Is the Festive Season a Truly Auspicious Time to Apply for Your Home Loan?

By Mansvi Prajapati

For countless Indians, owning a home is not just a mere financial transaction; it’s a profound “Griha Pravesh” into a new life chapter. This dream intensifies during the Festive Season, from Navratri to Diwali and Dhanteras, culturally revered as auspicious for significant purchases, with a new home topping the list.

This cultural fervor fuels the property market, making the decision to secure a home loan feel spiritually validated. But beyond emotion, is the festive season truly auspicious financially and practically? A resounding yes, with caution. Banks roll out aggressive home loan offers, fee waivers, and interest rate reductions.

To truly harness these benefits, an unbiased approach is crucial. This guide dissects cultural, financial, and procedural factors, ensuring your festive season home loan application is both auspicious and financially prudent, helping you capture fleeting market advantages.

The Cultural Compass: Unpacking the ‘Auspicious’ Factor

The cultural context of the Festive Season drives the entire Indian real estate market, creating a unique synergy between spiritual belief and economic activity that is unmatched globally. The concept of Shubh Muhoorat- an ideal, divinely determined time- is deeply embedded in our collective psyche, and lenders are acutely aware of this phenomenon.

The Power of Tradition: A Spiritual Green Light

Families inherently believe that starting a new, monumental

venture, especially buying or moving into a home, during these

select months guarantees success, prosperity, and abundance.

-

Navratri: Symbolizes the victory of good over evil and the welcoming of new beginnings. Finalising a property deal during this period is seen as conquering the hurdle of debt and entering a phase of growth.

-

Dhanteras & Diwali: These are the twin pillars of wealth and prosperity. Making a significant investment, particularly a house, on Dhanteras is believed to multiply that wealth. This spiritual momentum translates directly into increased consumer confidence and a heightened willingness to commit to a large debt like a home loan.

Many builders strategically align the launch of new inventory, offer special discount packages, or provide specific festive schemes to align with the Shubh Muhoorat for property registration. These schemes are almost invariably coupled with bank tie-ups that include special, limited-time interest rate subsidies or waivers that directly benefit the buyer, further reinforcing the idea that this is the best and most profitable time to transact.

The Economic Reality: Why Lenders Roll Out the Red Carpet

The primary reason the festive season is genuinely better for your finances is the intense, often cutthroat, competitive pressure among financial institutions. This period, typically spanning from Navratri to the New Year, is a prime battleground for market share, forcing lenders to offer real, quantifiable benefits they might not extend during the lean months.

The Rate Wars: Understanding Festive Home Loan Interest Rate Reductions

While the RBI’s repo rate remains the baseline, banks often shave off a few basis points (bps) from their standard offerings during this window-a strategic move to grab the attention of prospective homebuyers.

-

The 5 to 15 BPS Edge: A seemingly small reduction of 5 to 15 basis points on the effective home loan interest rate can translate into significant long-term savings. For example, on a loan of ₹50 Lakh over 20 years, a mere 10 bps drop can save you close to ₹70,000 in total interest paid over the life of the loan. This is pure, non-recoverable savings.

-

The CIBIL Rate Correlation: Importantly, the absolute best rates are almost always reserved for applicants with an immaculate CIBIL score (750+). The festive season makes the competition for these premium customers fiercer, pushing banks to offer their absolute lowest rates to capture this coveted, low-risk demographic.

-

The Hidden Cost of Teaser Rates: Be wary of “Teaser Rates” that offer an extremely low rate for the first year, but sharply increase thereafter, often with a clause that makes switching prohibitively expensive. Butter Money’s Stamp Duty Calculator understands your property costs and help you see the true cost over the full loan tenor, ensuring you compare the actual long-term expense.

