The Smart Guide to Personal Loan Balance Transfer: Save Big, Borrow Wisely

A personal loan balance transfer can help you lower your EMIs, reduce interest costs, and improve financial flexibility by switching to a lender offering better terms. While it can lead to significant savings, it’s crucial to compare interest rates, check for hidden charges, and assess the overall cost-benefit before making a move. Done right, this strategic shift can ease financial stress and accelerate debt repayment.

Estimated Read Time: 8-10 minutes

Introduction

Imagine this—you took a personal loan a year ago to fund a major expense. Maybe it was a wedding, home renovation, or an emergency medical bill. At the time, the interest rate seemed reasonable, and you were just relieved to have the funds. Fast forward to today, you realize that other lenders are offering significantly lower interest rates. You feel stuck paying high EMIs when a smarter option exists: the personal loan balance transfer.

If you’ve ever wondered how to reduce your interest burden and get better loan terms, this guide will break it all down for you. Let’s navigate through every aspect of a personal loan balance transfer, so you can make the most informed decision for your financial future.

Understanding Personal Loans — What, Why & How?

What is a Personal Loan?

A personal loan is an unsecured loan provided by banks and NBFCs (Non-Banking Financial Companies) based on factors like income level, employment history, repayment capacity, and credit score. Unlike home or car loans, personal loans do not require collateral, making them accessible to a wide range of borrowers.

If you’re looking for a quick explainer on personal loan balance transfers, you might find this video helpful:

5 Reasons Why Personal Loans Are Popular

Personal loans have gained immense popularity in recent years due to their quick processing time, minimal documentation requirements, and versatility in usage. Here are some of the reasons why people opt for personal loans:

-

No Collateral Required — Since they are unsecured, you don’t have to pledge assets like property or gold.

-

Quick Approval & Disbursal — Many lenders approve personal loans within 24-48 hours.

-

Minimal Documentation — Unlike home or business loans, which require extensive paperwork, personal loans can be availed with just identity proof, income proof, and address proof.

-

Flexibility in Usage — Whether it’s for a wedding, travel, medical emergency, education, or home renovation, you can use the loan for any purpose.

-

Flexible Tenure — Most personal loans come with a repayment tenure of 1 to 5 years, allowing you to choose a term that suits your financial capability.

Understanding the Other Side: Downsides of Personal Loans

While personal loans offer quick access to funds without collateral, they come with certain drawbacks that borrowers should be mindful of before committing. One of the biggest concerns is high interest rates, especially for those with lower credit scores. Unlike secured loans, where lenders have an asset as security, personal loans carry greater risk for banks, leading to interest rates that can sometimes exceed 20%. Over time, this can significantly increase the repayment burden.

Another challenge is the impact on financial stability. Since personal loans are relatively easy to obtain, it’s tempting to borrow more than necessary. This can lead to higher monthly EMIs, making it harder to manage expenses, especially if other financial commitments like home loans or credit card bills are already in place. Missing EMIs can further hurt credit scores, making future borrowing more difficult.

Additionally, many personal loans come with processing fees, prepayment penalties, and hidden charges, which can add to the overall cost. While some lenders allow early repayment, others impose penalties for pre-closing the loan, limiting flexibility in case you want to reduce your debt burden sooner.

This is where a personal loan balance transfer can be a game-changer. If you’re struggling with high EMIs, excessive interest costs, or unfavorable loan terms, switching to a lender offering lower interest rates and better repayment flexibility can provide financial relief. A well-timed balance transfer not only helps reduce monthly payments but also ensures that you’re getting the best possible deal for your financial situation.

What is a Personal Loan Balance Transfer?

A personal loan balance transfer is a process where a borrower shifts their existing personal loan from one lender to another to avail better terms, usually at a lower interest rate. This helps in reducing the monthly EMI burden and overall interest paid over the loan tenure.

