How Home Loans Can Help You Save Big on Taxes in India

In India, buying a home isn’t just a personal goal—it’s a milestone deeply rooted in aspiration, security, and long-term planning. But beyond the emotional fulfillment of having a place to call your own lies a less talked-about advantage: the significant tax benefits on home loans.

For many, a home loan is seen as a heavy financial burden. In reality, it can be a smart tax-saving instrument and a gateway to wealth creation. When structured strategically, your home loan EMI doesn’t just help you repay your mortgage—it actively reduces your annual tax liability.

For individuals in higher income brackets, this translates to lakhs of rupees saved each year while simultaneously investing in an asset that’s likely to appreciate over time. With rising property values and favorable home loan interest rates, buying a home today can be one of the most rewarding financial decisions you’ll ever make.

Why Buying a Home May Be Smarter Than You Think

The Triple Advantage of Owning a Home

Buying a home gives you:

1. Emotional Security: Stability & Control

Homeownership offers a sense of permanence and peace of mind. Unlike renting, you’re not subject to unpredictable landlord decisions or yearly rent hikes. You have the freedom to customize your space, invest in long-term improvements, and build a home that reflects your lifestyle and aspirations.

In today’s world, especially post-pandemic, people have come to value personal space, safety, and independence more than ever. A home of your own delivers all three.

2. Financial Leverage: Growing Wealth with Borrowed Capital

Real estate is one of the few appreciating assets you can purchase primarily with borrowed money—through a home loan. This is what makes it powerful.

Let’s say you buy a ₹1.5 crore property with a ₹30 lakh down payment. The rest is financed via a home loan. Even if the property appreciates at a modest 7% annually, you earn returns on the entire ₹1.5 crore—not just the ₹30 lakh you invested. That’s the power of leverage.

Plus, as you repay the loan, your ownership increases (through principal repayment), and your asset continues to grow in value. Over time, this creates equity, a foundation for long-term wealth.

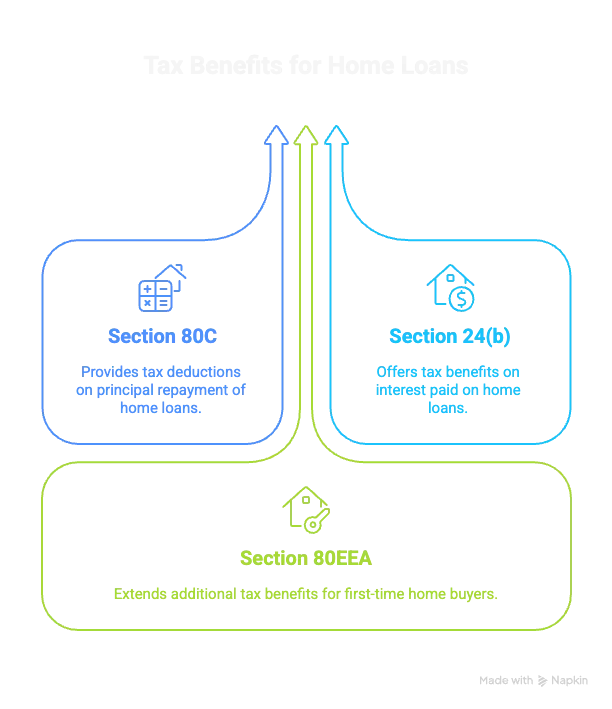

3. Home Loan Tax Benefits: Save Lakhs Every Year

Taking a home loan doesn’t just help you buy your dream house—it can also significantly reduce your tax burden. The Indian Income Tax Act offers multiple provisions that allow borrowers to save money every year by claiming deductions on both the principal and interest components of the loan.

Here’s a quick overview of the three key sections:

- Section 80C: Claim up to ₹1.5 lakh on principal repayment

- Section 24(b): Deduct up to ₹2 lakh annually on interest paid for self-occupied property

- Section 80EE / 80EEA: First-time homebuyers can avail additional interest deductions ranging from ₹50,000 to ₹1.5 lakh, depending on eligibility

Combined, these provisions can help you save lakhs in taxes every year.

In this blog, we’ll delve deep into how each of these sections works, who can benefit from them, and how to maximize your savings. Let’s take a closer look below.