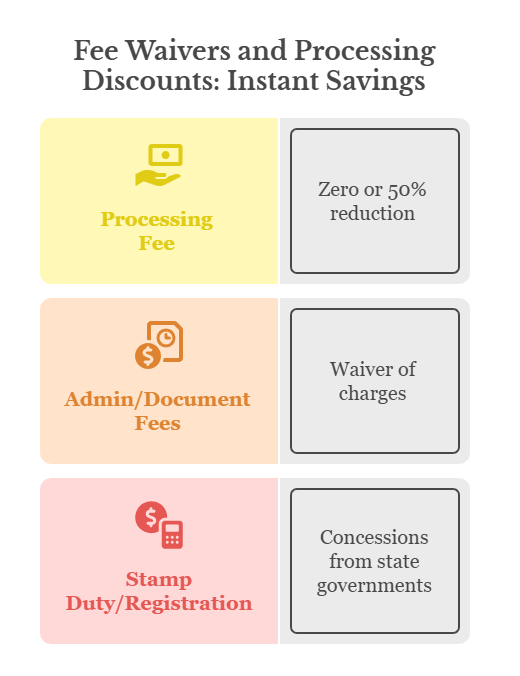

Fee Waivers and Processing Discounts: Instant Savings

This is perhaps the most tangible, immediate saving offered during the festive period, hitting your upfront costs directly.

-

Zero or 50% Processing Fee: Standard processing fees can range from 0.5% to 1.5% of the loan amount. On a ₹75 Lakh loan, this fee could easily be ₹75,000. During the festivals, many top banks reduce this to a flat, low fee (e.g., ₹10,000) or waive it entirely. This is an immediate saving of tens of thousands, which can instead be used for furnishing your new home.

-

Waiver of Administration and Document Retrieval Charges: These smaller, ancillary charges for legal/technical evaluation or document retrieval often add up to a sizable amount. Festive schemes frequently bundle these waivers, offering a genuine “no-hassle,” lower-cost application experience.

-

Stamp Duty and Registration Concessions: While not a bank offer, some state governments occasionally announce temporary reductions or rebates in stamp duty and registration charges during the festive months to boost property transactions. This is a massive potential saving that stacks perfectly with bank offers.

Special Loan-to-Value (LTV) and Eligibility Schemes

Some lenders, in order to meet quarterly or annual targets before the financial year ends, slightly relax their LTV (Loan-to-Value) ratio norms for specific schemes or provide faster sanctioning timelines. This is particularly true for:

-

Salaried Women Applicants: Often qualify for an extra 5-10 bps reduction on the interest rate, which is frequently combined with festive rate drops.

-

Government Employees: Sometimes benefit from relaxed LTV norms or faster processing due to perceived job security.

-

High-Value Properties: Lenders compete aggressively for large-ticket loans, using the festive season to unveil their best, most customized offers.

A Deep Dive into the Financial Checklist: Making the Most of Festive Offers

The excitement of the festive season must be channeled into methodical preparation. Remember, the best offers are temporary, and speed, coupled with accuracy, is of the essence. A delay in your paperwork means missing the low rate window.

CIBIL Score and Festive Season: The Myth vs. Reality

-

Reality Check: Your CIBIL score is more important, not less. The best, most competitive festive rates and lowest interest are reserved for individuals with a flawless credit profile (typically 750+). Banks use these top offers as a bait to capture the most reliable, creditworthy customers. If your score is low, you will likely only qualify for the standard or elevated rates, missing the core festive advantage.

-

Actionable Advice: Use the weeks leading up to any festive season to check your credit report. Rectify any discrepancies, pay off small outstanding debts, and ensure your credit utilization is low. A good CIBIL score is your non-negotiable ticket to the best Diwali home loan deals.

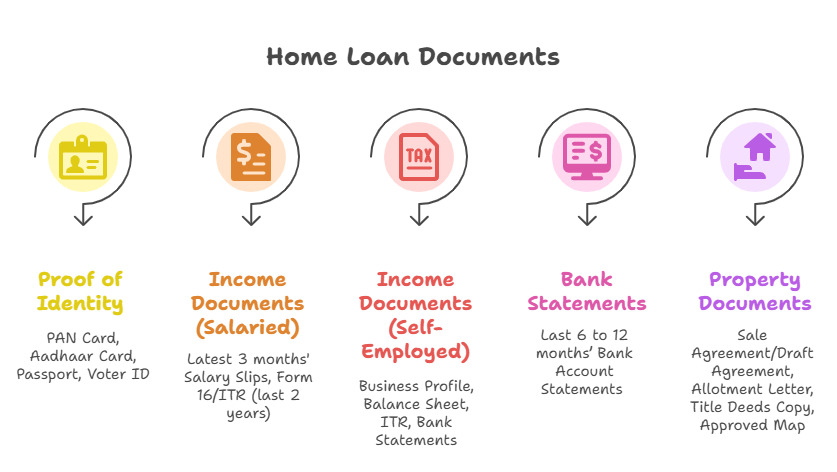

Documentation Readiness: Prepping Your File Before the Rush

The fastest way to miss a great, limited-time festive offer is a stalled application. Banks are swamped during this period. Prepare your home loan documents in advance:

-

Proof of Identity/Address: PAN Card, Aadhaar Card, Passport, Voter ID

-

Income Documents (Salaried): Latest 3 months’ Salary Slips, Form 16/ITR (last 2 years)

-

Income Documents (Self-Employed): Business Profile, P&L Statement, Balance Sheet (last 3 years), ITR (last 3 years), Business

-

Bank Statements: Last 6 to 12 months’ Bank Account Statements (Salary/Main Account)

-

Property Documents (Pre-Sanction): Sale Agreement/Draft Agreement, Allotment Letter (if applicable), Title Deeds Copy, Approved Map

The Art of Comparison: Why All Festive Offers Are Not Equal

A 6.8% rate from Bank A and a 6.75% rate from Bank B might look nearly identical, but the difference often lies in the fine print. You must look beyond the advertised home loan interest rate.

-

Foreclosure and Prepayment Penalties: Are you planning to pay off the loan early? Ensure the festive offer does not introduce a penalty. Crucially, as per RBI guidelines, floating-rate home loans have no prepayment penalty for individual borrowers. You can also figure out your prepayment savings using Butter Money’s prepayment calculator.

-

The Switch from Floating to Fixed: Some festive schemes encourage applicants to lock into a fixed rate. While appealing for stability, compare the fixed rate against the historical performance of the floating rate. Ask about the cost of switching later.

-

Insurance Mandates: Does the lender make home loan insurance mandatory under the festive scheme? Calculate the cost of the premium and add it back to the overall cost of the loan to determine the true Effective Interest Rate.

-

Legal and Technical Fees: Even if the processing fee is waived, the charges for the bank’s mandated legal and technical evaluation of the property are sometimes passed on to the borrower.

-

Sanction Letter Validity: How long is the sanctioned offer (rate, fee waiver, etc.) valid? Given the festive rush, property finalization can take time. Ensure the loan rate is locked in for a sufficient period.

The Butter Money Advantage: Your Digital Home Loan Guru

The sheer volume of festive home loan offers during Diwali and Navratri can create ‘analysis paralysis.’ This is the precise moment when an aggregator like Butter Money becomes indispensable. We are your navigator through the celebratory chaos, ensuring you don’t choose the most advertised deal, but the most profitable deal for your unique profile.

The Aggregator Difference

-

50+ Lenders, 1 Dashboard: Instead of spending your precious festive time visiting 10 bank branches, queuing up, and dealing with conflicting sales pitches, Butter Money compares offers from leading public and private banks, Housing Finance Companies (HFCs), and Non-Banking Financial Companies (NBFCs). We are the central marketplace for all Indian home loan deals.

-

Real-Time Rate Tracking: Festive offers are dynamic-they can change daily or have a limited number of slots. Our platform provides real-time updates, allowing you to lock in the best home loan interest rate the moment it drops and ensure the offer is still active.

Personalized Eligibility

-

Algorithm-Driven Matching: Based on your CIBIL score, income profile (salaried/self-employed), existing liabilities, and location, we filter out offers you won’t qualify for. This saves you weeks of frustration and protects your credit report from multiple “hard inquiries” from mismatched applications, which can harm your score.

-

Exclusive Partner Deals: Due to our high volume and strong partner network, we often secure exclusive deals, accelerated processing timelines, or enhanced fee waivers from lenders that are not available directly to the public. By applying through Butter Money you secure the best festive season home loan available in the market.