Think of it as refinancing your home loan—except it’s quicker and requires less paperwork. For instance, imagine Ravi, who took a ₹5 lakh loan two years ago at an interest rate of 16%. At the time, it seemed reasonable given his urgent financial need. However, market conditions have changed, and lenders now offer personal loans at 12-13%. By switching to a new lender at 12%, Ravi can reduce his EMI by a few thousand rupees every month, which adds up to significant savings over time.

The minimum and maximum amounts eligible for a personal loan balance transfer can vary depending on the lender’s policies. For instance, Tata Capital requires a minimum outstanding loan amount of ₹50,000 to qualify for a balance transfer. (If you’re unsure about your eligibility or need guidance on the best options, feel free to connect with Butter Money for expert assistance.)

While specific maximum limits aren’t universally defined, they are typically influenced by factors such as the borrower’s creditworthiness, income, and the lender’s internal policy.

Why Should You Consider a Personal Loan Balance Transfer?

A balance transfer isn’t just about switching lenders—it’s about making a strategic financial move that benefits you in multiple ways. It’s not just about securing a lower interest rate; it’s about improving financial flexibility, reducing stress, and unlocking opportunities for better money management. Here’s why a balance transfer can be a game-changer:

Lower Interest Rates = More Savings

Even a slight reduction of 0.5% to 2% in interest rates can result in substantial savings over the course of your loan tenure. For instance, if you have a ₹5 lakh loan at 15% interest for five years, you might not think that a transfer to 12% interest would make a huge difference. However, when you do the math, the savings add up—this move can save anywhere between ₹45,000 to ₹60,000 in total interest paid. That’s money that could be redirected toward investments, emergency savings, or other financial goals. The larger the loan amount, the greater the savings.

Reduced EMI Burden

A lower interest rate doesn’t just mean less money paid in interest—it directly reduces your monthly EMI. This, in turn, improves your cash flow, giving you the flexibility to allocate funds elsewhere. Whether you choose to invest, save, or spend on essential expenses, the extra breathing room in your budget makes a difference. A lower EMI can be especially beneficial if you’re navigating a tight financial situation, such as managing a home loan, rent, or unexpected medical expenses alongside your personal loan repayments.

Longer Tenure for Better Financial Planning

Some lenders allow borrowers to extend the tenure of their loan when opting for a balance transfer. While this means paying smaller EMIs every month, it’s important to consider the trade-off—it also means paying more interest over time. This option is best suited for those who are struggling with monthly repayments and need immediate relief from financial pressure. On the other hand, if your financial position improves later, you can always prepay a portion of the loan to reduce the interest burden without extending the tenure unnecessarily.

Top-Up Loan Facility

One of the biggest advantages of transferring your personal loan is the possibility of a top-up loan. Many lenders offer additional funds when you transfer your balance, allowing you to access extra cash without going through the hassle of applying for a new loan separately. This can be particularly useful for emergencies, business expansion, home renovation, or any other unexpected financial needs. If you’re already considering taking out a new loan, opting for a balance transfer with a top-up could be a smarter, cost-effective solution since you’ll be managing only one EMI instead of multiple loans.

Improved Credit Score

When you successfully transfer your loan and continue making timely payments, your credit score gradually improves. This happens because your loan repayment history is one of the most significant factors in determining your creditworthiness. A lower EMI reduces the risk of missed or delayed payments, helping to build a stronger repayment record. Over time, an improved credit score can make a huge difference—it can help you qualify for better interest rates on future loans, increase your borrowing capacity, and even make it easier to get approved for credit cards or home loans on more favorable terms.

A personal loan balance transfer is much more than just shifting your loan from one lender to another—it’s about financial empowerment. By carefully evaluating your options, understanding the costs involved, and making the right decision, you can take better control of your financial health and unlock significant savings in the long run.

Determining Interest Rates on Transferred Personal Loans

When considering a personal loan balance transfer, understanding how banks and Non-Banking Financial Companies (NBFCs) determine the interest rate on the transferred loan is essential. Several factors influence the new interest rate offered:

-

Creditworthiness: Your credit score and credit history play a pivotal role. A higher credit score typically leads to more favorable interest rates, as it indicates responsible credit behavior.