Home Loans as a Tool, Not Just a Burden

Yes, home loans come with long tenures and interest costs, but they also unlock powerful tax-saving mechanisms under the Income Tax Act. Rather than viewing your home loan EMI as a drain on cash flow, think of it as a tax-advantaged investment.

Deductions on principal repayment under Section 80C (up to ₹1.5 lakh), interest payments under Section 24(b) (up to ₹2 lakh), and additional relief for first-time homebuyers under Section 80EEA (up to ₹1.5 lakh) can significantly reduce your tax liability.

These benefits convert your home loan into a strategic lever for financial efficiency, especially in the early, interest-heavy years of repayment.

How Home Loans Help You Save Tax in India

When structured correctly, a home loan is not just a financing tool—it becomes a powerful tax-saving vehicle. The Indian Income Tax Act offers multiple avenues to reduce your taxable income by leveraging your home loan. Here’s a comprehensive breakdown of the key provisions:

Section 80C – Principal Repayment

Under Section 80C, you can claim a deduction of up to ₹1.5 lakh per annum on the principal component of your home loan EMI.

Key Conditions:

-

Property Holding Period: To retain this benefit, the property must not be sold within 5 years from the end of the financial year in which possession is obtained. Selling earlier will lead to reversal of the claimed deductions.

-

Possession-Based: Deductions under this section are allowed only after possession is obtained. If you’re still in the construction phase, the principal repayments made during that period won’t qualify.

-

Shared Limit: The ₹1.5 lakh deduction is not exclusive to home loans. It includes other investments like EPF, PPF, NSC, life insurance premiums, ELSS, children’s tuition fees, etc.

So, if you’re already maxing out this limit through other means (e.g., salaried individuals contributing to EPF), the tax benefit on home loan principal repayment may be partial or nil.

Implication: While this section does provide relief, the real advantage often comes into play when your other 80C-linked investments are optimized or limited.

Section 24(b) – Interest on Home Loan

This is where the bulk of the tax-saving potential lies. Section 24(b) allows a deduction of up to ₹2 lakh per annum on the interest component of your home loan for a self-occupied property.

Key Provisions:

-

For Rented/Deemed Let-Out Property: There is no upper cap on the interest deduction. However, under current rules, the maximum loss from house property that can be set off against other income (like salary or business) is capped at ₹2 lakh per year. The excess loss can be carried forward for up to 8 years, but it can only be adjusted against future house property income.

-

Construction Timeline: The property must be acquired or construction completed within 5 years from the end of the financial year in which the loan was taken. If not, the eligible deduction reduces from ₹2 lakh to just ₹30,000 per year.

-

Pre-construction Interest: Interest paid before possession is not lost. It can be claimed in five equal annual installments starting from the year of possession, subject to the ₹2 lakh cap.

Real-World Relevance: For high-income earners with large loans (e.g., ₹1.5 crore and above), the interest outflow in the early years can exceed ₹7–9 lakh annually. Although capped, the ₹2 lakh deduction still delivers a tax saving of up to ₹62,400 per year (at 31.2% tax rate).

Section 80EE and 80EEA – Additional Benefits for First-Time Buyers

To encourage affordable housing and homeownership, the government offers supplementary deductions under Sections 80EE and 80EEA.

Section 80EE (Legacy Provision)

- Deduction Limit: Up to ₹50,000 per year

-

Eligibility:

- Loan amount ≤ ₹35 lakh

- Property value ≤ ₹50 lakh

- Loan sanctioned between April 1, 2016, and March 31, 2017

- Applicant must be a first-time homebuyer

- Not Repeatable: Once claimed, this benefit cannot be availed again on future purchases.

Section 80EEA (More Recent Provision)

- Deduction Limit: Up to ₹1.5 lakh per year, in addition to the ₹2 lakh under Section 24(b)

-

Eligibility:

- Loan sanctioned between April 1, 2019, and March 31, 2022

- Stamp duty value of the property ≤ ₹45 lakh

- Applicant must not own any residential property at the time of sanction

- Not claiming deduction under Section 80EE

Important Distinction: These sections are targeted at budget home buyers. For premium properties (e.g., ₹1.5 crore), these deductions do not apply. However, understanding them helps in planning for a smaller second property, either for personal use or investment.

