Understanding and Unlocking Your Home Loan Eligibility

By Mansvi Prajapati

Buying a home in India can feel overwhelming, but understanding home loan eligibility is your first big step. Butter Money simplifies this with our new Eligibility Calculator and clear guidance.

Lenders evaluate your income and employment stability, ensuring you can comfortably repay. Your CIBIL score helps improve your chances for better interest rates. The Debt-to-Income (DTI) ratio shows your capacity for new debt. Factors like your age, desired loan tenure, and property details also play a role, and a co-applicant can significantly boost your eligibility.

Finally, organizing your documents and comparing lender offers

wisely are key to a smooth home loan application process. Butter

Money is here to help you navigate these “stepping stones” to

homeownership with confidence.

.

Estimated Read Time: 10-12 minutes

Envisioning your own home in India? Big dreams. Big feelings. And, well, a good deal of confusion as to whether one is eligible for a loan. We have been there; it’s for this very reason that Butter Money was born: to cut through the jargon, team up, and help people own homes confidently.

Now, we’ve gone a step further by launching the brand-new Eligibility Calculator, available at https://butter.money/eligibility. It’s fast, simple, and provides real answers to your home loan questions.

First things first: let’s understand what home loan eligibility really means, why it really matters, and what can be done to take charge of this process and maybe have some fun along the way!

Eligibility Flow: Stepping Stones to a Financial Life

At Butter Money, we always hold this philosophy: “You’re supposed to be able to grasp your home loan eligibility facts without going through a complex maze.” It is never just about a “yes” or a “no.” Rather, it is the journey of transformation. Imagine our eligibility flow is a layer of stepping stones that the user begins from that initial, uneasy thought of:

“I’m not sure if I can buy a home… is this even possible for me?”

To a more empowering realization of:

“Yes! I am home-loan-ready, and here’s exactly what my next steps are.”

This blog will focus on everything regarding the home loan eligibility flow, from income and employment criteria to credit score, debt-to-income ratio, age, property specifications, and documentation. Some useful tips and tricks for an advantage will also be shared during the home loan application.

Let us go on this journey! As we wind up this blog, you’ll have a definite understanding of what lenders want and, most importantly, Butter Money will help you get through the process without any hassle.

The Foundation – Your Income and Employment

Incomes are not just mere numbers. They form the basis for the whole house-owning aspiration. If one is given the ability to pay for a home loan continuously, it would be a great source of income. This happens to be one of the highest deciding factors for lenders in association with candidates’ eligibility.

Why Do Lenders Care?

The primary question for banks and financial institutions remains: Can the candidate afford to pay back the loan without going into financial stress? Gross income is a variable that determines your repayment capacity hence a stable income puts less risk onto the lenders. To put this simply, they want to confirm that meeting EMI monthly obligations will not strain you much. Lenders in India usually consider your net income on a monthly basis and your stability of employment and other income sources while determining your eligibility.

Key Income Components Lenders Look For

1. Net Salary

This is the simplest income type for net salary earners. Lenders generally use your net salary as a benchmark for determining eligibility. Usually, a loan of up to 60 times the monthly net income of a borrower can be sanctioned by banks.

2. Bonuses & Incentives

Long-term bonuses and incentive performance payments are also considered by lenders when evaluating income eligibility, but the more consistent and documented the bonuses, the more favorable their view will be.

3. Allowances

Some allowances that an employee may be offered are House Rent Allowance (HRA), Conveyance Allowance, and Special Allowance. They usually consider the HRA component of your salary as income eligibility, provided you give proof that you are staying in rented accommodation. They usually disregard other allowances like travel reimbursement, except when you can prove that it is part of your regular income.

4. Other Income Sources

Rental income, dividends, or income from freelance work would work under other sources of income. In addition to that, a self-employed person will rely on his business income per se to aid and strengthen his eligibility for the home loan. Non-salary incomes can thus increase your eligibility but that would be presuming these incomes are regular and that you have the right evidence to prove them.