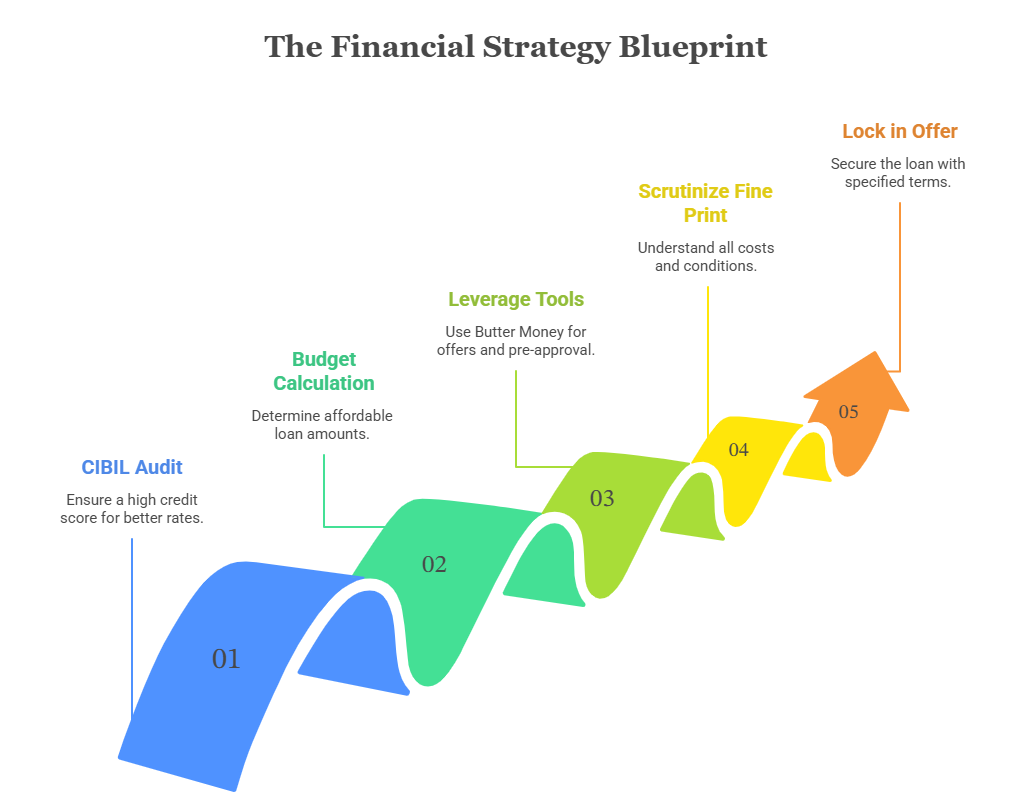

The Financial Strategy Blueprint: A 5-Step Festive Action Plan

A successful festive loan application is the result of methodical preparation. Follow this five-step plan to convert auspicious sentiment into tangible financial savings.

Step 1: The Pre-Festive CIBIL Audit (1 Month Prior): As detailed, ensure your credit score is 750+. Access your report, fix any errors, and settle any outstanding dues. This is the single most critical step to unlocking premium festive rates. A high CIBIL score is your primary negotiation tool.

Step 2: Calculate Your Budget and EMI Tolerance: Use the Butter Money EMI calculator before you even start property hunting or loan shopping. Know the maximum home loan amount you are comfortable servicing, regardless of the bank’s maximum eligibility.

Step 3: Leverage Butter Money’s Tools: Start tracking offers as soon as Navratri begins (typically the start of the festive season). Check for a pre-approval through our platform to understand your precise eligibility and rate before the Diwali rush peaks.

Step 4: Scrutinize the Fine Print (The ‘Why’ Behind the Waiver): If a bank offers 100% processing fee waiver, ask what else they are recovering the cost through (e.g., mandatory insurance, higher conversion fee, or a slightly higher base rate).

Step 5: Lock in the Offer, Not Just the Rate: Ensure the sanction letter clearly specifies the validity period of the Festive Home Loan Offer (the special rate and waivers). Be prepared to submit all final documents promptly to the bank to prevent the offer from expiring before final disbursal.