-

Existing Debt Obligations: Lenders assess your current debt-to-income ratio to ensure you have the capacity to manage additional debt. A lower ratio suggests better financial health, potentially resulting in a lower interest rate.

-

Employment and Income Stability: Stable employment and a consistent income reassure lenders of your repayment ability, which can positively impact the interest rate offered.

-

Loan Amount and Tenure: The amount you wish to transfer and the desired repayment period can influence the interest rate. Larger loan amounts or extended tenures might attract higher rates due to increased risk to the lender.

-

Lender’s Policies and Market Conditions: Each bank or NBFC has its own risk assessment criteria and may adjust interest rates based on prevailing economic conditions and internal policies.

It’s advisable to compare offers from multiple lenders, considering both the interest rates and associated fees, to ensure the balance transfer aligns with your financial goals.

Finding the Best Deal: Comparing Loan Amounts & Interest Rates

When considering a personal loan balance transfer, it’s essential to understand how different banks structure their offers. While the core process remains consistent—transferring your existing loan to a new lender for better terms—the specifics can vary. Here’s a comparative overview to guide your decision:

Loan Amounts and Interest Rates:

Banks offer varying loan amounts and interest rates based on their policies and your credit profile. Take a look at the table below for a quick comparison of different banks and their offerings. If you’d like to check your eligibility with each lender, you can explore more here.

| Bank | Max. Loan Amount | Rate of Interest | Tenure | Processing Fee | Key Features |

|---|---|---|---|---|---|

| HDFC Bank | Up to ₹40L | 10.85% - 24% | Up to 6 Years | ₹6,500 | 100% Digital Process, Quick Disbursal |

| Axis Bank | Up to ₹10L | 11.25% - 22% | Up to 5 Years | Up to 2% | Low Processing Fee |

| Kotak Mahindra Bank | Up to ₹35L | 10.99% - 16.9% | Up to 6 Years | Up to 5% | Lowest Income Requirement, 100% Digital Process |

| IDFC FIRST Bank | Up to ₹10L | 10.99% - 23.99% | Up to 5 Years | Up to 2% | 100% Digital Process, Max Loan Amount |

| ICICI Bank | Up to ₹50L | 10.85% - 16.65% | 1 - 6 Years | Up to 2% | Quick Disbursal, 100% Digital Process |

| Yes Bank | Up to ₹40L | 11.25% - 21% | Up to 5 Years | 0% - 2.5% | 100% Digital Process, Quick Disbursal |

| Tata Capital Ltd | Up to ₹50L | 11.99% - 35% | Up to 7 Years | Up to 4% | 100% Digital Process |

| IndusInd Bank | Up to ₹50L | 10.49% - 26% | 1 - 7 Years | Up to 4% | Quick Disbursal, Lowest Income Requirement |

| Federal Bank | Up to ₹5L | 12% - 22.5% | 1 - 4 Years | 1.5% - 2.5% | - |

Source: paisabazaar.com updated as on: 18-03-2025 07:32:56 AM

How to Transfer Your Personal Loan — A Step-by-Step Guide

Transferring a personal loan may seem like a daunting task, but breaking it down into clear steps makes it much easier to navigate. Instead of seeing it as a complex financial process, think of it as a strategic move—one that helps reduce debt burden, free up cash flow, and make loan repayment more manageable.

