How to Download Form 26QB and Form 26AS - Guide

By Noorah

When you buy a property, there are a few tax steps that need to be completed to stay compliant with government rules. One such step is filing Form 26QB, which is used to pay the TDS deducted from the property payment. Another important document is Form 26AS, which shows all the taxes paid or deducted in your name during the year. Downloading these forms ensures your property purchase and tax records are smooth and hassle-free.

1) At a glance - What / Why / How

What is Form 26QB?

Form 26QB is the challan‑cum‑statement generated when a buyer deducts TDS at 1% on purchase of immovable property (non‑agricultural) under Section 194‑IA. It records payment of the TDS deposited to the Government.

Form 26QB is a document created when someone buying a property deducts 1% tax (TDS) from the payment for non-agricultural land, as required by Section 194-IA. This document serves as proof that this deducted tax has been paid to the government.

What is Form 26AS?

Form 26AS is like a statement that shows all the taxes (TDS, advance tax, etc.) credited to your Permanent Account Number (PAN). You download it to make sure all your tax deductions are correctly recorded before you file your income tax return (ITR) and to catch any errors early.

Why download them?

-

Form 26QB: You download this to prove that the tax deducted when buying a property has been paid to the government. It’s important for giving the seller their tax certificate (Form 16B) and for your own financial records.

-

Form 26AS: This is like a statement that shows all the taxes (TDS, advance tax, etc.) credited to your Permanent Account Number (PAN). You download it to make sure all your tax deductions are correctly recorded before you file your income tax return (ITR) and to catch any errors early.

2) Eligibility / Who needs these?

Form 26QB (Section 194‑IA): The buyer must deduct TDS at 1% and deposit it when the consideration or stamp‑duty value of immovable property is ₹50,00,000 (50 lakh) or more. If value < ₹50 lakh, Sec. 194‑IA is not triggered.

Form 26AS: Any PAN holder can view Form 26AS - it lists TDS/TCS credited against that PAN, and other tax payments/refunds. Useful for both buyers and sellers to confirm credits.

Form 16B: After Form 26QB payment is completed, the buyer (registered on TRACES) can download Form 16B (TDS certificate issued to the seller).

How does Form 26QB and Form 26AS help for financial security?

Form 26QB and Form 26AS contribute to financial well-being in the following ways:

Form 26QB: This form serves as proof that the tax deducted when purchasing a property has been paid to the government. This is crucial for:

-

Issuing Form 16B to the seller, which is their tax certificate.

-

Maintaining accurate financial records for the buyer.

-

Assisting with accounting and capital gains calculations.

Form 26AS: This consolidated tax credit statement helps you:

-

Verify that all taxes deducted from your income (TDS, advance tax, etc.) have been correctly credited to your Permanent Account Number (PAN).

-

Identify any mismatches or errors in tax deductions early, before filing your Income Tax Return (ITR), which can prevent potential issues and ensure accurate tax submissions.

