Decoding the Loan-to-Value (LTV) Ratio: Your Guide to Smarter Home Financing

Buying a home is one of the biggest financial decisions you will ever make. Whether you’re applying for your first mortgage, refinancing an existing loan, or considering a home equity loan, one key factor influences your borrowing power, interest rates, and overall loan terms—the Loan-to-Value (LTV) ratio.

Despite its importance, LTV often remains a confusing term for many borrowers. But don’t worry—this guide will break it down for you step by step, explaining how LTV works, why it matters, and how you can optimize it to secure better loan terms.

Estimated reading time: 8-10 minutes

Imagine this: You’ve finally found your dream home. The perfect location, the right size, and even a cozy balcony where you can sip your morning coffee. But before you can move in, there’s one major hurdle to cross—financing. As you sit down with your bank representative, they start throwing around terms like “Loan-to-Value Ratio” or “LTV.” You nod along, but deep down, you’re wondering: What does this really mean for me?

If you’ve ever felt lost in the jargon of home loans, you’re not alone. The LTV ratio is one of the most crucial factors lenders use to determine how much money they’re willing to lend you. It affects everything—from your loan approval chances to the interest rate you get. But don’t worry. By the end of this guide, you’ll have a clear, practical understanding of LTV, how it’s calculated, and how you can use this knowledge to make smarter financial decisions.

What is LTV and Why Does It Matter?

At its core, the LTV ratio is a measure of how much of the property’s value a lender is financing compared to your own contribution. Think of it as a risk assessment tool for banks and financial institutions. It is a percentage that represents how much of a property’s value is being financed through a loan and how much is covered by the borrower. It helps lenders assess the risk of lending money and determines the loan terms, including the amount you qualify for, interest rates, and additional conditions like insurance requirements.

The formula is straightforward:

LTV=(Loan AmountProperty Value)×100

For instance, if you’re buying a house worth ₹1 crore and the bank agrees to finance ₹75 lakh, your LTV ratio is 75%.

However, the story doesn’t end with just the loan amount and down payment. There’s another key element—mortgage—that determines how your property is used as security against the loan.

While LTV tells the lender how much of the property is financed, the mortgage secures the loan by using the property itself as collateral.

What is a Mortgage?

A mortgage is a legal agreement where the borrower pledges their property as collateral to the lender. If the borrower fails to repay the loan (default), the lender has the right to seize and sell the property to recover the loan amount.

How Does Mortgage Affect LTV?

Since the lender’s money is tied up in the property, they prefer a lower LTV ratio to minimize their risk. A higher LTV means the lender has more at stake, making them more cautious.

Let’s consider two borrowers, Amit and Neha, who are applying for home loans:

| Borrower | Property Value | Loan Amount | LTV Ratio | Mortgage Risk |

|---|---|---|---|---|

| Amit | ₹1 crore | ₹90 lakh | 90% | High risk—bank may charge higher interest or reject loan |

| Neha | ₹1 crore | ₹60 lakh | 60% | Low risk—bank may offer better interest rates |

Since Amit has a higher LTV (90%), his mortgage comes with a greater risk for the bank. If he defaults and the property value drops, the bank may not recover the full amount from selling the house.

Neha, on the other hand, has a lower LTV (60%), meaning she has invested more in the property upfront. The bank sees her as a less risky borrower and is likely to offer her better loan terms, lower interest rates, and faster approval.

How LTV and Mortgage Affect Loan Terms

When a bank issues a mortgage-backed loan, they consider the LTV ratio carefully. Here’s how different LTV levels impact your loan terms:

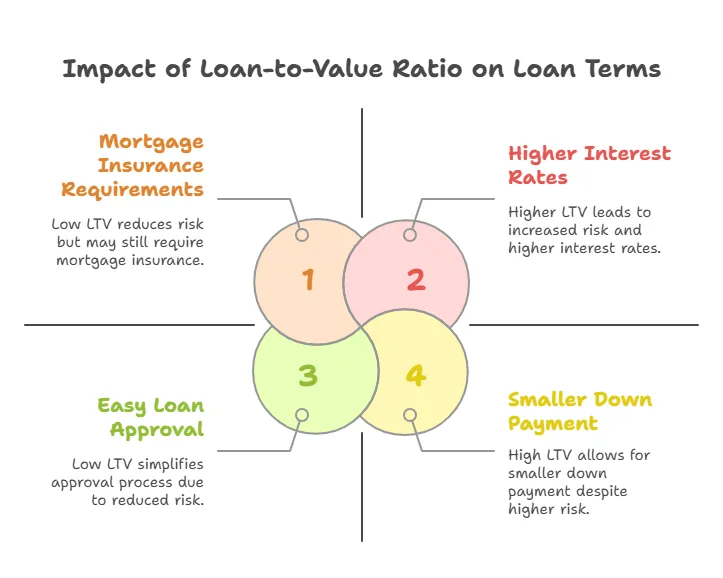

1. Loan Approval

A lower LTV means you’re financing more from your own pocket, making lenders more confident in approving your loan. Conversely, a high LTV may require extra scrutiny, more documentation, or even rejection.

2. Interest Rates

Higher LTV loans pose a greater risk for banks, so they often charge higher interest rates to compensate for the risk. Borrowers with lower LTV ratios may qualify for lower interest rates.

3. Down Payment Requirements

The lower your LTV, the higher your down payment. While this requires more upfront money, it reduces the amount borrowed, leading to lower EMIs and total interest paid over the loan tenure.

4. Mortgage Insurance

If your LTV is very high (usually above 80%), the lender may require mortgage insurance. This is an additional cost meant to protect the lender in case of default.

Why does LTV really matter?

The Loan-to-Value (LTV) ratio is a crucial factor in home financing, determining how much of a property’s value a bank is willing to lend. It impacts everything from loan approval and interest rates to down payments and mortgage insurance requirements. A higher LTV means you borrow more and may face stricter terms, while a lower LTV can help secure better loan conditions. Understanding LTV helps borrowers make informed decisions, optimize loan costs, and navigate the mortgage process more effectively. Let’s break down its key aspects one by one.

- Loan Approval: A lower LTV means the bank is taking on less risk, making it easier for you to get approved. On the other hand, a higher LTV may raise concerns about your ability to repay the loan.

- Interest Rates: The higher the LTV, the higher the risk for lenders. To compensate, they may charge you a higher interest rate. A lower LTV can help you secure better loan terms.

- Down Payment: Your LTV ratio determines how much you need to pay upfront. A high LTV means the bank is financing more, requiring a smaller down payment from you. However, this often comes with trade-offs like higher interest or stricter loan conditions.

- Mortgage Insurance Requirements: In some cases, loans with a high LTV ratio require additional mortgage insurance, adding to your cost.

Understanding these factors is crucial because they shape not just your loan but your overall financial health. A well-thought-out LTV strategy can save you lakhs over the course of your home loan.

Now that you know why LTV matters, the next step is figuring out how to optimize it to your advantage. Whether you’re a first-time homebuyer or an experienced investor, making informed choices about your LTV ratio can make all the difference in your home financing journey.

How Do Banks Determine Property Valuation, and Why Does It Matter for LTV?

When you apply for a home loan, the property valuation process becomes a pivotal step in determining how much money a bank is willing to lend. Since the Loan-to-Value (LTV) ratio is directly linked to the property’s assessed value, understanding how banks determine this valuation is crucial for borrowers.

The Importance of Property Valuation in LTV Calculation

The valuation process ensures that the loan amount accurately reflects the worth of the property, protecting both the borrower and the lender. If a bank overvalues a property, it risks financing more than what the property is worth, which could lead to losses if the borrower defaults. Conversely, if the property is undervalued, the borrower may have to contribute a higher down payment than expected, affecting affordability.

Since property markets fluctuate based on demand, location, infrastructure developments, and economic conditions, banks rely on structured valuation methods to assess a property’s fair market value.

How Do Banks Conduct Property Valuation?

Banks usually hire professional valuers or use their in-house teams to conduct an objective property appraisal. This process involves:

-

Physical Inspection – The valuer assesses factors like location, size, condition, age, legal clearances, and amenities of the property.

-

Legal Verification – Banks check the title deed, encumbrance certificate, land-use permissions, and other legal documents to ensure the property is clear of disputes.

-

Comparison with Market Trends – Valuers analyze recent sales and ongoing price trends in the property’s location.

-

Selection of Valuation Method – The valuer applies the most appropriate valuation method based on the property type and purpose.