Employment Stability: The Unsung Hero

For Salaried-Individuals:

Lenders like stability in your employment history. If you have been working for the same company for more than 2 years and even up to 3 years or in a reputed company such as an MNC, PSU, or any large private company, your loan would almost automatically get approved. Changing jobs frequently signals instability, which in turn would make it difficult for you to get a loan.

Self-Employed Individuals:

Through the analysis of income statements and business stability, lenders establish an understanding of your status as a self-employed professional, whether you might be a doctor, a lawyer, or an entrepreneur. Self-employed individuals must ideally have been profitable for at least two to three years, and the profitability should be verifiable through an audited Profit & Loss (P&L) statement and Balance Sheet. Lenders also view Income Tax Returns (ITR) as evidence of the financial standing of your business.

Ways of Strengthening Income Profile:

- For salary earners, it is the steady employment profile with a prestigious employer that matters.

- For the self-employed, showing consistent profitability together with a proper book of accounts is of importance.

- You may want to explore the option of a co-applicant who has a steady income.

The Score That Speaks Volumes – Your CIBIL Score

Your CIBIL score is like a financial report card, and it becomes the defining point for your home loan eligibility. It describes your creditworthiness and how you purchased or repaid your existing credit. A high score means a person is deemed to be a lower risk borrower-if you have higher scores, you will be able to get bigger loan offers and better terms.

What is CIBIL?

A CIBIL score is a three-digit number (between 300 and 900) that, when considered by lenders, measures your creditworthiness. So, if one’s CIBIL score goes higher, he/she will be more likely to get a loan with a lower interest rate.

Why Is It Crucial for Home Loans?

Lenders use your CIBIL score to measure how risky it would be to lend money to you. A high score means that you are a responsible person who pays bills on time. Lower score means that you might be in some financial instability, putting you either through the gates of higher interest rates or outright rejection.

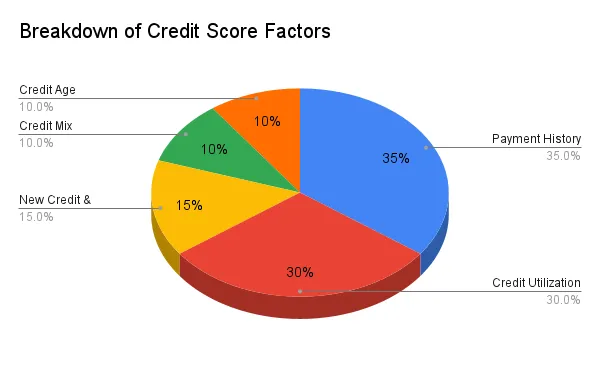

What Are the Variables of CIBIL Score?

The score considers varied factors. Here is the breakdown of these factors:

-

Payment History-35%

In fact, the largest part of the score will be decided by your record of paying your bills, EMIs, etc., on time. Any default, missed payment, or delayed payment will severely affect your score. -

Credit Utilization-30%

Basically, this factor calculates how much you use out of your credit limit. It is best to maintain an acceptable credit utilization rate, though, which means below 30%, as it means you are not over-relying on credit. -

Credit Mix-10%

A solid mixture of securities credits (such as home loans, car loans), along with unsecured credits (such as credit cards, personal loans), has had a positive impact on your score. -

Credit Age-10%

The more you have a history of responsibly managing credit, the better it reflects on your score. One must refrain from closing old accounts, for credit history length remains vital in building a good score. -

New Credit & Enquiries-15%

Having multiple loan applications or inquiries recently could affect your score. Lenders may assume that you are overwhelmed with debt and will not lend to you.

What’s a Good CIBIL Score for a Home Loan?

- 750+: This score comes with an implication of being a good credit score. Loans are likely to be offered with the best terms and competitive interest rates.

- 700-750: Good. Loans can be obtained but with a couple of extra basis points of interest.

- Below 700: Considered risky. There may be outright rejection or acceptance charges at high interests.

How to Improve Your CIBIL Score:

- Pay dues on time: Make sure all dues, including credit card dues, personal loans, and EMIs, are paid on time. The score takes a huge knock even if a single payment is missed.