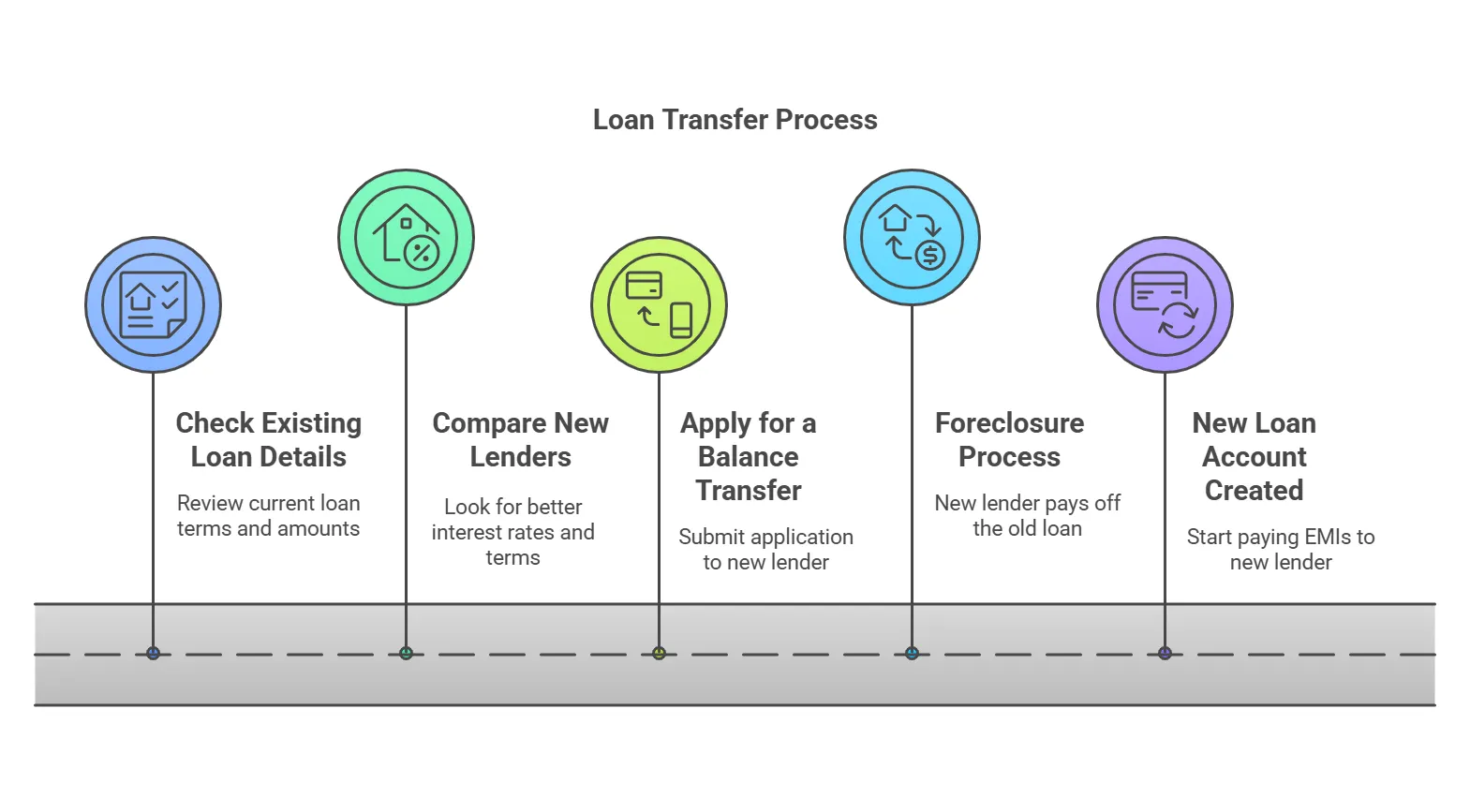

The first step in this process is evaluating the existing loan. This means checking the outstanding loan balance, the interest rate being paid, and the remaining tenure. Without these details, it’s impossible to determine whether a balance transfer is even worthwhile. For example, if a personal loan is nearing its last few EMIs, a transfer may not be beneficial, as the interest component is already significantly reduced. However, if a loan still has several years left, shifting to a lower rate could bring substantial savings. Another crucial detail at this stage is obtaining a foreclosure statement from the current lender. This document provides the exact amount needed to close the loan, which will be necessary when applying for a transfer.

Once the current loan details are clear, the next step is to compare new lenders. Not all banks and financial institutions offer the same interest rates or terms, and the key is to find a lender offering a significantly lower rate—typically at least 1% lower than the existing rate—to ensure meaningful savings. But interest rate alone isn’t enough. Many lenders charge processing fees, foreclosure fees, and administrative costs, which can eat into the benefits of transferring. The best approach is to look at the Annual Percentage Rate (APR) rather than just the interest rate. The APR factors in additional costs, giving a more accurate picture of how much the loan will truly cost.