Summary Table

| Section | Component | Maximum Deduction | Key Eligibility |

|---|---|---|---|

| 80C | Principal Repayment | ₹1.5 lakh | After possession; part of 80C cap |

| 24(b) | Interest Payment | ₹2 lakh | Self-occupied; possession in 5 years |

| 80EE | Interest (additional) | ₹50,000 | 1st home; loan ≤ ₹35L; prop ≤ ₹50L |

| 80EEA | Interest (additional) | ₹1.5 lakh | 1st home; prop ≤ ₹45L; loan ≤ 3/22 |

Real-Life Tax Saving Examples

Case Study: Meet Rohit — The Smart Homebuyer Leveraging Tax Benefits

Rohit is a 35-year-old software professional living in Mumbai. Earning a solid ₹45 lakh per annum, he had been renting a comfortable apartment for years. But Rohit dreamed of owning his own home — a place to call his own and an investment for the future.

After some research, Rohit decided to buy a property worth ₹2.5 crore. As a first-time homebuyer, he took a home loan of ₹1.5 crore at an interest rate of 8.5% per annum, opting for a 20-year tenure. His monthly EMI came to around ₹1.30 lakh (₹15.6 lakh per year).

Year 1: The EMI Breakdown and Tax Benefits

In the first year, Rohit paid approximately ₹12.6 lakh as interest and ₹3 lakh as principal repayment. While the monthly EMI might have felt like a significant expense, Rohit knew the home loan came with tax advantages that would ease his financial burden.

How Rohit Saved Tax on His Home Loan

| Section | Component | Amount Claimed | Tax Savings (Approx. at 30% slab) |

|---|---|---|---|

| 80C | Principal Repayment | ₹1.5 lakh | ₹45,000 |

| 24(b) | Interest Deduction | ₹2 lakh | ₹60,000 |

| Total | — | — | ₹1.05 lakh per year |

What Does This Mean for Rohit?

Though Rohit pays ₹15.6 lakh annually in EMIs, he effectively recoups over ₹1 lakh each year in tax savings alone. Over a 10-year period, this adds up to a substantial ₹10 lakh in tax benefits—not even counting the potential appreciation in property value.

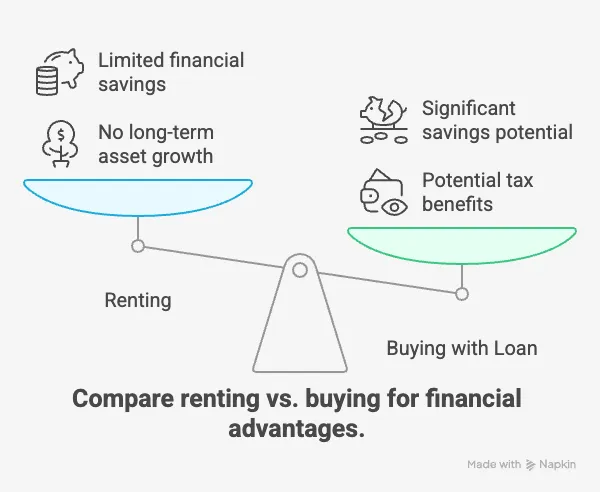

Renting vs. Buying: Why Rohit’s Decision Makes Financial Sense

Before buying, Rohit was paying ₹60,000 monthly in rent (₹7.2 lakh per year). While he could claim House Rent Allowance (HRA) benefits, these were limited and capped, especially given his high income.

By choosing to buy instead, Rohit not only gained:

- Ownership of a valuable asset with potential capital appreciation

- But also saved ₹1.05 lakh annually in taxes through home loan deductions

Building Long-Term Wealth: Rohit’s Smart Financial Moves

Rohit isn’t stopping at tax savings. He plans to:

- Reinvest his tax savings wisely, boosting his investment portfolio

- Use home loan calculators to consider refinancing if better mortgage rates appear

- Explore joint home loans with his spouse to maximize deductions

- Treat his home as both a personal haven and a financial asset

Through this thoughtful approach, Rohit turns what might seem like a heavy EMI burden into a strategic tool for wealth creation and tax efficiency.