Key Valuation Methods Banks Use

Banks rely on three primary methods to determine a property’s value:

1. Market Comparable Approach (Sales Comparison Method)

The Market Comparable Approach is the most common method banks use to determine the valuation of residential properties. It works by comparing the property in question to recently sold properties in the same locality that share similar characteristics, such as size, layout, location, amenities, age, and overall condition. Since property values fluctuate due to market trends, demand-supply dynamics, and infrastructure developments, this method helps lenders establish a fair market price for the property before approving a loan.

How Does the Market Comparable Approach Work?

Let’s say you are buying a 3BHK apartment in South Delhi that is 1,500 sq. ft. and located in a gated community with modern amenities like a gym and swimming pool. To determine the fair market value, the bank will look at similar recent sales in the same neighborhood:

| Property Sold | Location | Size (sq. ft.) | Age of Property | Amenities | Sale Price (₹) |

|---|---|---|---|---|---|

| Property A | Same society | 1,550 sq. ft. | 5 years | Gym, Pool | 1.75 Cr |

| Property B | Nearby society | 1,500 sq. ft. | 10 years | Basic amenities | 1.60 Cr |

| Property C | Same Locality | 1,480 sq. ft. | 3 years | Gym, Clubhouse | 1.80 Cr |

The bank will adjust the value of your property based on these comparisons. For example:

-

If your apartment lacks a clubhouse, the value may be adjusted downward.

-

If it has a newly renovated interior, it might receive a small upward adjustment.

Assuming the bank settles on a valuation of ₹1.70 Cr, your LTV ratio will be calculated based on this amount rather than the seller’s asking price.

Limitations of the Market Comparable Approach

While this method works well in established residential areas, it has some limitations:

-

Lack of Recent Sales – If no similar properties have been sold recently, the valuation may be inaccurate.

-

Unique or High-End Properties – Luxury homes or unique constructions may not have many comparable sales, making valuation tricky.

-

Market Fluctuations – If the market is volatile, a recent sale price may not reflect current property values.

For buyers, this means that if the bank undervalues a property due to a lack of proper comparables, the loan amount offered may be lower than expected. In such cases, negotiation with the lender or requesting an independent valuation can help bridge the gap.

2. Cost Approach (Replacement Cost Method)

The Cost Approach is used to estimate the value of a property based on how much it would cost to rebuild or replace it from scratch using current construction costs. This method is particularly useful for:

-

Newly built houses that have not yet been sold in the market.

-

Properties in developing areas where there aren’t enough comparable sales.

-

Special-use properties like schools, hospitals, or heritage buildings that don’t have standard market sales.

How Does the Cost Approach Work?

This method involves three key steps:

-

Estimate the Replacement Cost - The bank calculates the cost of rebuilding the property using current prices of materials, labor, and construction expenses.

For example, if a 2,000 sq. ft. house would cost ₹2,500 per sq. ft. to build today, the total replacement cost would be ₹50 lakh. -

Factor in Depreciation - If the property is not new, depreciation is applied to account for wear and tear. Depreciation could be based on the age of the building, outdated design, or structural issues.

-

Add the Land Value - Since land doesn’t depreciate, the bank adds the current market value of the land to the equation. For example, if a 10-year-old house has a depreciated replacement cost of ₹45 lakh and the land is worth ₹30 lakh, the final property valuation would be ₹75 lakh.

When is the Cost Approach Most Useful?

-

When comparable market sales are not available.

-

For new constructions where market value is still unclear.

-

When valuing custom-built homes or special-use buildings.

Limitations of the Cost Approach

-

Does Not Reflect Market Trends – If property prices are rising due to demand, the cost approach may undervalue the property.

-

Difficult to Estimate Depreciation Accurately – Older buildings may have hidden issues that affect value.

-

Ignores Supply-Demand Dynamics – Just because a home is expensive to build doesn’t mean buyers are willing to pay that price.

In practical terms, this method is not the best choice for typical homebuyers looking at resale properties, as it does not account for market fluctuations or buyer sentiment.

3. Income Approach (Rental Yield Method) – The Investor’s Choice

The Income Approach is primarily used to value rental properties and commercial real estate. Instead of looking at construction costs or sale prices, this method focuses on the income potential of the property.

How Does the Income Approach Work?