3) Step‑by‑step procedures

A - Download Form 26QB

- (Method 1) - Income Tax Portal

-

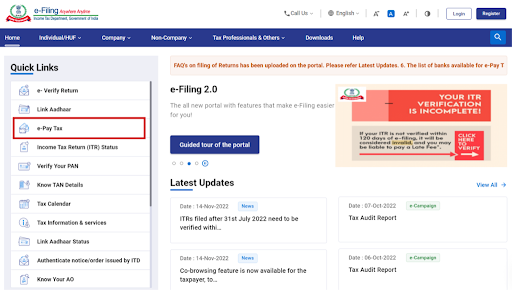

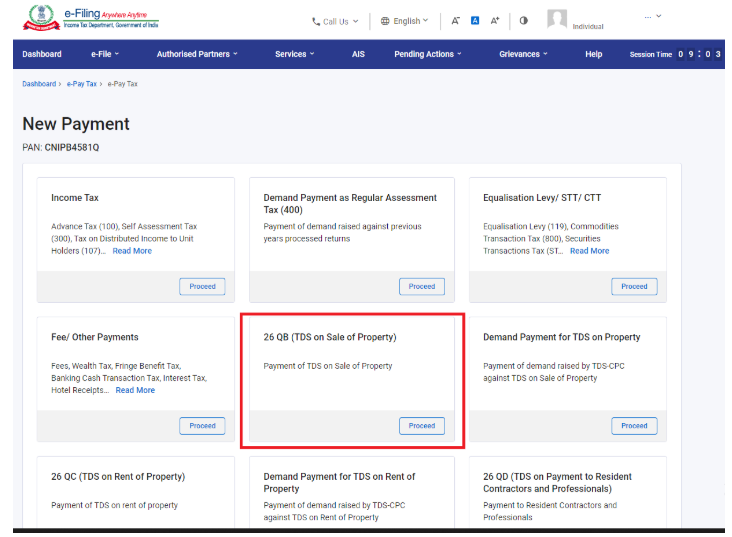

Open the Income Tax e‑Filing portal: https://www.incometax.gov.in and log in with your PAN/Aadhaar and password.