- Keep credit utilization low: Aim to utilize less than 30% of your available credit limit.

- Monitor your credit report regularly: In case of discrepancies or errors, dispute them immediately.

- Avoid taking out too many loans at once: Each loan application leads to a “hard inquiry” on your credit report, and too many inquiries can drag down your score.

The Balancing Act - Your Debt-to-Income Ratio (DTI)

Your Debt to Income Ratio is one of the most important factors in determining whether you’ll be considered for a home loan. It measures how much of your income is already committed to paying off existing debt and how much is free to take on a new loan.

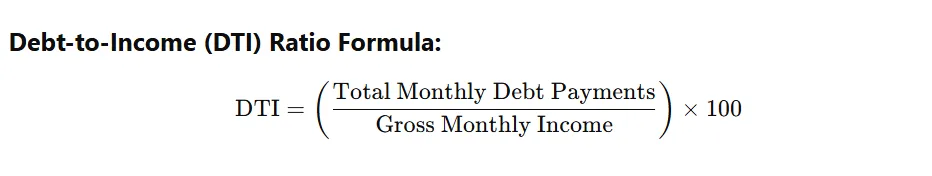

What is DTI?

Your DTI is calculated as the proportion of your gross monthly income that goes towards servicing your existing debt obligations. These include an EMI payment for other loans, credit card bills, and any other monthly debt obligations.

An investor with a high DTI ratio poses a danger for a lender to further commit the investor to additional debt. These lenders become wary of the borrower’s capacity to take on another debt. While, a low DTI ratio stands for more disposable income available with the lender for servicing new debt and hence is good for a home loan application.

Why Do Lenders Care?

Lenders want to make sure your income is not stretched by existing commitments. If your DTI ratio is high, it sends a red flag to them that you might have a hard time repaying additional loans and increasing the risk of default. The lower the DTI ratio, the more disposable income you have, thus assuring that you can pay the EMI of your home loan without compromising on your other financial obligations.