The bank calculates the property’s value based on the rental income it can generate, using two key components:

-

Net Operating Income (NOI) - This is the property’s annual rental income minus expenses like maintenance, property tax, and vacancy losses.

Example: If a property earns ₹5 lakh per year in rent but has ₹1 lakh in annual expenses, the NOI would be ₹4 lakh. -

Capitalization Rate (Cap Rate) - This is the expected return on investment based on market conditions. If similar properties have a cap rate of 5%, the valuation formula is:

Property Value = NOI ÷ Cap Rate

₹4 lakh ÷ 5% = ₹80 lakh

Thus, in this case, the bank would value the property at ₹80 lakh, irrespective of its construction cost or sales comparison.

When is the Income Approach Most Useful?

-

When valuing rental properties or commercial real estate.

-

For investors looking at return on investment (ROI).

-

When market comparables are unreliable (e.g., in developing commercial hubs).

Limitations of the Income Approach

-

Not Suitable for Self-Occupied Homes – A property with no rental income would be undervalued.

-

Rental Yields Can Fluctuate – A property’s value may change if rental demand drops.

-

Assumes Steady Occupancy – If a property has high vacancy rates, its valuation may be inaccurate.

For homebuyers purchasing a self-occupied home, this method is not relevant. However, if you are buying a rental property, this approach provides a clear picture of how much income the property can generate relative to its price.

Which Valuation Method is the Most Suitable?

-

For residential properties, banks prefer the Market Comparable Approach as it reflects real-time property value based on actual transactions.

-

For under-construction or custom-built homes, the Cost Approach is more suitable.

-

For rental properties, banks rely on the Income Approach to assess long-term profitability.

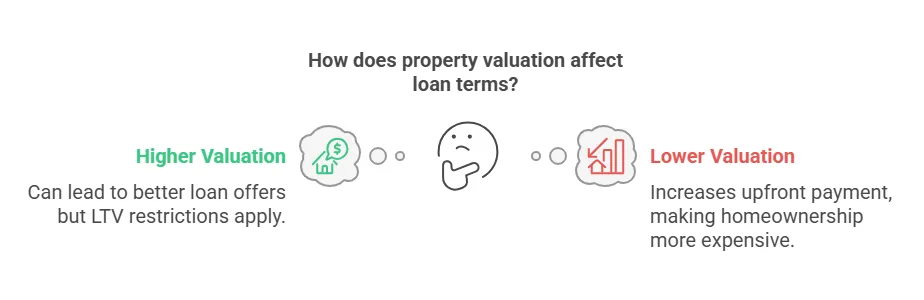

How Valuation Affects Your LTV Ratio

Once your property is valued, the bank uses this figure to determine how much loan they can sanction. This directly influences your Loan-to-Value (LTV) ratio, which is calculated as:

LTV=(Loan AmountProperty Valuation)×100

A higher valuation allows for a higher loan sanction, whereas a lower valuation reduces the loan eligibility. This can significantly impact your financial planning, as it determines how much you need to contribute upfront as a down payment.

What Happens When Property Valuation is Lower Than Expected?

If the bank values your property at a lower price than what you anticipated, your LTV ratio drops. This leads to two key consequences:

1. Reduced Loan Sanction - Since banks lend a percentage of the property’s value, a lower valuation means they will finance a smaller loan amount than you expected.

For example: You apply for an 80% LTV loan on a property you believe is worth ₹1 crore. However, the bank values it at ₹90 lakh instead of ₹1 crore. Instead of getting ₹80 lakh (80% of ₹1 crore), you will now get only ₹72 lakh (80% of ₹90 lakh).

2. Higher Down Payment Requirement - Since the loan amount is lower, you will have to arrange a larger down payment from your own funds.

Using the example above:

If you expected an ₹80 lakh loan, your down payment requirement was ₹20 lakh. But now, with a lower valuation, you only get a ₹72 lakh loan, meaning your down payment increases to ₹28 lakh.

What Can You Do If Your Property Is Undervalued?

-

Request a Revaluation: If you believe the valuation is too low, you can ask the bank to reassess it or provide supporting documents (such as recent sales data of similar properties). Some banks allow a second appraisal using another valuation method.

-

Compare Valuations Across Lenders: Different banks may have different valuation policies. If one bank undervalues your property, another bank may offer a more favorable assessment, allowing you to secure a better loan amount.

