Master Your Loan Repayments: A Complete Guide to EMI Calculation in Excel

Taking a loan is big financial decision, but understanding EMIs can be overwhelming. How much will you pay each month? Should you choose a longer tenure or higher EMIs? While online calculators give quick estimates, Excel lets you adjust variables, plan prepayments, and compare options. This guide breaks down EMI calculations step by step, helping you make informed financial decisions with ease.

Estimated Read Time: 8-10 minutes

Before we dive in, let’s look at some of the most commonly asked questions on Quora about home loan EMI calculations:

We noticed that many people struggle to find clear, step-by-step answers to these questions. We understand how overwhelming loan repayment planning can be—after all, your financial future depends on it!

That’s why we’ve created this complete guide to help you master EMI calculations using Excel—breaking it down into simple, actionable steps. Let’s get started!

Introduction: Making Loan Planning Simple with Excel

Imagine you’re planning to take a loan for a home, a car, or even personal expenses. One of the first questions that comes to mind is: “How much will my EMI be?” While banks and financial websites offer EMI calculators, wouldn’t it be great if you could calculate it yourself, tweak variables, and plan your finances better?

The good news is, you can! Microsoft Excel provides a simple yet powerful way to calculate your Loan EMI with accuracy. Whether you’re a beginner or an Excel enthusiast, this guide will take you through every step of using Excel for EMI calculations in a simple and engaging manner.

What is EMI and Why Does It Matter?

Understanding EMI (Equated Monthly Installment)

EMI stands for Equated Monthly Installment — a fixed amount you pay every month to repay your loan. Think of it as a structured way of clearing your debt in manageable chunks instead of a large one-time payment.

Every EMI consists of two key components:

Principal — The original amount you borrowed from the lender.

Interest — The cost charged by the lender for allowing you to borrow that money.

The ratio of principal and interest in your EMI changes over time. In the initial months, a major portion of your EMI goes toward interest payments, while toward the later part of your loan tenure, more of your EMI goes toward repaying the principal.

For example, if you take a ₹10 lakh loan for a 5-year tenure at 10% interest, your EMI will be ₹21,247 per month. In the first few months, you might be paying ₹15,000 as interest and only ₹6,247 toward the principal. By the end of the tenure, almost the entire EMI will contribute toward reducing your principal amount.