After choosing a lender, the application process begins. This requires submitting necessary documents, including identity proof, income proof, loan repayment history, and the foreclosure statement from the current lender. The new lender then evaluates the application, checks the borrower’s credit profile, and processes the approval. This part of the process is crucial, as lenders consider multiple factors before approving a balance transfer. A strong repayment history can lead to faster approval, while missed payments on the existing loan might make the new lender hesitant.

Once the application is approved, the foreclosure and disbursement process begins. The new lender directly pays off the outstanding balance to the previous lender, effectively closing the old loan account. This is a critical step, as any delays in the foreclosure process can lead to additional interest charges from the existing lender. At this stage, ensuring that the previous lender provides a loan closure certificate is essential. This serves as proof that the old loan has been fully repaid and avoids any issues with lingering dues.

Finally, the transition to the new loan takes place. The borrower now starts repaying the new lender at the revised EMI amount, which should be lower due to the reduced interest rate. The impact is immediately visible in monthly budgets, with extra cash available for savings, investments, or other expenses. In some cases, the new lender might also offer a top-up loan, providing additional financial flexibility.

A personal loan balance transfer isn’t just about switching lenders—it is about maximizing financial benefits. However, like any financial decision, it requires careful evaluation. Processing fees, penalties on the existing loan, and the overall cost-effectiveness of the transfer must be considered. Done wisely, it helps ease the EMI burden, improve cash flow, and create better financial stability for the future.

Executing a balance transfer correctly ensures seamless debt restructuring, reducing the financial burden while maintaining credit health. However, evaluating all associated costs and ensuring a substantial difference in interest rates is key to making this process beneficial. Done strategically, a balance transfer doesn’t just ease EMI payments—it creates a stronger financial foundation for the future.

Unlocking Savings: How Much Can a Balance Transfer Really Help?

Imagine you’re carrying a personal loan with a hefty interest rate, and each month, a significant chunk of your payment seems to vanish into interest charges. It’s a common scenario, but there’s a strategic move that can tilt the scales in your favor: a personal loan balance transfer.

The Scenario: Let us understand this through a hypothetical scenario

Consider Priya, who has an outstanding personal loan of ₹5 lakh at an annual interest rate of 15%, with a remaining tenure of 3 years. Her monthly EMI stands at approximately ₹17,326.

The Opportunity:

Priya learns about a balance transfer option from another bank offering a reduced interest rate of 12% for the same tenure. Intrigued, she decides to explore how much she could save by making the switch.

Savings Breakdown: Before vs. After Balance Transfer

| Loan Details | Before Balance Transfer | After Balance Transfer | Your Savings |

|---|---|---|---|

| Loan Amount | ₹5,00,000 | ₹5,00,000 | - |

| Interest Rate | 15% per annum | 12% per annum | 3% lower |

| Remaining Tenure | 36 months | 36 months | - |

| Monthly EMI | ₹17,326 | ₹16,607 | ₹719/month |

| Total Repayment | ₹6,23,736 | ₹5,97,852 | ₹25,884 |

| Total Interest Paid | ₹1,23,736 | ₹97,852 | ₹25,884 |

The Savings:

By opting for the balance transfer, Priya’s new monthly EMI decreases to ₹16,607, resulting in a monthly saving of ₹719. Over the remaining tenure of 3 years, her total interest outflow reduces by ₹25,884.

This not only eases financial stress but also allows for better cash flow management, making loan repayment more affordable and efficient.