-

Increase Your Loan Tenure or Opt for a Different Loan Structure: If arranging a higher down payment is difficult, you can explore loan restructuring options with the bank, such as increasing tenure to reduce EMI burden.

What Happens When Property Valuation is Higher Than Expected?

If the bank values your property higher than anticipated, you might qualify for a larger loan amount. However, this is still subject to RBI-mandated LTV limits, meaning:

-

Even if the valuation is high, banks cannot lend beyond the maximum LTV allowed by RBI (e.g., up to 90% for loans below ₹30 lakh, up to 80% for ₹30-75 lakh, and up to 75% for above ₹75 lakh).

-

Your loan eligibility will also depend on your income, credit score, and repayment capacity—a higher valuation alone does not guarantee a bigger loan.

For instance, You expect your property to be valued at ₹80 lakh,

but the bank values it at ₹90 lakh. If your bank offers 80% LTV,

you may now get a loan of ₹72 lakh instead of ₹64 lakh.

However, if your income and credit profile don’t support a larger

loan, you may still be eligible only for the original amount.

Why Property Valuation is Crucial for Borrowers

A higher valuation can give you a better loan offer, but RBI’s LTV restrictions will still apply. A lower valuation can increase your upfront payment requirement, making homeownership more expensive than planned. Understanding valuation methods and their impact on LTV helps in financial planning and loan negotiation.

If your goal is to maximize your home loan while

keeping your down payment manageable, it’s essential to:

✔ Compare bank valuations.

✔ Ensure your property has proper documentation (clear title,

approved construction plan, etc.).

✔ Choose lenders strategically based on their valuation policies.

Conversely, if the valuation is higher, you may be eligible for a larger loan amount, but this also depends on RBI-mandated LTV limits.

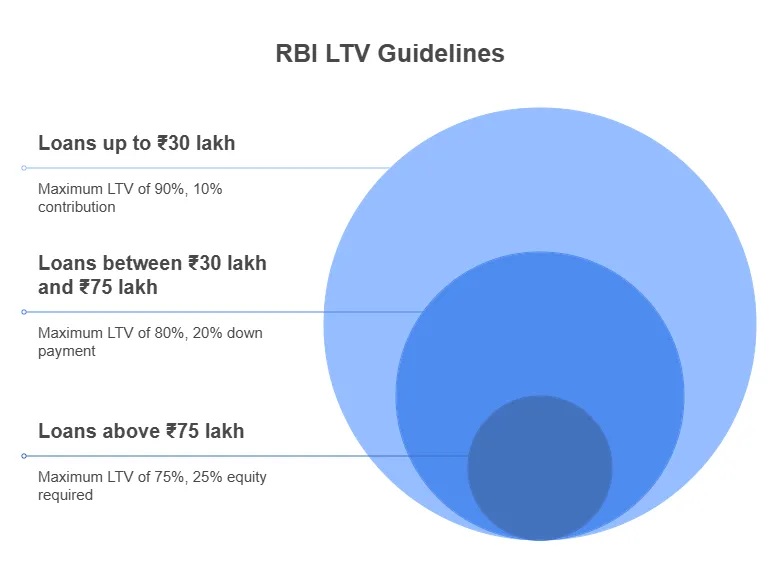

RBI Guidelines on LTV: How Much Can You Borrow?

The Loan-to-Value (LTV) ratio is a pivotal metric in the housing finance sector, representing the proportion of a property’s value that a lender is willing to finance through a loan. To ensure prudent lending practices and maintain financial stability, the Reserve Bank of India (RBI) has established comprehensive guidelines governing LTV ratios for home loans.

RBI’s LTV Ratio Guidelines

The RBI’s directives delineate the maximum permissible LTV ratios based on the loan amount:

-

Loans up to ₹30 lakh: Maximum LTV of 90%, necessitating a minimum borrower contribution of 10%.

-

Loans between ₹30 lakh and ₹75 lakh: Maximum LTV of 80%, requiring at least a 20% down payment.

-

Loans above ₹75 lakh: Maximum LTV of 75%, mandating a minimum borrower equity of 25%.

These tiered limits are designed to balance accessibility to housing finance with the imperative of risk mitigation for lenders. By stipulating higher borrower contributions for larger loan amounts, the RBI aims to ensure that borrowers have a substantial stake in the property, thereby reducing the likelihood of default.