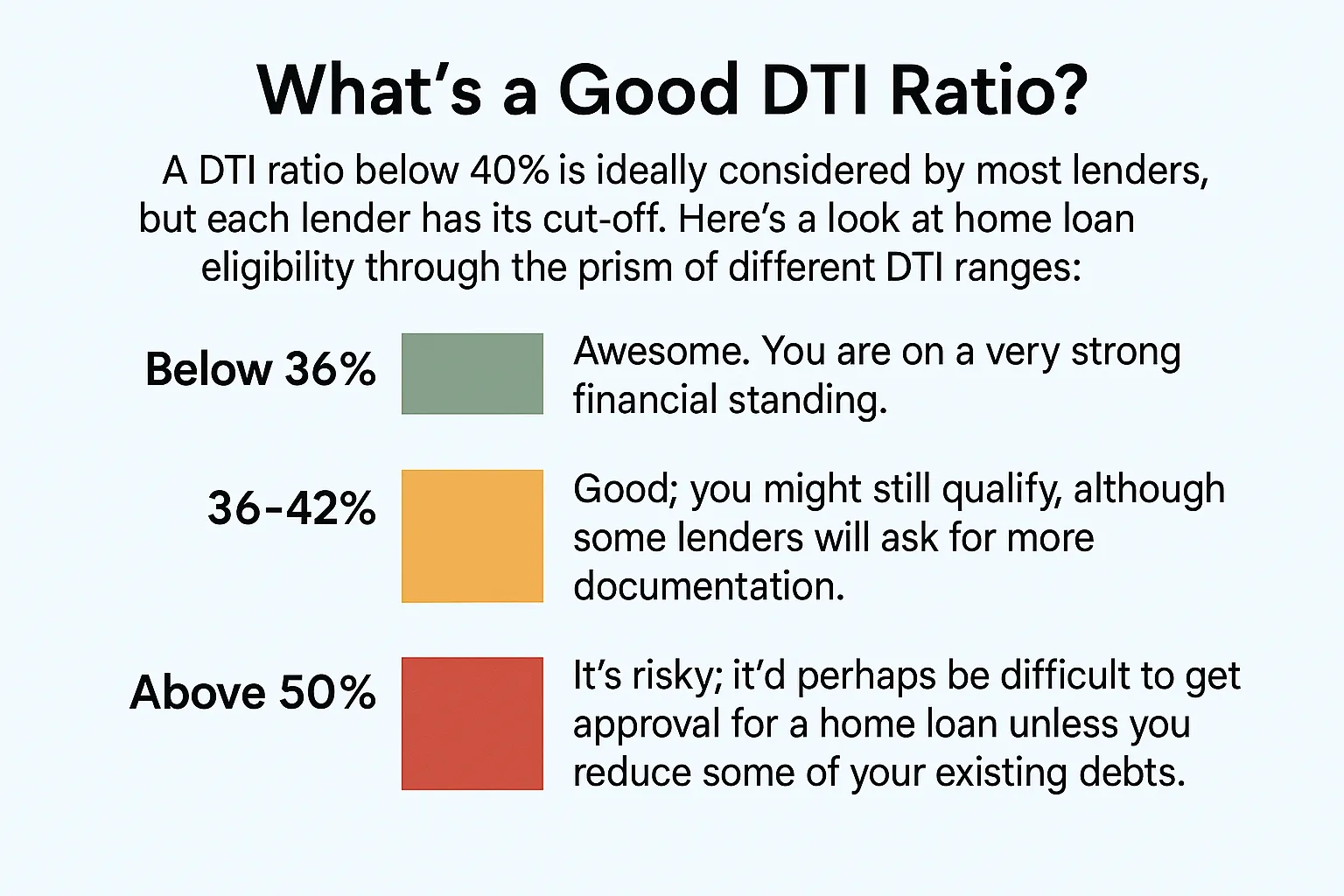

What’s a Good DTI Ratio?

A DTI ratio below 40% is ideally considered by most lenders, but each lender has its cut-off. Here’s a look at home loan eligibility through the prism of different DTI ranges:

- Below 36%: Awesome. You are on a very strong financial standing.

- 36-42%: Good; you might still qualify, although some lenders will ask for more documentation.

- Above 50%: It’s risky; it’d perhaps be difficult to get approval for a home loan unless you reduce some of your existing debts.

How to Improve Your DTI Ratio:

- Pay existing loans: If you can, pay off smaller loans or credit card debt that have a higher interest. This option will cut your monthly debt payments and improve your DTI.

- Increase income: More income opportunities mean side jobs.

- Consolidate debts: Where you have more than one high-interest loans, consolidating them into a single one with a lower EMI will help reduce your DTI.

- Review monthly expenditures: Reducing discretionary expenditure will give you cash to pay off some debt.

Beyond the Numbers - Age, Tenure, and Property Considerations

While your income, credit score, and DTI ratio determine eligibility, other factors like your age, tenure of loan, and property details garner consideration when finalizing your home loan eligibility. These considerations determine how much loan can be availed and for how long you are going to repay it.

Age and Loan Tenure

Minimum and Maximum Age:

- Generally, the minimum age for a home loan application is 21 years. This sets a standard for a financially stable background and ensures that the tenure for repayment is long and manageable.

- The maximum age for salary-goers is usually between 60 and 65 while for self-employed people it is 65 to 70 years. This just means that by the time you reach retirement, your loan must have been repaid.

The Impact of Age on Eligibility:

- Younger applicants. They mostly get longer tenure and smaller EMIs. This way they get to qualify for a higher loan amount.

- Older applicants. They mainly get shorter tenure and higher EMIs. This in turn may qualify them for lesser loan amounts.

Building Price and Loan-to-Value (LTV) Ratio

Loan-to-Value (LTV) ratio is the percentage of the market value of the property that the lender will finance. For example:

- Amount of up to ₹30 lakh: Finance up to 90% of the value of the property.

- Between ₹30 lakh and ₹75 lakh: Up to 80%.

- Over ₹75 lakh: Up to 75%.

The higher your down-payment amount, the more attractive you will be to the lender. This lowers the LTV ratio and reduces the risk involved with providing the loan to the bank.