Estimate Your Savings with Balance Transfer Calculators

If you’re considering a personal loan balance transfer, it’s crucial to calculate your potential savings before making a decision. Online balance transfer calculators help you estimate how much you can save by comparing your existing loan terms with the new offer. These tools typically require details such as your outstanding loan amount, current interest rate, remaining tenure, and the new interest rate. By entering these values, you can determine your revised EMI, total interest savings, and overall financial benefit. Many banks and financial institutions provide such calculators to simplify the process. You can explore options like Butter Money’s Savings Calculator or ICICI Bank’s Balance Transfer Calculator or HDFC Bank’s Balance Transfer Calculator to assess your potential savings and make an informed decision.

Things You Should Know Before Transferring Your Loan

A personal loan balance transfer is a great financial tool, but naturally, borrowers have questions before making a move. While the process seems straightforward, there are a few key factors to consider to ensure it’s the right decision.

One common concern is the impact of a balance transfer on credit scores. When applying for a transfer, the new lender conducts a hard inquiry to assess creditworthiness, which can cause a slight dip in the credit score. However, this effect is usually temporary. Over time, as timely repayments continue on the new loan, the credit score tends to improve. In fact, a lower interest rate and reduced EMI can make repayment easier, reducing the risk of missed payments and strengthening credit history.

Another question borrowers often ask is whether a loan can be transferred multiple times. The answer is yes—there is no strict restriction on the number of times a personal loan can be transferred. However, it’s important to be strategic. Repeated transfers may raise red flags for lenders, making them hesitant to approve future loans. Additionally, each transfer involves processing fees and foreclosure charges, which can add up and diminish the benefits of switching lenders frequently.

Sometimes, borrowers worry about what happens if a balance transfer application is rejected? If a lender denies the request, the existing loan remains active under the same terms. In this case, it’s advisable to check the reason for rejection—whether it’s due to a low credit score, high debt-to-income ratio, or inadequate documentation. Addressing these issues, such as improving repayment behavior or reducing outstanding debts, can increase the chances of approval when reapplying in the future.

The next concern is how long the process takes? Typically, a balance transfer takes 5-10 business days, depending on the lender’s internal approval process, the borrower’s documentation, and the speed at which the previous lender issues the foreclosure letter. Some lenders offer faster processing times, while others may have additional verification steps. Ensuring that all necessary documents—such as salary slips, loan statements, and KYC proofs—are readily available can help speed up the process.

Another key consideration is the hidden charges involved in a loan transfer. Many lenders charge a processing fee, usually 1-2% of the loan amount, while the current lender may apply foreclosure charges, often 1-4% of the outstanding balance. Additionally, GST and administrative fees can add to the overall cost. Before proceeding, it’s essential to calculate these expenses and ensure that the savings from a lower interest rate outweigh the upfront charges. Some banks may waive processing fees for existing customers or during special offers, so it’s always worth negotiating.

While a personal loan balance transfer can be an excellent financial move, careful planning is necessary. Assessing overall savings, understanding the terms, and selecting the right lender ensure that the transfer genuinely benefits long-term financial stability.

Is a Balance Transfer Right for You?

A personal loan balance transfer can be a powerful financial tool when used wisely, but it isn’t a one-size-fits-all solution. If you find yourself struggling with high EMIs, a high-interest rate, or an unfavorable loan structure, switching to a new lender could provide much-needed relief. A lower interest rate can significantly reduce the total amount paid over time, while a longer tenure can help ease monthly financial strain. However, before making the move, it’s crucial to conduct a thorough cost-benefit analysis—ensuring that the savings outweigh any fees or penalties involved in the process.

Understanding when and why a balance transfer makes sense is key. If you are nearing the end of your loan tenure, the interest component of your EMI is already lower, making a transfer less beneficial. But if you still have several years left, securing a better rate with flexible terms can improve your overall financial stability. Evaluating processing charges, foreclosure fees, and administrative costs will help determine whether the transfer is truly worth it.

By aligning the decision with your financial goals, carefully comparing lenders, and timing the transfer strategically, you can maximize benefits while avoiding unnecessary costs. A well-planned balance transfer doesn’t just reduce debt—it enhances financial flexibility, making way for smarter money management in the long run.