Exclusion of Ancillary Costs in LTV Calculation

A critical aspect of the RBI’s guidelines is the exclusion of ancillary costs—such as stamp duty, registration fees, and other documentation charges—from the property’s value when calculating the LTV ratio. This policy prevents the inflation of the property’s assessed value, ensuring that the LTV ratio accurately reflects the loan amount relative to the property’s intrinsic worth. Consequently, borrowers must account for these additional expenses separately, emphasizing the importance of comprehensive financial planning during the home-buying process.

Risk Weight Assignments Based on LTV Ratios

The RBI also assigns risk weights to home loans based on their LTV ratios, influencing the capital provisioning requirements for banks: Refer here to read more about it in detail https://webtel.in

-

Loans up to ₹30 lakh:

-

LTV ≤ 80%: Risk weight of 35%.

-

LTV between 80% and 90%: Risk weight of 50%.

-

-

Loans above ₹75 lakh:

- LTV ≤ 75%: Risk weight of 50%.

These risk weightings compel banks to allocate capital commensurate with the perceived risk of the loan, thereby promoting responsible lending practices. Higher LTV loans, indicative of greater risk, necessitate increased capital reserves, influencing the bank’s lending capacity and potentially affecting the interest rates offered to borrowers.

Implications for Borrowers

Understanding the RBI’s LTV guidelines is crucial for prospective homebuyers:

- Financial Preparedness: Awareness of the required down payment percentages enables borrowers to assess their financial readiness and plan savings accordingly.

- Loan Eligibility and Terms: A lower LTV ratio can enhance loan eligibility, potentially securing more favorable interest rates and reducing the overall cost of borrowing.

- Comprehensive Budgeting: Recognizing that ancillary costs are excluded from LTV calculations underscores the need for borrowers to budget for these expenses separately, ensuring a holistic approach to financial planning.

The RBI’s meticulously structured LTV ratio guidelines serve as a cornerstone for stability and prudence in India’s housing finance landscape. By delineating clear parameters for loan amounts, borrower contributions, and risk assessments, these regulations safeguard both financial institutions and borrowers, fostering a balanced and sustainable approach to home financing.

For a comprehensive understanding of these guidelines, refer to the RBI’s official Master Circular on Housing Finance.

How Does LTV Impact Loan Sanctions and Home Buying Decisions?

Now that you understand Loan-to-Value (LTV), let’s explore its real-world implications on loan approvals and how it shapes your home-buying strategy.

1. A Higher LTV Means a Smaller Down Payment

LTV directly determines the percentage of the property’s value that the bank is willing to finance. If you secure a 90% LTV loan, the bank funds 90% of the property price, and you only need to cover the remaining 10% as a down payment.

Implications for Homebuyers:

-

Lower upfront cost: This makes homeownership more accessible, especially for first-time buyers who may not have substantial savings.

-

Higher loan burden: Since you are borrowing more, your Equated Monthly Installments (EMIs) will be higher.

-

More lender scrutiny: Higher LTV loans are riskier for banks, leading to stricter credit checks, higher interest rates, or mandatory mortgage insurance.

Imagine you are purchasing a home worth ₹50 lakh. With an LTV of 90%, your loan amount will be ₹45 lakh, and your down payment is ₹5 lakh. With an LTV of 80%, your loan amount reduces to ₹40 lakh, but you must arrange ₹10 lakh as a down payment. While a higher LTV loan helps bridge financial gaps, it increases long-term interest payments and may result in a higher debt burden.

2. A Lower LTV Reduces Your Loan Burden

If you increase your down payment, you can opt for a lower LTV, which reduces the amount you borrow.