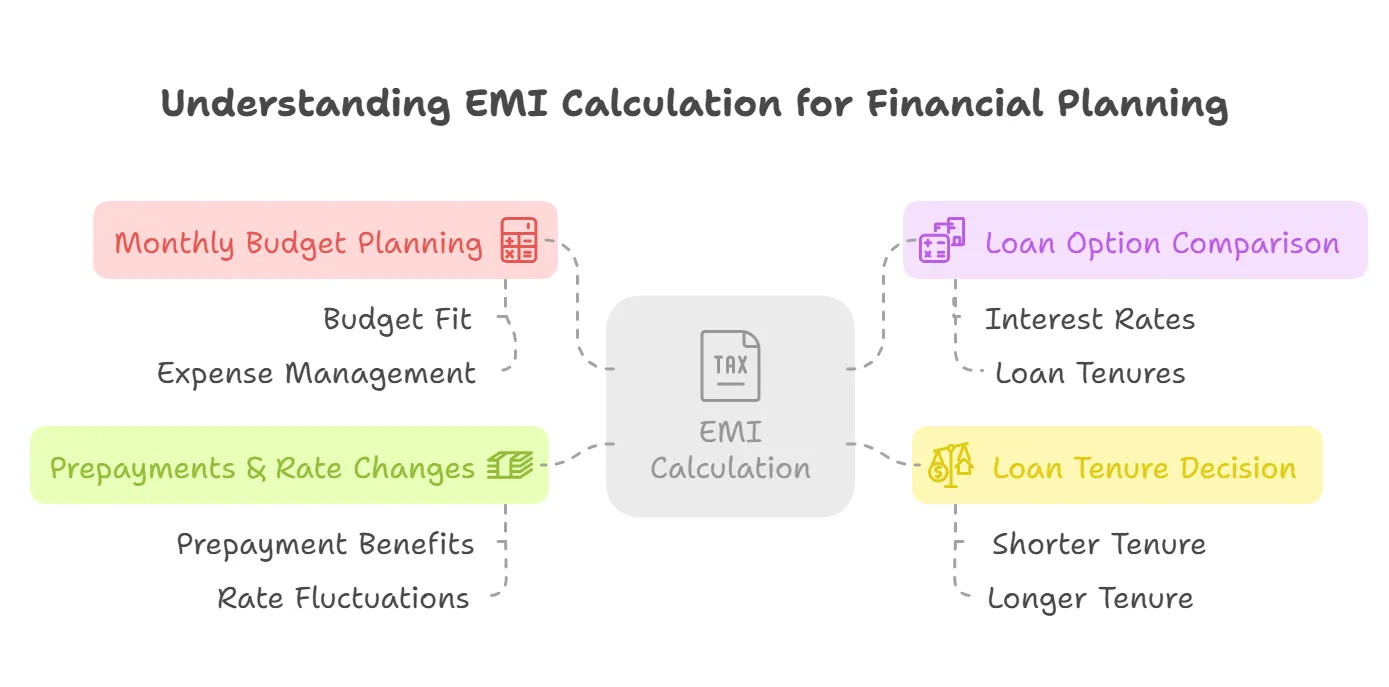

Why Should You Calculate EMI Before Taking a Loan?

Knowing your EMI in advance is crucial for smart financial planning. Here’s how it helps:

-

Plan Your Monthly Budget Better: Imagine committing to an EMI that eats up 50% of your salary—leaving you with little room for other expenses. Calculating EMI beforehand ensures you take a loan that fits within your financial comfort zone.

-

Compare Different Loan Options: Banks and NBFCs offer different interest rates and loan tenures. For instance, a ₹5 lakh loan at 12% interest for 5 years will have a different EMI compared to the same loan for 7 years. Calculating EMI helps you choose the most cost-effective option.

-

Decide on a Comfortable Loan Tenure: A longer tenure means lower EMIs but higher overall interest paid, while a shorter tenure means higher EMIs but less interest paid overall. If you’re comfortable paying a slightly higher EMI, you can save thousands in interest by reducing your loan tenure.

-

Understand the Impact of Prepayments & Rate Changes: If your bank allows partial prepayments, you can recalculate your EMI and reduce your financial burden. Similarly, for floating-rate loans (like home loans), EMI can change based on interest rate fluctuations—calculating it in Excel helps you anticipate the changes and stay prepared.

For example, if you took out a home loan at 7% interest, and the RBI hikes the rate to 8.5%, your EMI will increase. Calculating these variations in Excel helps you see how much extra you’ll be paying and whether you should consider refinancing or prepaying your loan.

By knowing your EMI in advance, you stay in control of your finances rather than letting your loan dictate your budget.

Let’s Understand how EMI is Calculated!

For many people, taking a loan is a big financial decision—whether it’s for buying a house, a car, or funding an education. But when it comes to understanding EMI (Equated Monthly Installment), things start to feel overwhelming. The moment you hear words like interest rates, loan tenure, and principal, your mind might start racing.

“How is my EMI actually calculated?”

“Am I paying too much interest?”

“Would a longer tenure be better?”

If you’ve ever struggled with these questions, you’re not alone! EMI calculations may seem complicated, but once you break them down, they’re actually quite simple to grasp. Let’s decode the process step by step.

The Standard EMI Formula

The standard EMI formula used by banks is

EMI = P×r×(1+r)ⁿ / ((1+r)ⁿ−1)

where:

P = Principal Loan Amount

r = Monthly Interest Rate (Annual Rate / 12 / 100)

n = Loan Tenure in Months

At first glance, this formula might look intimidating. But in simple terms, it helps determine a fixed amount that includes both interest and principal, ensuring that your payments remain uniform throughout the loan period.

How EMI Works in Real Life

Let’s assume you take a loan of ₹10,00,000 at an annual interest rate of 10% for 5 years (60 months).

First, convert the annual interest rate into a monthly rate:

10% ÷ 12 = 0.8333 % per month

= 0.00833

Now plug in the values in the formula:

EMI = 10,00,000×0.00833×(1+0.00833)⁶⁰ / ((1+0.00833)⁶⁰−1)

After solving, the EMI comes out to be ₹21,247 per month.

