dream of homeownership. For many, it’s the single largest financial commitment of their lives, and with a tenure stretching for decades, the monthly Equated Monthly Installment (EMI) can feel like a lifelong obligation.

But what if you could change that? What if you could take control of your loan, drastically reduce your interest burden, and cut years off your tenure? By arming yourself with the right knowledge and tools, you can transform your home loan from a burden into a stepping stone toward financial freedom.

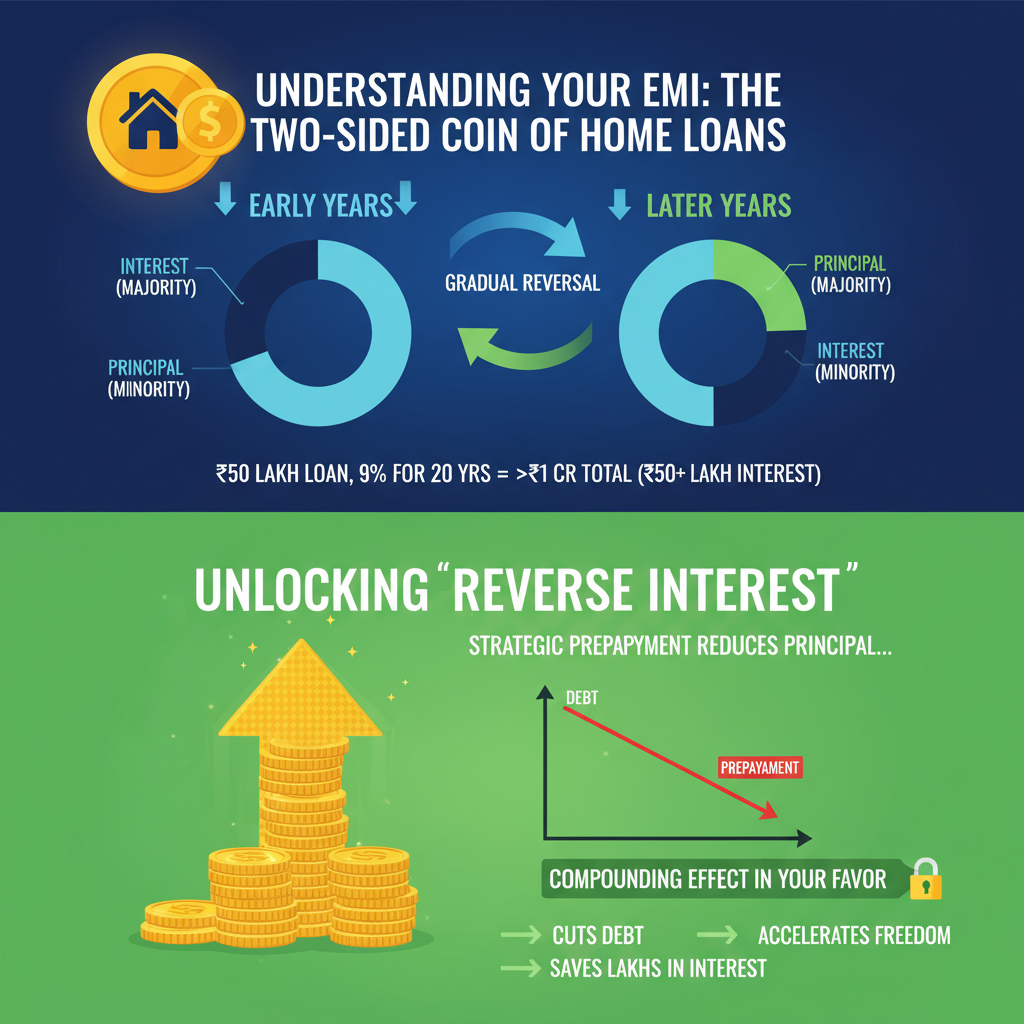

Understanding Your EMI: The Two-Sided Coin of Home Loans

The first step to mastering your loan is understanding how your EMI works. An EMI is a fixed amount you pay to your lender each month, but its composition changes over time. Your EMI is made up of two parts: the principal amount and the interest amount.