-

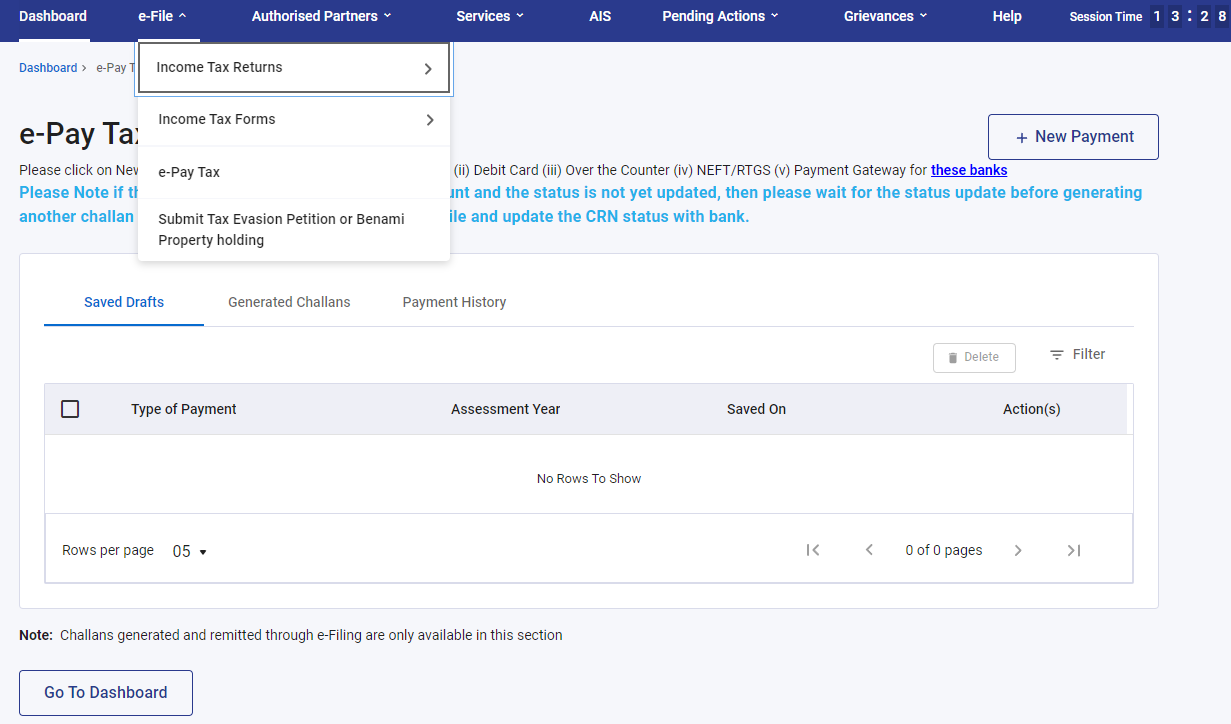

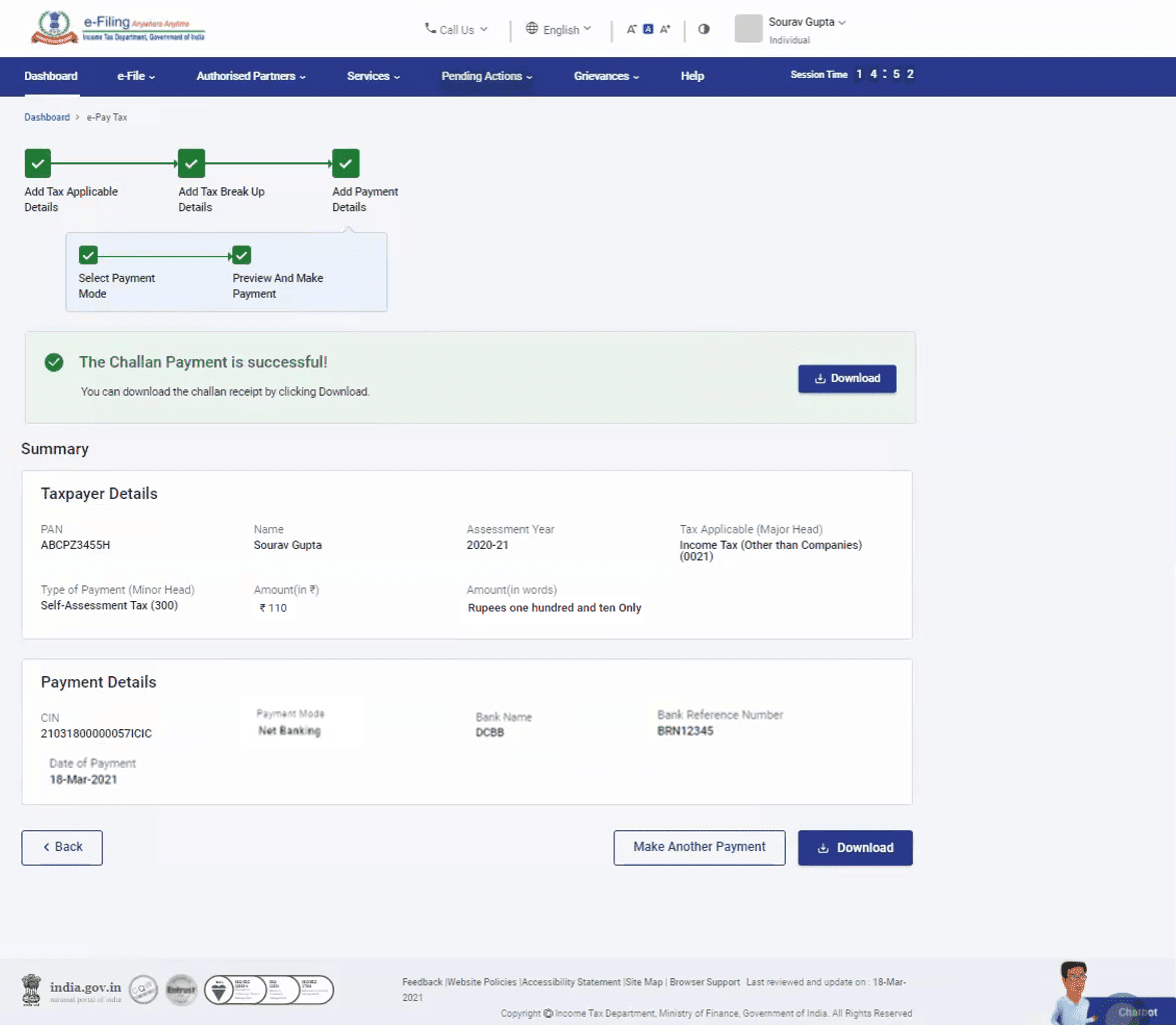

From the dashboard, go to e‑Pay Tax → Payment History.

-

In Payment History, look for the entry “TDS on sale of property (800)” (or similar) for the date / Assessment Year of your transaction.

-

Use the Acknowledgment / Reference number to identify the correct transaction (useful when multiple payments exist).

-

Under Action (or the relevant column) click to download the receipt and the Form 26QB (Statement) PDF.