This means that every month, you will pay ₹21,247 towards your loan. Initially, a larger portion of this amount goes towards interest, while later, more goes towards principal repayment—a concept known as amortization.

Understanding Amortization: How Your EMI is Structured?

When you take out a loan, your Equated Monthly Installment (EMI) isn’t simply a fixed sum that reduces your total loan amount evenly each month. Instead, it follows a financial principle called amortization, which governs how your payments are structured over the tenure of the loan. This process ensures that while your EMI remains constant, its composition—how much goes toward interest and how much repays the principal—changes over time.

At the beginning of your loan tenure, a larger portion of your EMI goes toward paying interest, while only a small fraction contributes to reducing the actual loan balance (principal). This is because interest is charged on the outstanding loan amount, which is at its highest in the initial months. Over time, as the principal reduces with each payment, the interest charged on it also decreases. This shift allows a greater portion of your EMI to go toward principal repayment in later years.

For example, if you take a ₹10 lakh loan for 5 years at 10% interest, your first EMI might include ₹15,000 as interest and ₹6,247 toward the principal. By the last year, most of your EMI will be repaying the principal, and the interest component will be minimal.

Why Understanding Amortization Matters?

-

Helps You See Where Your Money Goes

- Each EMI is split between interest and principal repayment

- In the early years, a significant chunk of your EMI goes toward interest, meaning the actual loan amount reduces slowly.

- Over time, more of your EMI starts repaying the principal, accelerating loan repayment.

-

Makes Prepayment Planning More Effective

- Since interest is front-loaded in an amortized loan, making prepayments early (in the first few years) can significantly reduce your total interest outflow.

- Example: Paying an extra ₹50,000 toward the principal in Year 1 can save you lakhs in interest over the entire tenure.

-

Helps Compare Loan Tenures and Interest Rates

- A shorter loan tenure means higher EMIs but lower total interest paid.

- A longer tenure means lower EMIs but a higher total interest burden.

- Knowing how amortization works helps you pick the right balance between affordable EMIs and lower interest costs.

-

Prevents Loan Traps

- Some borrowers assume that after paying EMIs for a few years, they have repaid a large portion of the loan. However, due to amortization, in the initial years, most payments go toward interest.

- If you refinance or transfer your loan too late, you may end up paying more in interest over time without reducing much of your principal.

-

Helps in Floating vs. Fixed Interest Rate Decisions

- If you understand amortization, you can predict how interest rate changes affect your EMI.

- In floating-rate loans, if rates go up, the interest component of your EMI increases, slowing down principal repayment.

- This knowledge helps you plan when to refinance, prepay, or restructure your loan effectively.

Understanding amortization puts you in control of your finances, allowing you to make smarter loan decisions, reduce interest costs, and avoid common borrower mistakes.

How to Calculate Loan EMI in Excel?

Using the PMT Function

Calculating your loan EMI manually using complex formulas can be overwhelming. Luckily, Excel has a built-in function—PMT (Payment Function)—that helps you calculate EMI in seconds with accuracy and ease.

Understanding the PMT Function

The PMT function in Excel simplifies EMI calculations by automatically applying the standard loan formula and giving you the exact monthly repayment amount. Here’s how it works:

Syntax:

=PMT(rate, nper, pv, [fv], [type])

- rate — The monthly interest rate (Annual Rate / 12)

- nper — The total number of payments (months)

- pv — The loan principal (present value)

- fv — Future value (optional, usually 0 as the loan is fully repaid)

- type — Payment due (0 for end of the period, 1 for the beginning — default is 0)

Now, let’s break this down continuing the same example for better understanding:

Example: EMI Calculation in Excel

Imagine you take a home loan of ₹10,00,000 at an annual interest rate of 10% for 5 years (60 months).

3 Steps to Calculate EMI in Excel

| Step | Formula/Calculation | Result |

|---|---|---|

| Convert Annual Interest to Monthly | 10% ÷ 12 | 0.0083 (0.83%) |

| Convert Loan Tenure to Months | 5 × 12 | 60 Months |

| Use PMT Formula in Excel | =PMT(0.0083, 60, -1000000) | ₹21,247 (EMI) |

(Note: The loan amount is entered as negative (-1000000) because it represents an outgoing payment.)