Co-Applicants - An Empowering Strategy

Addition of a co-applicant sometimes may be very helpful in enhancing a person’s eligibility standards. The co-applicant with a steady income combines resources that otherwise could increase the loan amount and improve the DTI ratio. But all parties of the loan are equally responsible for the repayment.

The Paperwork and Application Tips - Making the Process Easy and Efficient

The final hurdle in your home loan application process is the paperwork. Being prepared for this step would allow you to move forward in closeness to your dream house.

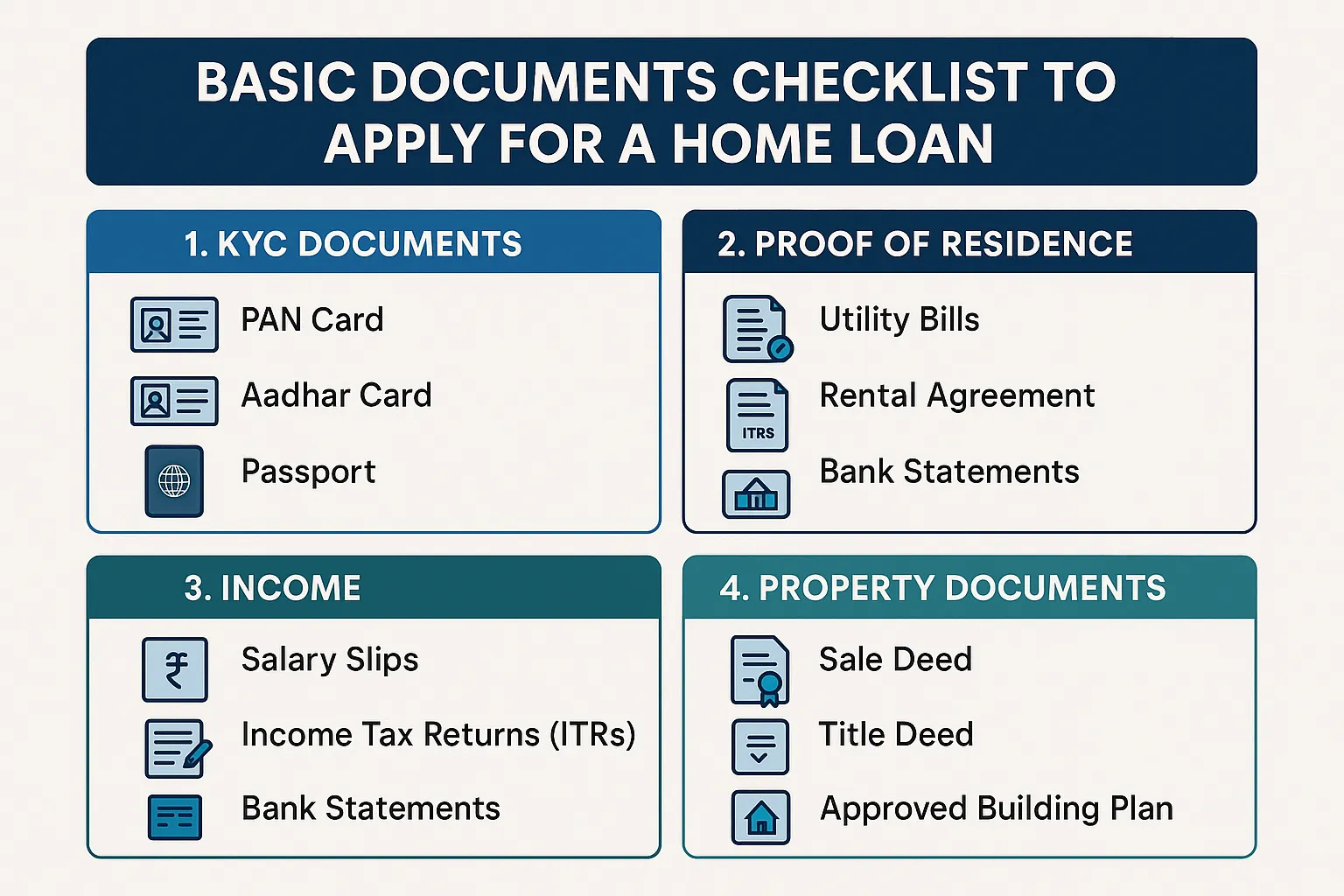

The Basic Documents Checklist to Apply for a Home Loan

Some documents are crucial for lenders to process your home loan application. Essentially, these documents will demonstrate who you are, how much you make, where you live, as well as the property you wish to purchase. Having them ready and organized ahead of time will facilitate a smoother and speedier application process.

1. KYC Documents (Know Your Customer)

These are the KYC documents to prove your identity and verify your eligibility. Below is a general list of such documents acceptable:

- PAN Card: All financial transactions in India, including home loans, require the PAN card. It aids the lenders in tracing your tax records and ensures that you are a registered taxpayer.

- Aadhaar Card: This serves as your unique ID and address. It has become an important document for verification, especially when applying for financial products.

- Passport: If you are an NRI, you can use your passport as an identity proof. Even the residents sometimes require it, especially with multiple addresses.

- Voter ID: Some lenders will further request certain documentation like a voter ID card to verify the address and identity.

2. Proof of Residence

The lender requires proof of your present place of residence, as it assists the lender in checking your rowdy stability and base. In brief, the usual documents are:

- Utility Bills: Electricity, water, or gas bills with your name on them. Most lenders accept utility bills that are not more than 2 months old as proof of residence.

- Rental Agreement: A registered rental agreement can suffice if you are renting. It should have the names of both the tenant and the landlord, the address of the property, and the duration of the lease.