Tip: If you made the payment via the e‑Pay Tax workflow, the challan/receipt and Form 26QB will appear in Payment History after the transaction completes.

Download Form 26QB (Method 2) - TRACES portal

-

Visit the TRACES (TDS CPC) portal: https://www.tdscpc.gov.in and register/login using the buyer’s PAN (if not already registered, register as a taxpayer using PAN).

-

Go to Downloads → look for Form 26QB (for buyer) or similar label under the Downloads menu.

-

Enter the Acknowledgment Number (from the payment), Seller’s PAN, and Assessment Year; submit the request.

-

Once TRACES generates the file, download the Form 26QB PDF from the requested downloads / available downloads area.

Note: TRACES may take a short time to generate the document after a request - keep the Acknowledgment No., buyer & seller PANs and AY ready.

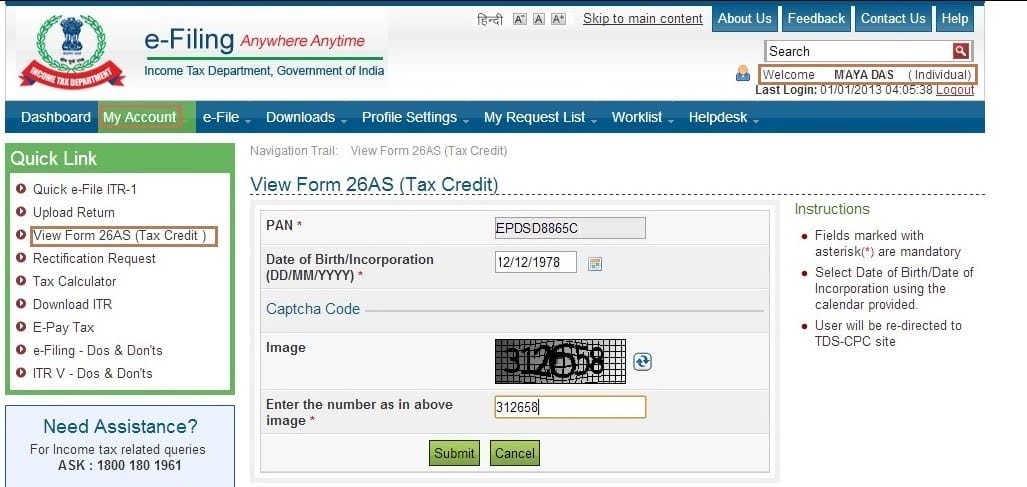

B - Download Form 26AS (Income Tax e‑Filing → TRACES)

-

Login to https://www.incometax.gov.in with your credentials (PAN/Aadhaar + password).

-

Navigate: E‑File → Income Tax Returns → View Form 26AS.

-

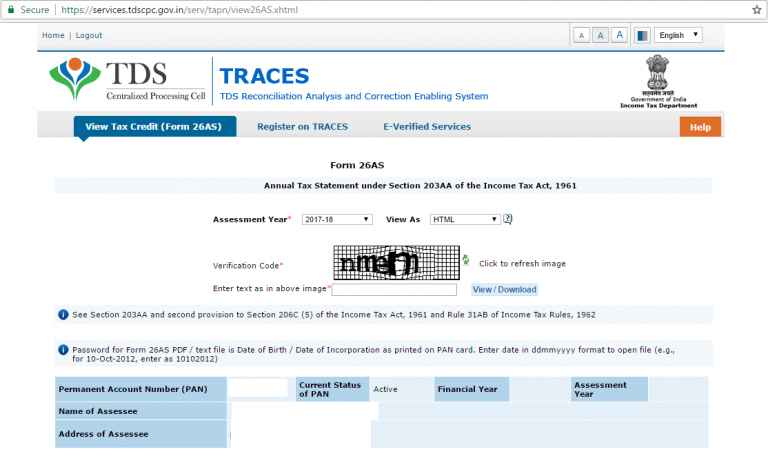

Read the disclaimer and click Confirm- you will be redirected to the TDS‑CPC / TRACES portal.