Your EMI amount of ₹21,247 includes both interest and principal repayment, which changes over time due to amortization. Here’s what happens:

- In the initial months, a larger portion of ₹21,247 goes toward interest payments.

- Over time, as the principal reduces, the interest portion decreases, and more of your EMI contributes to repaying the loan balance.

- For example, in Month 1, the interest might be ₹8,333, and the principal repayment will be ₹12,914. By Month 60, nearly the entire ₹21,247 will go toward principal repayment.

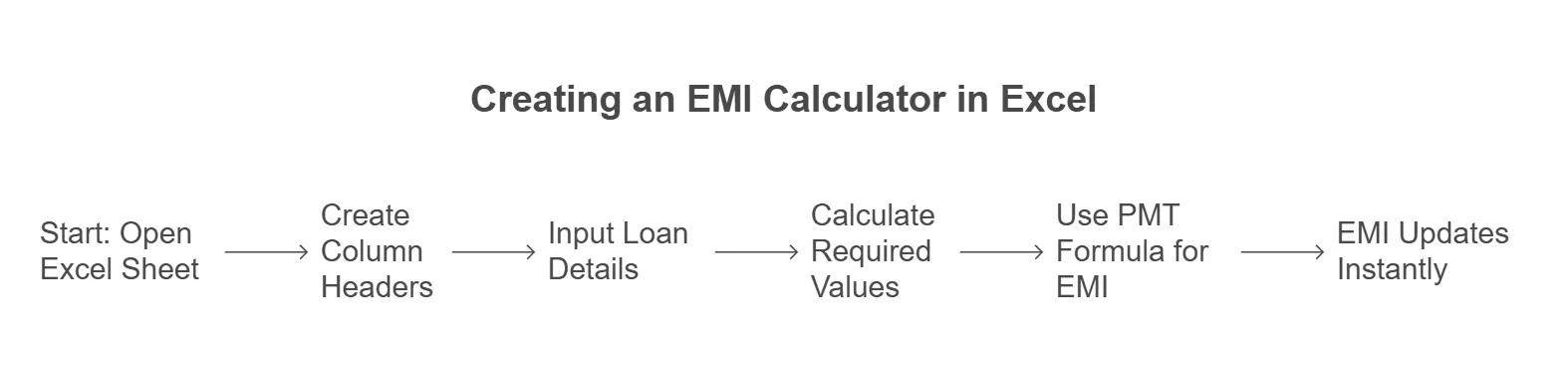

4 Steps to creating an EMI Calculator in Excel (DIY Guide)

Want to build your own interactive EMI calculator? Follow these steps:

Step 1: Create Column Headers

Open an Excel sheet and set up these headers:

- Loan Amount (P)

- Annual Interest Rate

- Loan Tenure (Years)

- Monthly Interest Rate

- Number of Payments (Months)

- EMI Calculation

Step 2: Input Loan Details

Fill in loan details:

Loan Amount: ₹10,00,000 (B1)

Annual Interest Rate: 10% (B2)

Loan Tenure: 5 Years (B3)

Step 3: Calculate Required Values

Monthly Interest Rate (B4) = Annual Rate / 12 →

=B2/12/100

Number of Payments (B5) = Loan Tenure * 12 →

=B3*12

Step 4: Use the PMT Formula to Get EMI

In the EMI cell, enter:

=PMT(B4, B5, -B1)

Now, whenever you change the values, your EMI updates instantly!

(Pro Tip: Use conditional formatting to highlight affordable or high EMI values!)

Get Started Instantly with Our Excel EMI Calculator

We understand that setting up EMI calculations in Excel from scratch can be overwhelming, especially if you’re unfamiliar with formulas and functions. That’s why we’ve collated pre-built Excel sheets to help you calculate your EMI instantly—without the hassle of manual setup!

Click here to access the EMI calculator sheet directly and start planning your loan repayments with ease!

With our ready-to-use EMI calculator, you can:

- Calculate your monthly EMI by simply entering your loan amount, tenure, and interest rate.

- Analyze prepayment impact by adjusting additional payments and seeing how much interest you save.

- Compare different loan options by entering multiple scenarios and choosing the best one for you.