- Passport: Using a passport card or booklet for KYC usually suffices for it to be proof of address, particularly if the document contains the current address of the holder.

3. Income

This is the main determiner of how much an amount you can borrow. Income documents are to establish the lender if you have a capacity to pay the loan back on time:

- Salary Slips: Lenders usually want salary slips for the past 3 to 6 months from salaried employees. These slips should show your net salary, allowances, and all deductions.

- Income Tax Returns (ITRs): Lenders tend to ask for ITRs for the last 2-3 years. This helps them to ascertain your total income and tax-paying capacity. The self-employed or freelancers must make sure that those ITRs are produced because it is like proof of income consistency.

- Bank statements: Your bank statements of the last six months act as proof of your financial discipline. So, keep your bank statements clean! An irregularity such as bounced checks or unexplained withdrawals can dampen your chances.

4. Property Documents

The property being purchased shall also be examined. These documents establish the legal genuineness of a property and its use as collateral for a loan:

- Sale Deed: This is a legal document whereby ownership of the property is conveyed from the seller to you. It is essential to verify the genuineness of the property and to establish your legal ownership of the property after the transaction has been completed.

- Title Deed: This proves that the seller has a clear and marketable title to the property. It is very important that the property is not entangled in any legal dispute or encumbrance. The title deed also proves that the seller is the rightful party who is selling the property to you.

- Approved Building Plan: If you are buying an under-construction property, the builder should provide the approved building plan from the local municipal authority, ensuring that the construction complies with local zoning laws and building regulations.

- Occupancy Certificate (OC): The OC certifies that a building is fit for occupation. For a newly constructed house, you will require this certificate to verify that the building has been constructed lawfully, both safety-wise and technically.