In the initial years of your loan, a disproportionately large part of your EMI goes toward paying off the interest, while a very small portion goes toward reducing the principal. As your loan matures, this ratio gradually reverses. This is why a loan of ₹50 lakh at a 9% interest rate for a 20-year tenure can end up costing you more than ₹1 crore in total, with over ₹50 lakh paid in interest alone.

This sharp reality highlights the immense financial leverage that lenders hold. But by strategically paying off a portion of your principal ahead of schedule, you can significantly reduce the amount on which future interest is calculated. This creates a powerful compounding effect in your favor, a “reverse interest” that works to cut your debt and accelerate your freedom.

The Delusion of Debt: Why We Pay More Than We Should

Most of us are taught to make our minimum monthly payments on time. While this is crucial for maintaining a good credit score and staying in the lender’s good graces, it’s a strategy designed for the bank, not for you. By only paying the minimum, you’re often paying off a small fraction of the principal (the original loan amount) and a large chunk of interest. Over the loan’s life, this can lead to you paying thousands-or even tens of thousands-more than you originally borrowed.

Think of it this way: your loan is a partnership. The bank provides the funds, and you agree to pay them back with a fee (the interest). The longer you take to pay off the principal, the more interest you accumulate, and the more the bank profits. By making extra payments, you’re essentially saying, “I want to change the terms of this partnership. I’m going to pay you back faster and keep more of my money.”

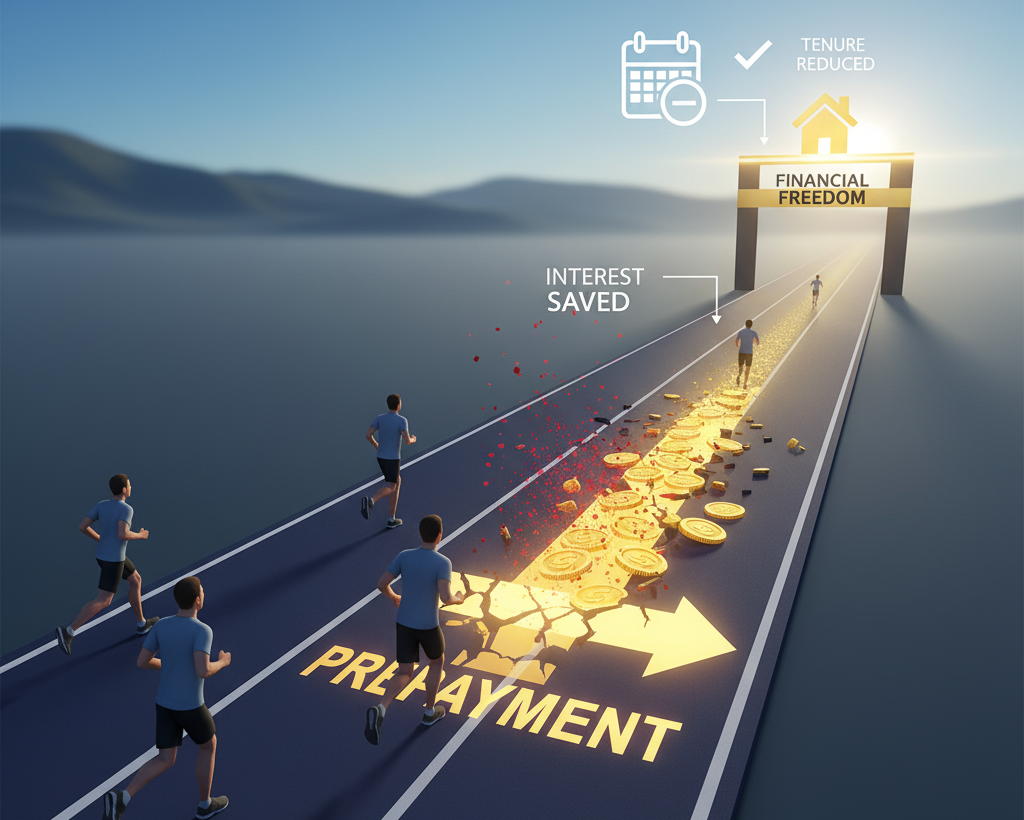

The Power of Prepayment: Your Best-Kept Secret to Savings

Prepayment is the act of paying an additional amount toward your loan principal before the due date. This can be a one-time lump sum or a regular, smaller payment. It is arguably the single most effective way to save money on your home loan.