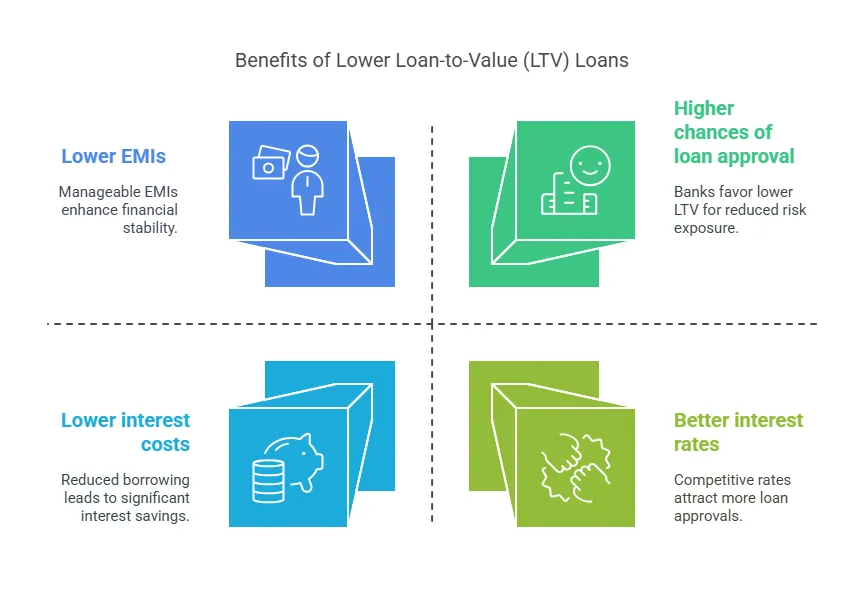

Advantages of a Lower LTV Loan:

Let’s assume the home price is ₹50 lakh, and you have enough savings to increase your down payment. With an LTV of 75%, you borrow only ₹37.5 lakh, reducing your EMI and interest burden. Over a 20-year loan tenure at 9% interest, your total interest payout would be significantly lower than if you had taken a 90% LTV loan. While reducing LTV helps you save, it requires higher upfront capital, which may not be feasible for everyone.

3. Property Type Affects LTV

Banks assess the type of property before determining the LTV ratio. The stage of construction and the nature of the property impact valuation and loan approvals.

LTV for Different Property Types:

-

Ready-to-Move-in Homes → Higher LTV (80-90%)

-

Banks prefer such properties as they carry lower risks.

-

Immediate possession means lower chances of construction delays or abandonment.

-

-

Under-Construction Properties → Lower LTV (70-80%)

-

Since the property is not yet complete, banks perceive it as riskier.

-

If the builder faces financial issues or delays, the property’s actual value may not match the estimated value at the time of sanction.

-

-

Resale Homes → Moderate LTV (70-80%)

-

Age and condition of the property impact valuation.

-

If the property is well-maintained and in a good location, banks may offer a competitive LTV.

-

-

Plots/Land Loans → Lower LTV (50-75%)

-

Plots are considered speculative investments, leading to lower LTV limits.

-

Lenders evaluate factors like the location, zoning regulations, and land title before finalizing the LTV.

-

Key Takeaway:

If you are purchasing a ready-to-move-in home, you can maximize your LTV, but for an under-construction property or land, be prepared for a lower loan amount.

4. Location Matters: Prime Areas Get Better LTV

Banks assess location-based risks before approving a loan. The higher the property’s marketability, the better the valuation, leading to a favorable LTV ratio.

How Location Impacts LTV?

-

Properties in metro cities & premium localities → Higher LTV (80-90%)

-

Strong demand, established infrastructure, and better resale value reduce the lender’s risk.

-

Examples: South Mumbai, Gurgaon, Bangalore’s Whitefield, and other commercial hubs.

-

-

Tier-2 & Tier-3 city properties → Moderate LTV (70-80%)

-

Growth potential exists, but resale value may be uncertain.

-

Banks may assign conservative valuations, limiting the loan amount.

-

-

Rural or poorly developed areas → Lower LTV (50-70%)

-

Due to lower demand and liquidity concerns, banks restrict loan exposure.

-

Limited infrastructure and connectivity reduce the property’s long-term value.

-

A ₹1 crore property in a prime Mumbai location may get an LTV of 90% (₹90 lakh loan), while a similar property in a Tier-3 city may get only 80% LTV (₹80 lakh loan) due to lower demand and resale potential.

Key Takeaway:

If you want higher LTV and a larger loan, opt for a property in a high-demand urban area.

How to Optimize Your LTV Ratio and Secure the Best Home Loan Deal

Your Loan-to-Value (LTV) ratio plays a crucial role in determining how much loan you get, how much interest you’ll pay, and even your overall financial stability. But did you know that you can optimize your LTV ratio to get the best possible loan terms? Here’s a practical guide to help you make smart financial decisions when applying for a home loan.