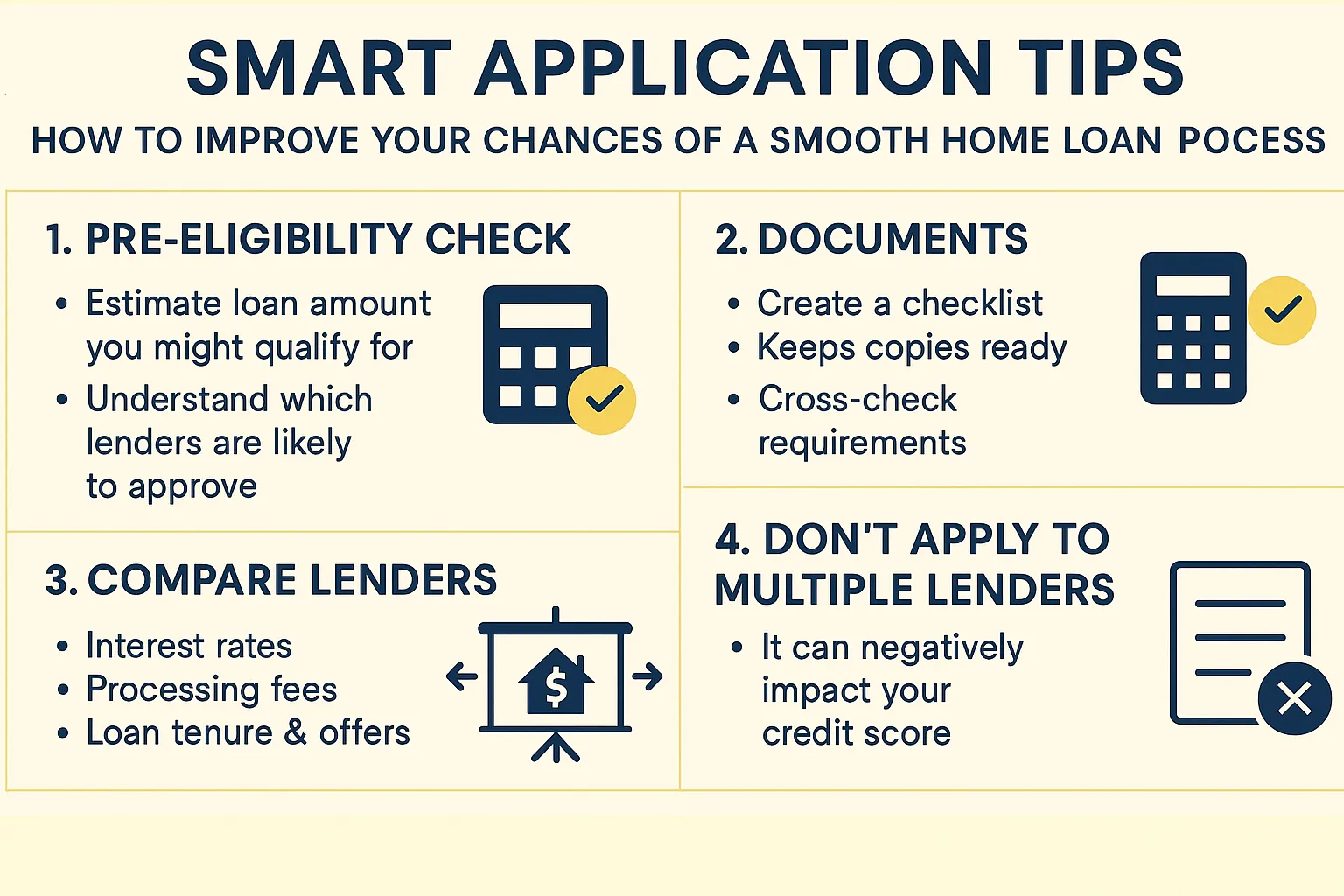

Smart Application Tips: How to Improve Your Chances of a Smooth Home Loan Process

While acquiring the necessary documents is paramount, there are other measures that increase your chances of getting a home loan and also secure the home loan application process from delays. Here are the top smart pieces of advice that help you avoid common pitfalls and hasten the approval process:

1. Pre-Eligibility Check: Assess Your Chances Before You Apply

Before you apply for the loan, it is wise to assess your eligibility for it. Butter Money provides a pre-eligibility calculator for you to check whether you qualify for a home loan based on your income, credit score, and other key parameters. This service will particularly benefit those who are unsure of their own eligibility or just want to ensure that they enter the application in a very strong position. It will help you:

- Estimate the loan amount you might qualify for

- Understand which lenders are most likely to approve your application

- Identify areas where you need to improve (e.g., reducing existing debt or improving your credit score)

Doing this upfront saves you time and effort, so you can then focus on areas that need improvement from a weak point in your application.