-

On TRACES (TDS‑CPC), click View Tax Credit (Form 26AS).

-

Select the Assessment Year and View Type (HTML / Text / PDF). Click View/Download.

Tip: For a clean printable copy, choose PDF as the view type. The PDF is password‑protected: the password is usually your Date of Birth in DDMMYYYY format (for individuals)- open instructions appear on the TRACES page.

4) Quick troubleshooting & notes

-

Delay / Mismatch: If the payment/filing was done recently, allow 2–7 days for systems to update before the entry appears in Form 26AS or TRACES.

-

Wrong PAN / Details: If details (PAN / AY / Acknowledgment No.) are incorrect, TRACES/e‑File will not show the document. Re‑check and re‑submit the correct values.

-

Form 16B: After filing 26QB, buyer can request/download Form 16B from TRACES (Downloads → Form 16B). The buyer then provides Form 16B to the seller as proof of TDS deduction.

-

Password to open 26AS PDF: Typically DDMMYYYY of the PAN holder’s date of birth. If organizational, check TRACES instructions.

Here’s how Butter Money can support you:

-

Recent Payments / Filing- If you have filed or paid very recently, it may take 2–7 days for the entry to show up in Form 26AS or TRACES. This is normal.

-

PAN / Details Verification- We will cross-check your PAN, Assessment Year, and Acknowledgment Number against the challan/receipt to ensure the details are correct. If there is a mismatch, we’ll guide you on correcting it.

-

Form 16B Download- After filing Form 26QB, we can guide you step-by-step on downloading Form 16B from TRACES, or, if you prefer, we can assist you directly and share the file with you.

-

Form 26AS PDF Access- The password to open the 26AS PDF is usually your date of birth in DDMMYYYY format. For organizations, we will confirm the correct password format from TRACES and share it with you.

Our role is to make this process stress-free. We’ll track the issue, coordinate with the portal/bank if needed, and keep you updated until everything is resolved.

Please share with us:

-

The date of filing/payment

-

Your Acknowledgment Number (if available)

Once we have this, we’ll troubleshoot right away and keep you informed of the next steps

6) Handy checklist before you start

-

Buyer’s PAN (must be registered on TRACES for downloads)

-

Seller’s PAN (for TRACES requests / Form 16B)

-

Acknowledgment / Reference Number of Form 26QB (from payment)

-

Assessment Year (AY) for which the payment applies

-

Registered mobile/email on e‑Filing (for transaction alerts)

7) Conclusion

By keeping Form 26QB and Form 26AS updated and properly downloaded, you ensure smooth compliance with property-related tax requirements and maintain accurate tax records. This not only avoids penalties but also helps in seamless loan processing, property registration, and future tax filings.

8) Frequently Asked Questions (FAQs)

Q: Who issues Form 26QB?

A: Form 26QB is generated when the buyer pays the TDS (1% under

Sec. 194‑IA) via the e‑Pay Tax or challan flow; both Income Tax

e‑File and TRACES allow retrieval of the generated Form 26QB.

Q: How soon after payment can I download 26QB / 26AS?

A: Usually payment entries show up within hours, but systems can

take 2–7 days. If not visible after a week, recheck the details or

raise a support request.

Q: Can the buyer download Form 16B?

A: Yes- buyers registered on TRACES can request/download Form 16B

after Form 26QB is filed. The buyer then issues Form 16B to the

seller.

References (official + helpful guides)

-

Income Tax e‑Filing- e‑Pay Tax / Payment History and related FAQs: https://www.incometax.gov.in/iec/foportal/help/e-PayTax-faqs

-

Income Tax (TDS on sale of property)- How to download / TRACES instructions: https://incometaxindia.gov.in/Pages/tds-sale-of-immovable-property.aspx

-

Online Form 26AS (View / Download)- Income Tax / TRACES flow: https://incometaxindia.gov.in/Pages/tax-services/online-26AS-traces.aspx

-

TRACES (TDS CPC) portal: https://www.tdscpc.gov.in

-

Helpful user guides (examples): https://www.bajajfinserv.in/how-to-download-form-26qb