The benefits of prepayment are twofold:

-

Interest Saved: By reducing your principal, you directly lower the total interest you will pay over the loan’s life.

-

Tenure Reduced: Prepaying also shortens your loan tenure, freeing you from debt years ahead of schedule.

Think of it this way: your home loan is like a marathon, and every prepayment is a shortcut that gets you to the finish line faster and with less effort.

Simplifying the Home Loan Prepayment Calculator

A home loan prepayment calculator is your most valuable strategic tool. It’s a financial simulator that shows you the exact impact of your prepayment decisions. By inputting your loan details, it provides a crystal-clear picture of your potential savings.

Key Inputs for the Calculator:

-

Original Loan Amount & Tenure: The initial details of your loan.

-

Current Outstanding Principal: The remaining amount you owe.

-

Interest Rate: Your current loan interest rate.

-

Prepayment Amount & Frequency: The amount you plan to pay and how often (e.g., monthly, annually, or a one-time lump sum).

Key Outputs from the Calculator:

-

Total Interest Saved: The exact amount of interest you will save.

-

Tenure Reduced: The number of years you will cut from your loan term.

-

New Amortization Schedule: A revised table showing your new repayment timeline.

By experimenting with different scenarios, you can find the perfect prepayment strategy that fits your budget and helps you achieve your financial goals.

That’s why tools like the new Butter Money Prepayment Calculator were built. It’s not just a tool, it’s a roadmap to your financial freedom. It provides a clear, personalized roadmap to either pay off sooner or reduce your monthly burden. You’ll get a clear vision of your future by seeing your new, faster debt-free date, a specific and personalized date that shows you exactly when you will be 100% debt-free!

Calculated term of your existing loan is 20 years

Pro Tip

Making a prepayment

in the early years of the loan reduces interest

Talk to us to prepay your exisiting home loan

Strategic Prepayment: The ‘When’ and ‘How’ of Making a Move

Knowing how to use the calculator is one thing, knowing when and how to act is another.

Timing Is Key: Prepayments are most effective in the early years of your loan. Because the initial EMIs are heavily skewed toward interest, any principal reduction at this stage has a much bigger impact on the total interest you will pay over the full tenure. The savings from a prepayment in year two are exponentially greater than the savings from the same prepayment in year 15.

The Prepay vs. Invest Dilemma: This is a classic financial debate.

-

Prepaying offers a guaranteed, risk-free return equal to your loan’s interest rate.

-

Investing could potentially yield higher returns, but it comes with market risk.

The smart choice depends on your risk tolerance and the current interest rate. If your home loan rate is high (above 8-9%), prepayment is often the safer, smarter bet.

Check for Penalties: Before making a prepayment, always check your loan agreement for any associated penalties. In India, the RBI has mandated that banks cannot charge foreclosure penalties on floating-rate home loans, which is a massive win for borrowers.