5 Red Flags to Watch Out for in a Personal Loan Balance Transfer

A personal loan balance transfer can be a smart financial move, but only if done with caution. While legitimate lenders offer better terms, hidden traps can turn a promising deal into a financial headache. Here are some warning signs to be mindful of:

-

Too-Good-to-Be-True Offers – If a lender promises unbelievably low interest rates without any eligibility checks, it’s likely a bait-and-switch tactic. Always compare multiple lenders and read the fine print.

-

Upfront Payment Demands – Genuine lenders deduct processing fees from the loan amount; they never ask for advance payments. If someone insists on upfront money to “fast-track” approval, it’s a red flag.

-

Pressure to Act Fast – Scammers create urgency, pushing borrowers to make hasty decisions without reading the loan terms. A credible lender will give you time to review and understand all conditions.

-

Unregistered or Unverified Lenders – Before proceeding, always check if the lender is registered with RBI or a recognized financial institution. Dealing with unknown or unverified lenders can lead to financial fraud.

-

Hidden Charges and Changing Terms – Some lenders lure borrowers with attractive offers but later introduce unexpected charges or change repayment terms post-transfer. Always get everything documented before signing.

A balance transfer is meant to ease financial stress, not add to it. Stay vigilant, do your research, and never rush into a deal without reading the fine print.

Final Thoughts: Making the Most of Your Loan Transfer

A personal loan balance transfer isn’t just a financial transaction—it’s a recalibration of your borrowing strategy. It’s about paying less for the money you’ve borrowed, regaining control over your finances, and making sure your loan works for you, not the other way around.

For those weighed down by high EMIs, this move can bring immediate relief. A lower interest rate doesn’t just mean a smaller monthly payment—it means more room in your budget for things that truly matter. Maybe that’s building an emergency fund, investing for the future, or simply breathing a little easier each month.

But a balance transfer isn’t a magic fix. The real savings lie in making informed choices—comparing lenders, watching out for hidden charges, and ensuring the new loan terms genuinely align with your financial goals. It’s not just about switching for the sake of it; it’s about switching smartly.

At the end of the day, the power of a balance transfer lies in how well you use it. Done right, it’s not just about saving money—it’s about creating financial flexibility and peace of mind. So, take your time, crunch the numbers, and make a move that sets you up for a stronger financial future.

FAQ’s

Answering popular Quora questions:

-

What is a home loan balance transfer and top-up?

A home loan balance transfer allows you to shift your existing home loan from one lender to another offering lower interest rates or better terms, helping you reduce EMI payments and save on interest costs.

A top-up loan is an additional loan amount that you can borrow over and above your existing home loan when transferring to a new lender. It can be used for home renovation, personal expenses, or any other financial need, usually at a lower interest rate than personal loans.

-

How, why, and when do you transfer your home loan for a better deal?

How? You transfer your home loan by shifting the outstanding balance from your current lender to a new one offering a lower interest rate or better terms. The new lender repays your existing loan, and you start repaying under the revised terms.

Why? A home loan balance transfer helps you reduce EMIs, save on interest costs, and access additional funds through a top-up loan. It also allows you to switch to a lender with better service, flexible repayment options, or lower fees.

When? The best time to transfer is when interest rates drop, your credit score improves, or you find a lender offering significantly better terms. Ideally, transfer in the early years of the loan, when interest makes up a large portion of EMIs, to maximize savings.

-

What are the benefits of a home loan transfer?

- Lower Interest Rates – Reduce your EMI burden and overall loan cost by switching to a lender offering better rates.

- Lower Monthly EMIs – A reduced interest rate leads to smaller EMIs, improving your monthly cash flow.

- Top-Up Loan Option – Access additional funds for home renovation, education, or personal needs at lower rates than personal loans.

- Flexible Repayment Terms – Some lenders offer better tenure options, allowing you to extend or shorten your loan duration based on your financial goals.

- Better Customer Service – If you’re unhappy with your current lender, switching can provide a better service experience, faster processing, and more transparency.

A well-timed home loan balance transfer can lead to significant savings and financial flexibility—just ensure the benefits outweigh any transfer costs!