- Track your loan repayment with an automated amortization schedule, breaking down principal and interest payments over time.

5 Simple Steps to use our EMI Calculator:

- Download the sheet and open it in Excel or Google Sheets.

- Enter your loan details — loan amount, interest rate, and tenure.

- View your EMI — the sheet will instantly calculate the monthly installment for you.

- Adjust for prepayments — if you plan to make extra payments, input them to see how they reduce your loan tenure and total interest.

- Compare different loans — change values like interest rates or tenure to analyze the best option for your needs.

💡 Pro Tip: Save a copy of the sheet for future planning or share it with friends who might need help managing their loans. Download now and take control of your finances effortlessly!

Make your life easy with our Ready-To-Use EMI Calculator

If you’d rather skip the hassle of setting up an Excel calculator, grab our ready-to-use EMI calculator and make loan planning effortless!

Total Amount: 1,77,25,312

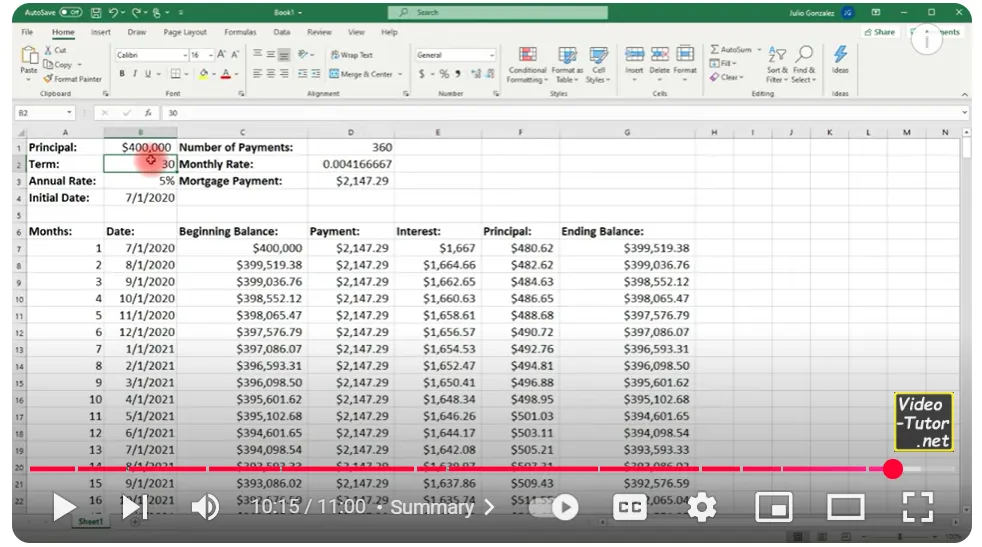

Understanding Loan Repayment: The Amortization Schedule

An amortization schedule breaks down your EMI into principal and interest components.

Here’s a quick video to guide you step by step on creating an amortization schedule and calculating EMI in Excel.

Creating an Amortization Table in Excel

Step 1: List months from 1 to Loan Tenure.

Step 2: Calculate Opening Balance (starting loan amount).

Step 3: Calculate the following -

Interest Paid = Previous Balance * Monthly Rate.

Principal Paid = EMI - Interest Paid.

New Balance = Previous Balance - Principal Paid.

To understand this just input the following values and practice yourself:

Loan Amount: ₹10,00,000

Annual Interest Rate: 8%

Loan Tenure (in months): (e.g., 60 months for a 5-year loan)

Using PMT function as discussed above calculate the monthly EMI = PMT(8%/12, 60, -1000000)

Step 3: Create the loan amortization schedule

| Month | Opening Balance | EMI | Interest Paid | Principal Paid | Closing Balance |

|---|---|---|---|---|---|

| 1 | ₹10,00,000 | ₹20,276 | ₹6,667 | ₹13,609 | ₹9,86,391 |

| 2 | ₹9,86,391 | ₹20,276 | ₹6,576 | ₹13,700 | ₹9,72,691 |

| 3 | ₹9,72,691 | ₹20,276 | ₹6,485 | ₹13,791 | ₹9,58,900 |

Over time, the interest paid decreases while the principal repayment increases.

Click here to access the amortization schedule sheet directly and start planning your loan repayments with ease!