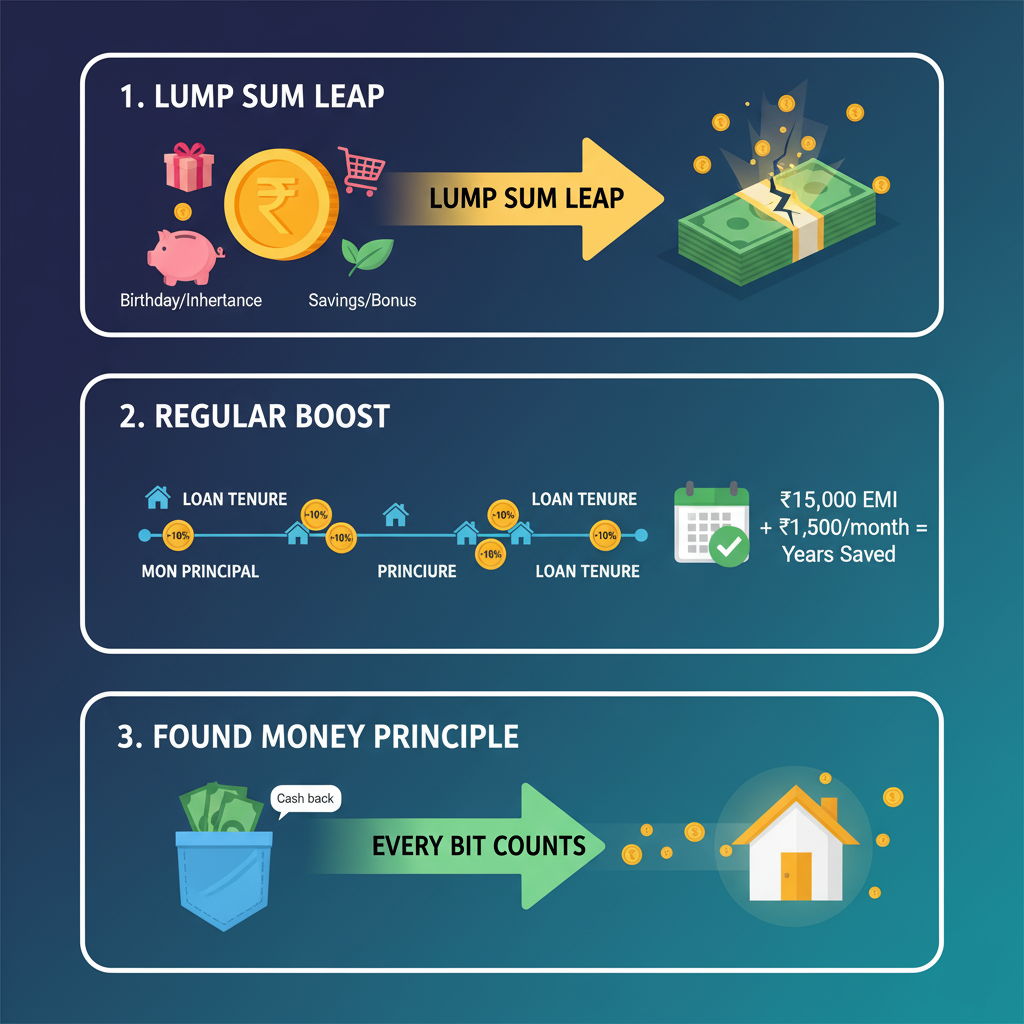

The Art of the Prepayment: How to Do It Right

Making prepayments isn’t about having a huge lump sum of cash, it’s about consistency and using all your available resources. Here are the most effective ways to make extra payments:

1. The Lump Sum Leap: This is when you use a large, one-time payment to make a significant dent in your principal. This could come from a work bonus, a tax refund, an inheritance, or proceeds from selling an asset. Even a small lump sum can have a huge impact, especially if you make it early in your loan’s life.

2. The Regular Boost: Consistency is key. Consider adding a small, extra amount to your regular monthly payment. Even an extra 5% or 10% can make a world of difference over time. For example, if your EMI is ₹15,000, paying an extra ₹1,500 each month can shave years off your loan.

3. The Found Money Principle: Use any unexpected windfalls to your advantage. Did you get a cash gift for your birthday? A refund on a recent purchase? An extra check from a side hustle? Put that money directly toward your loan instead of spending it on non-essentials. Every little bit counts.

The Prepayment Pitfalls: What to Watch Out For

While prepayments are overwhelmingly positive, there are a few things you need to be aware of before you start:

-

Prepayment Penalties: Some loans, especially fixed-rate loans, have a prepayment penalty. This is a fee that the lender charges for paying off the loan early. Always check your loan agreement to see if a penalty applies and if the interest savings outweigh this cost. Floating-rate loans, like most home loans, often have no prepayment penalty.