2. Documents: Prepare Everything in Advance

A well-organized application has a much greater chance of quick processing. One of the most common reasons for delay of home loan approval is incomplete and disorganized paperwork. Hence, make sure to:

- Create a checklist of all the required documents and tick each one as it is gathered.

- Confirm the documents are the latest ones available (say, a bank statement shouldn’t be older than six months).

- Keeps both hard and sup copies: It’s good to have copies of documents on both digital and physical formats, ready for submission. Lenders commonly are willing to accept scanned copies of the documents for faster processing-the documents must be clear and legible though.

- Cross-check: Some lenders will have slightly different documentation requirements so check with your lender or financial institution just to be sure before submitting an application.

3. Compare Lenders: Never Settle for the First Offer

Never just settle for the first offer you get while applying for a home loan. It is always best to shop around and compare home loan offers by different lenders. Each bank or financial institution may differ slightly in their terms, which include:

- Interest Rates: Even a slight difference in rate can save you loads of money over the lifetime of the loan.

- Processing Fees: Some lenders may charge you more in processing fees than others do, and these add up.

- Loan Tenure: The tenure sets the time on which you will be repaying the loan. In contrast to longer tenures, which lessen your EMI, they also increase the total interest.

- Special Offers: Banks now and then run promotions for getting away with low interest rates or some fees. Keep a lookout for these and use them to their advantage.

Hence, if you compare various lenders, you have a better chance of winning the best deal that will be in favor of your requirements.

4. Don’t Apply to Multiple Lenders at the Same Time.

While it might feel like your chances of getting that loan increase the more banks and lenders you apply with, it may actually backfire. Each time you apply for a loan, the lender will do a hard inquiry on your credit report. If there are multiple hard inquiries within a short span of time, it may adversely affect your CIBIL score as the lenders may think that you have desperation for credit. The end result might be a rejection of your loan application.

Instead, research, compare offers, and only apply to lenders you are confident will approve your loan.

Conclusion: Your Homeownership Journey Starts Here

Getting a home loan can be a scary contributor to buying a house; however, if you understand the basics—income, credit score, the DTI ratio, age, and property information along with documentation—you will be in control of the process and able to make informed decisions.

At Butter Money, we not only get you approved for a loan, but together, we navigate this path with confidence. We offer tools and resources to put you in the best position along with expert-guided support.

Your dream home is attainable, and we will help you make it your reality. Become part of the Butter Money butterhood community! Get regular updates and work together with others to achieve your homeownership dreams. Join us at https://community.butter.money/

So, act now: check your eligibility , start gathering your documents, and set up a consultation with us to begin your homeownership journey.

Frequently Asked Questions(FAQs)

-

What is the minimum CIBIL score needed for a home loan in

India?

While some lenders may approve loans for scores below 700, a CIBIL score of 750 or higher is generally considered excellent and significantly increases your chances of approval, often with better interest rates and loan terms. -

How is my Debt-to-Income (DTI) Ratio calculated for a home

loan?

Your DTI is calculated as (Total Monthly Debt Payments / Gross Monthly Income) x 100. Lenders typically prefer a DTI ratio below 40%, indicating you have sufficient income to manage new EMI obligations. -

Can a co-applicant improve my home loan eligibility?

Yes, absolutely! Adding a co-applicant with a stable income and a good credit score can significantly enhance your home loan eligibility, potentially allowing you to qualify for a larger loan amount and better terms. -

What are the most crucial documents required for a home loan

application?

Key documents include KYC documents (PAN, Aadhaar), proof of residence (utility bills, rental agreement), income documents (salary slips, ITRs, bank statements), and property documents (Sale Deed, Title Deed, Approved Building Plan). -

Why should I avoid applying for home loans with multiple lenders

simultaneously?

Each loan application results in a “hard inquiry” on your credit report, which can temporarily lower your CIBIL score if there are too many in a short period. It’s better to research and compare offers before applying to your preferred lender.