Moral of the story? Like Rohit, high-income earners can harness the power of home loan tax benefits not just to own a home, but to optimize their financial health and build lasting wealth.

Renting vs. Buying with Tax Benefits

If the same individual were paying ₹60,000/month in rent (₹7.2 lakh/year), he wouldn’t get any tax relief beyond HRA (capped for high-income earners). In contrast, the home loan yields:

- Ownership + Asset Appreciation

- ₹1.05 lakh in annual tax savings

- Long-term capital gains opportunity

Thus, even factoring in mortgage interest, buying with home loan tax benefits is significantly more rewarding for individuals in higher tax brackets.

Long-Term Wealth Building Through Smart Tax Planning

By:

- Reinvesting tax savings

- Leveraging home loan calculators to plan refinancing

- Switching to better mortgage rates

- Maximizing joint home loan tax benefits (if applicable)

you build wealth efficiently. Real estate, backed by intelligent tax deduction on home loans, becomes a long-term asset—serving both personal and financial goals.

How to Maximize Your Tax Benefits from Home Loans

Strategic planning around your home loan isn’t just smart — it’s essential. The Income Tax Act offers generous deductions, but to truly benefit, you need to align your financial decisions with these rules. Here’s how to do it effectively:

Choose the Right Loan Structure

1. Opt for a Joint Home Loan (If Applicable)

When you take a home loan jointly — for example, with your spouse — and both individuals are co-owners and co-borrowers, each one can claim:

- Up to ₹2 lakh on interest under Section 24(b)

- Up to ₹1.5 lakh on principal repayment under Section 80C

That’s a combined potential tax saving of ₹7 lakh (₹3.5 lakh × 2) — a major boost for salaried households.

2. Optimize Loan Tenure

- A longer tenure lowers your EMI, which improves affordability and cash flow

- However, it also means you pay more interest over time, which could be claimed under Section 24(b) — if you’re eligible

- Strike a balance: higher EMIs now may reduce interest costs and loan tenure overall

3. Refinance When Rates Drop

Interest rates fluctuate. If current market rates are lower than your loan rate, consider refinancing or transferring the loan to a different lender.

This lowers interest burden and can reduce your taxable income, especially if you’re early in the loan tenure (when interest dominates EMI).

Time Your Purchase Strategically

1. Claim Deductions Only After Possession

Tax benefits under Sections 80C and 24(b) kick in only after you’ve received possession of the property. If you’re paying EMIs before this, you’re not eligible for deductions yet.

2. Consider Advanced Construction or Ready-to-Move Homes

Buying a home nearing possession or ready-to-move can help you start claiming deductions sooner, rather than waiting years for the property to be ready.

3. Under-Construction Property Interest - Use 5-Year Rule

Interest paid on the loan before possession (during construction) isn’t wasted.

You can claim it in five equal installments starting from the year of possession under Section 24(b), capped within the ₹2 lakh limit for self-occupied homes.

Consult a Tax Advisor or Use Tax Filing Tools

The home loan tax landscape has multiple conditions and limits. Even small errors — like missing documents or filing in the wrong section — can mean lost tax benefits.

Key Documents You’ll Need:

- Home loan sanction letter (proof of loan approval and terms)

- EMI statements (for principal vs. interest breakup)

- Interest certificate from the lender

- Possession certificate or occupancy certificate

- Registration and stamp duty receipts (some portions are deductible under Section 80C)

Tip: A qualified tax advisor or reliable online tax-filing tool can:

- Accurately compute and apply your deductions

- Prevent loss of benefits due to incorrect filings

- Notify you about new rules, caps, or budget changes affecting home loan tax benefits

Bottom Line: Maximizing your home loan tax benefits is not automatic — it requires thoughtful planning, regular reviews, and proactive actions like choosing the right co-borrower, refinancing, and using available deductions strategically. When done right, your home loan can work with you, not against you, in your wealth-building journey.

Conclusion

A home loan is much more than a financing mechanism—it’s a powerful tax-saving and wealth-building tool. When you leverage tax benefits on home loans available under Section 80C, Section 24b, and other provisions smartly, you don’t just buy a home—you invest in your financial freedom.

Whether you’re a high-income salaried individual or a savvy investor, using your home loan EMI to unlock tax deductions can create long-term savings, reduce your tax burden, and boost your net worth.