-

Emergency Funds: Before you start making extra payments, ensure you have a solid emergency fund. Ideally, this should be at least three to six months of living expenses. Don’t sacrifice your financial safety net just to pay off a loan a few months earlier.

-

The Investment Opportunity Cost: If the interest rate on your loan is very low (e.g., 2-3%), you might earn more money by investing that extra cash rather than paying down the debt. This is known as opportunity cost. Always compare your loan’s interest rate with the potential returns from a stable, low-risk investment.

Seeing Your Future in Numbers: The Power of a Prepayment Calculator

One of the biggest motivators for making extra payments is seeing the tangible results of your efforts. This is where a prepayment calculator becomes an essential tool. It’s not just a calculator, it’s a window into your financial future.

This powerful tool lets you input your loan details-outstanding balance, interest rate, and current EMI-and then experiment with different prepayment scenarios. Want to see what would happen if you made a one-time lump sum payment? Or if you added a small amount to each monthly EMI? The calculator will instantly show you how much interest you’ll save and, most importantly, the new, faster date you’ll be completely debt-free.

A fantastic tool for this purpose is the Butter Money Prepayment Calculator. As an example, the calculator shows how making a one-time prepayment of ₹2.5 Lakh on a loan of ₹40 Lakh can save you over ₹9 Lakh in interest and reduce your loan tenure by almost 3 years. It’s a clear, user-friendly tool that takes the guesswork out of debt repayment and provides the motivation you need to stay on track.

The Butter Money calculator and similar tools are more than just numbers on a screen, they are a clear, visual representation of what is possible. They help you build a clear, actionable plan and show you exactly what your financial future looks like with each prepayment you make.

Conclusion: Your Home Loan, Your Terms

A home loan is a long-term commitment, but it doesn’t have to be a lifelong burden. By embracing a strategic approach and using tools like a prepayment calculator, you can stop just paying your loan and start actively conquering it. Your home loan should be a stepping stone to achieving your dreams, not a debt that weighs you down.

Take control of your finances, make informed decisions, and secure a brighter financial future for yourself and your family. The power is in your hands.

Frequently Asked Questions (FAQs)

Q1: What is the difference between a prepayment and a

foreclosure?

A prepayment is any extra payment made toward your loan’s

principal, on top of your regular EMI. A foreclosure, on the other

hand, is paying off the entire remaining loan amount in one lump

sum to close the loan account completely.

Q2: Will a prepayment affect my credit score?

Yes, in a positive way. Making extra payments shows responsible

financial behavior and reduces your credit utilization ratio (the

amount of debt you have compared to your total credit limit). This

can lead to an improvement in your credit score, as long as you

continue making your regular payments on time.

Q3: Is it better to reduce my EMI or my tenure after a

prepayment?

This is a key decision to make with your lender. Reducing your EMI

gives you more cash flow each month, which can be useful if you

need to free up funds for other expenses. However, reducing your

tenure is the better choice if your main goal is to save the

maximum amount of interest and become debt-free as quickly as

possible. Most financial experts recommend reducing the tenure to

maximize savings. A good prepayment calculator can help you

simulate both scenarios to see which one works best for your

personal financial situation.

Q4: Should I pay off my high-interest debt or low-interest debt

first?

Generally, it is best to focus on paying off your highest-interest

debt first. This is because high-interest debt, like credit card

debt or personal loans, costs you the most money over time. By

eliminating it first, you save more in the long run. Once that

debt is paid off, you can then take that extra cash and apply it

to the next highest-interest loan, creating a powerful debt

snowball.

Q5: Are there any tax implications for prepaying my

loan?

Yes, there can be. For example, in many countries, interest paid

on a home loan is eligible for tax deductions. By prepaying your

loan and shortening the tenure, you will pay less interest

overall, which may reduce your total tax deduction. It’s important

to weigh these potential tax implications against the overall

interest savings. You should consult a financial advisor or a tax

professional to understand the specific implications for your

situation.