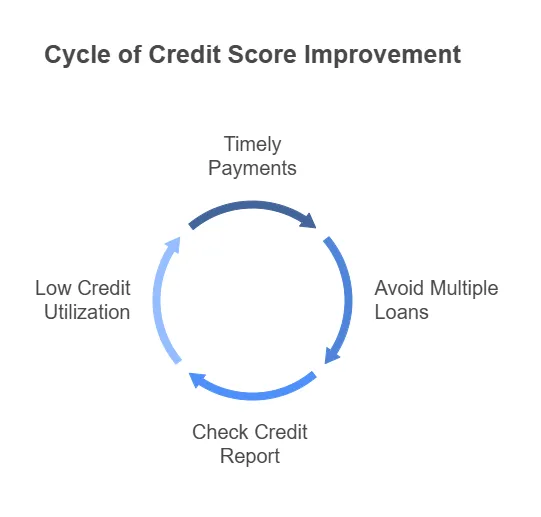

1. Improve Your Credit Score – Your Ticket to Better Loan Terms

Lenders don’t just look at the LTV ratio; they also check your

creditworthiness. A higher credit score (750 and above) makes you

eligible for:

✔ Lower interest rates

✔ Higher loan amounts

✔ Faster approvals

2. Negotiate the Property Valuation – Don’t Settle for the First Quote

Banks assess the value of your property to determine the LTV ratio. However, different banks may value the same property differently. If one lender undervalues your property, you might get a lower loan amount than expected.

How to handle a low valuation?

-

Get a second opinion from another lender and compare their valuation reports.

-

If you believe the valuation is unfair, request a reassessment with additional supporting documents.

-

Work with a professional property appraiser to get an independent valuation before applying.

3. Increase Your Down Payment – The Smartest Way to Reduce LTV

While a higher LTV means you put in less money upfront, it also leads to higher interest payments over the years. If you can afford it, making a larger down payment significantly benefits you in the long run.

Benefits of making a larger down payment:

✔ Lower LTV = Lower interest rates

✔ Smaller EMIs = Less financial burden

✔ Higher chances of loan approval

4. Time Your Purchase Right – Market Timing Can Influence Your LTV

Real estate values fluctuate based on market conditions. If you buy a house when property prices are inflated, your LTV ratio may be less favorable. But if you wait for a dip in prices, you can get a better deal on the property valuation and, ultimately, a better LTV ratio.

When is the right time to buy?

-

Look for market downturns when property prices are low.

-

Watch for government incentives (like lower stamp duties or interest rate cuts).

-

Avoid buying in a seller’s market where demand is high, and prices are inflated.

Final Thoughts: Make LTV Work in Your Favor!

Your LTV ratio isn’t just a number—it directly impacts how much you pay for your home in the long run. By improving your credit score, negotiating property valuation, increasing your down payment, and timing your purchase right, you can optimize your LTV and secure a home loan that works in your favor.

At the end of the day, buying a home is one of the biggest financial decisions you’ll make. So, don’t just accept the first loan offer you get—analyze, negotiate, and plan smartly to get the best deal possible.

Smart borrowers don’t just take loans—they take the best loans!

This is where Butter Money can help you. Click here to get expert advice on securing the best home loan tailored to your needs!

FAQs

-

Is a high Loan to Value Ratio bad?

A high LTV ratio isn’t necessarily bad, but it increases financial risk. While it allows for a lower down payment, it also means higher EMIs, interest rates, and stricter loan terms. If possible, opting for a lower LTV can save you money in the long run. -

What is the ideal LTV?

The ideal LTV ratio depends on your financial situation, but generally, an LTV of 70-80% is considered optimal. It balances affordability (reasonable down payment) with manageable EMIs and better loan terms. Lower LTVs (below 70%) can get you even better interest rates, while higher LTVs (above 80%) may come with stricter conditions and higher costs. -

What is the loan to value ratio(LTV) in a home loan?

The Loan-to-Value (LTV) ratio in a home loan is the percentage of the property’s value that a lender is willing to finance. It is calculated as:LTV = (Loan Amount / Property Value) × 100

For example, if a bank offers a loan of ₹75 lakh for a property worth ₹1 crore, the LTV ratio would be 75%.

A higher LTV means a smaller down payment but higher risk for the lender, often leading to higher interest rates or additional requirements like mortgage insurance. Conversely, a lower LTV can result in better loan terms and lower EMIs.