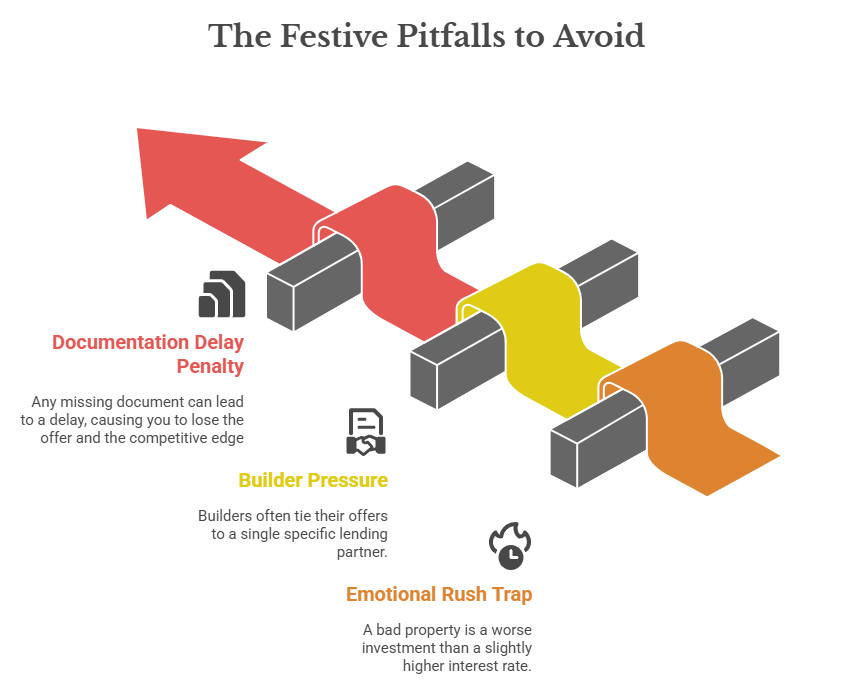

Mitigating the Risks: The Festive Pitfalls to Avoid

While the festive season is beneficial, the intense marketing and time pressure can lead to critical, costly mistakes.

-

The Emotional Rush Trap: Never let the deadline of a Diwali offer override due diligence. Do not rush the verification of the property title, the Occupancy Certificate (OC), or the building’s structural stability just because the loan application window is closing. A bad property is a worse investment than a slightly higher interest rate. Due diligence always comes first.

-

Beware of Builder Pressure: Builders often tie their offers (like free car parking or modular kitchens) to a single specific lending partner. While convenient, this partner may not offer the best home loan interest rate for your profile. Always compare that tied rate against the open-market offers available.

-

The Documentation Delay Penalty: Remember, a loan is sanctioned only when the full, accurate documentation is provided. Banks are under massive pressure during this period. Any missing document can lead to a delay, causing you to lose the offer and the competitive edge, or worse, trigger the high penal charges for delayed submission.

The Underrated Bonus: Maximize Tax Savings with Your Home Loan

The festive season coincides perfectly with the start of your tax planning for the financial year, and a home loan is one of the most powerful tools available to reduce your taxable income under the Old Tax Regime (which many continue to opt for).

Dual Tax Benefits on Home Loans (Section 80C and Section 24(b))

A new home purchase allows you to claim tax deductions on both the principal and interest components of your home loan EMI.

Deduction on Principal Repayment (Section 80C):

-

Benefit: The amount of the EMI that goes towards the repayment of the principal loan amount is eligible for a deduction.

-

Limit: Up to ₹1.5 Lakh per financial year.

-

Note: This deduction is part of the overall ₹1.5 Lakh ceiling under Section 80C, which includes life insurance, PPF, etc.

Deduction on Interest Paid (Section 24(b)):

-

Benefit: The interest component of the EMI is eligible for a separate deduction.

-

Limit: Up to ₹2.0 Lakh per financial year for a self-occupied property. For rented/let-out properties, the entire interest paid is deductible, subject to the overall ‘Loss from House Property’ rules.

The Joint Loan Advantage:

If you and your co-applicant (spouse) take the loan and are co-owners of the property, each person can claim the full deduction limits (₹1.5 Lakh under 80C and ₹2.0 Lakh under 24(b)), effectively doubling the total tax benefit to ₹7 Lakh combined annually! This is a massive, long-term saving that further enhances the financial viability of a festive purchase.

The high interest-saving rates offered during the festive season, combined with these powerful tax deductions, truly make the timing auspicious from a pure wealth-building standpoint.

Conclusion

The answer to the central question-is the festive season a truly auspicious time for your home loan application?-is unequivocally yes. Culturally, it aligns with our deepest traditions of prosperity. Financially, it forces lenders to offer their most competitive products, including genuine rate reductions, fee waivers, and preferential schemes, creating a golden window of opportunity.

However, the auspiciousness is not automatic, it is earned through preparedness, planning, and unbiased market knowledge. The Festive Season creates a temporary market inefficiency that smart buyers can exploit. The key is to separate the celebration from the calculation.

Your first and most strategic step is to visit Butter Money today. Start comparing the thousands of festive season home loan offers available now and find the one that makes your Griha Pravesh both a cultural success and a financial masterpiece.

Unlock the Best Festive Home Loan Offer. Compare Today. Your dream home awaits.

Start your home loan journey now!