Additional Loan Scenarios You Can Analyze with Excel

Scenario 1: Impact of Prepayments on EMI

Making prepayments reduces the outstanding principal, which lowers the interest burden. Here’s how you can track it:

- Reduce the principal in the closing balance.

- Recalculate EMI or reduce the tenure accordingly.

Example - If you prepay ₹1,00,000 after 12 months, your new EMI or tenure will be lower.

Scenario 2: Comparing Different Loan Offers

Use Excel to compare loan offers with varying interest rates and tenures.

Scenario 3: Floating vs Fixed Interest Rate Loans

Analyze how EMI changes in case of interest rate fluctuations. With a floating rate, your EMI fluctuates based on market conditions, while a fixed rate remains constant.

4 Common Mistakes to Avoid While Calculating EMI in Excel

Excel makes loan calculations simple, but a few common mistakes can lead to incorrect EMI values and flawed financial decisions. Here’s what to watch out for:

Forgetting to Convert the Annual Interest Rate to Monthly

One of the biggest mistakes is using the annual interest rate directly in Excel’s PMT formula. Since EMI is calculated monthly, the interest rate must be divided by 12 before applying it to the formula.

Example Mistake: Using 9% (0.09) instead of 9% ÷ 12 (0.0075) in the formula.

What’s the Fix? Always divide the annual rate by 12 to get the correct monthly rate.

Entering the Loan Amount as a Positive Value in the PMT Formula

In Excel, the PMT function calculates EMI based on the loan amount, interest rate, and tenure. However, if you enter the loan amount as a positive number, Excel will return a negative EMI value, which can be confusing.

Example Mistake: =PMT(0.0075, 240, 5000000) gives EMI as -₹44,986

What’s the Fix? Enter the loan amount as a negative value (-5000000) or multiply the result by -1 to ensure a positive EMI value.

Not Using Absolute References in Formulas for Multiple Calculations

When working with multiple EMI calculations for different loans or interest rates, forgetting to lock reference cells can lead to errors when copying formulas across rows or columns.

Example Mistake: Writing =B2*(C2/12) instead of =$B$2*(C2/12).

What’s the Fix? Use absolute references ($ symbol) where needed to keep key values fixed when dragging formulas.

Ignoring the Amortization Schedule and Only Checking EMI

Many users only focus on the EMI amount without understanding how their payments are split between principal and interest. Without an amortization schedule, you may not realize that interest is much higher in the initial years.

What’s the Fix: Always create an amortization table in Excel to track how each EMI contributes to reducing the loan balance over time.

By avoiding these mistakes, you can accurately calculate your EMI and make smarter loan decisions. Take control of your finances—double-check your formulas and plan wisely!

Final Thoughts: Excel Puts You in Control of Your Loan Decisions

Using Excel for EMI calculations isn’t just about crunching numbers—it’s about taking charge of your financial future. When you understand how your loan repayments work, you can:

- Make informed decisions on loan tenures, interest rates, and repayment strategies.

- Save money on interest by exploring prepayment options and comparing lenders.

- Plan ahead by simulating different scenarios, like floating vs. fixed interest rates.

Now that you’ve learned how to calculate EMI in Excel, why not put this knowledge to use? Open a spreadsheet, input your loan details, and see how different factors—like tenure, prepayments, or interest rates—impact your overall repayment. Small tweaks today can lead to big savings tomorrow!

Pro Tip: Save your EMI calculator template for future loan planning, or share it with friends and family who might be considering a loan. The power to make smarter financial decisions is now at your fingertips—start planning, stay ahead, and take control of your financial journey!

FAQs (Frequently Asked Questions)

-

Can I calculate EMI for a home/car/personal loan using the same method?

Yes, the formula works for all types of loans!

-

What if my EMI amount includes additional charges?

If your EMI includes additional charges (like insurance or processing fees), it increases your total monthly payment but doesn’t reduce the loan principal. Some lenders deduct charges upfront, lowering the effective loan amount. Always check the EMI breakdown to understand what you’re paying for.

-

Are there Excel templates available for EMI calculations?

Yes! Many pre-made templates are available online, or you can create your own using this guide. We have also provided our Ready-To-Use calculator.

Now, go ahead and take charge of your finances!