Ready to take the next step? Use a home loan EMI calculator on Butter Money and start exploring the best home loan options to turn your financial liabilities into strategic assets.

Frequently Asked Questions

1. Can I claim 100% tax benefit as a co-owner?

Yes — but only if you also contribute 100% of the repayment.

If you’re a co-owner and co-borrower, and you’re the sole one paying the EMIs, you can claim the full tax benefit on both interest (under Section 24(b)) and principal repayment (under Section 80C).

If both co-owners share the EMI, the benefit must be split in the same proportion as repayment.

2. Can I claim both HRA and home loan benefits?

Yes — if you meet both conditions.

You can claim:

- HRA (House Rent Allowance) if you’re living in a rented house

- Home loan benefits (Sections 80C & 24(b)) if you own another property

Common case: You own a house in one city (under loan) but live on rent in another city for work — you’re eligible for both benefits.

3. Can I claim both 80C and 80D?

Absolutely.

These are for different expenses:

- Section 80C: For investments and principal repayment (like PPF, ELSS, life insurance, home loan principal) — up to ₹1.5 lakh

- Section 80D: For medical insurance premiums — up to ₹25,000 (₹50,000 for senior citizens)

These deductions are independent and can be claimed together.

4. What are the tax benefits on home loans — Section 24, 80EE, and 80C?

Here’s a simple breakdown:

| Section | What It Covers | Max Deduction | Conditions |

|---|---|---|---|

| 24(b) | Home loan interest | ₹2,00,000 | Only after possession; property must be self-occupied |

| 80C | Home loan principal repayment | ₹1,50,000 | Property must not be sold within 5 years |

| 80EE | Extra interest for first-time buyers | ₹50,000 | Loan ≤ ₹35L; Property ≤ ₹50L; sanctioned before 31 Mar 2017 |

| 80EEA | Additional interest for first-time buyers | ₹1,50,000 | Property ≤ ₹45L; Loan sanctioned between Apr 2019–Mar 2022; not claimed 80EE |

5. Is LIC under 80C or 80D?

LIC premiums (Life Insurance Corporation) are covered under Section 80C, not 80D. 80D is for medical/health insurance premiums, not life insurance.

6. Can we claim both 80C and 80TTB?

Yes, if eligible.

- 80C covers investments, insurance, and home loan principal

- 80TTB is for senior citizens (60+) and allows deduction on interest from bank deposits (up to ₹50,000)

7. Can I claim both 80EE and Section 24?

Yes, if you meet the conditions.

- Section 24(b): ₹2 lakh deduction on interest

- Section 80EE: Additional ₹50,000 interest deduction for first-time buyers, subject to conditions (loan ≤ ₹35L, property ≤ ₹50L, sanctioned before 31-Mar-2017)

8. Can I claim both 24(b) and 80GG?

No, not usually.

- Section 24(b) is for homeowners claiming interest deduction

- 80GG is for those paying rent but not receiving HRA and not owning any home

You can’t claim both unless there are two separate residential situations (rare).

9. Which tax regime to choose if you have a home loan?

Old regime is generally better if you’re claiming:

- Home loan benefits (80C + 24b)

- Other deductions (80D, HRA, etc.)

But you should compare both using a tax calculator for your actual income and deductions.

10. Is a home loan under 80C or 80D?

- Home loan principal repayment is under Section 80C

- Home loan interest is under Section 24(b)

- 80D is for medical insurance, not related to home loans

11. Which tax regime is better for ₹30 lakh salary with a home loan?

Likely the old regime, if you:

- Claim ₹2 lakh under 24(b)

- Claim ₹1.5 lakh under 80C

- Claim 80D and other deductions

But run both scenarios to be sure — tax software or your CA can help compare.

12. Is home loan interest exempted in the new tax regime?

No. Section 24(b) benefits are not available under the new regime. You lose home loan tax deductions if you opt for the new regime.

13. How much tax will reduce if I take a home loan?

It depends on your tax slab.

- If in the 30% slab, ₹2 lakh deduction under Section 24 saves up to ₹62,400

- ₹1.5 lakh under 80C saves ₹46,800

Combined, you could save up to ₹1.09 lakh per year in the old regime